Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.11% lower at 18,329, signalling that Dalal Street was headed for negative start on Tuesday.

Asian shares were mixed as investors awaited trade data from China that will provide more information on the country’s economic growth prospects. The Nikkei 225 index was up 0.77% and the Topix gained 0.97%. The Hang Seng fell 0.27% and the CSI 300 index rose 0.39%.

Indian rupee closed at 81.7950 against the US dollar on Monday.

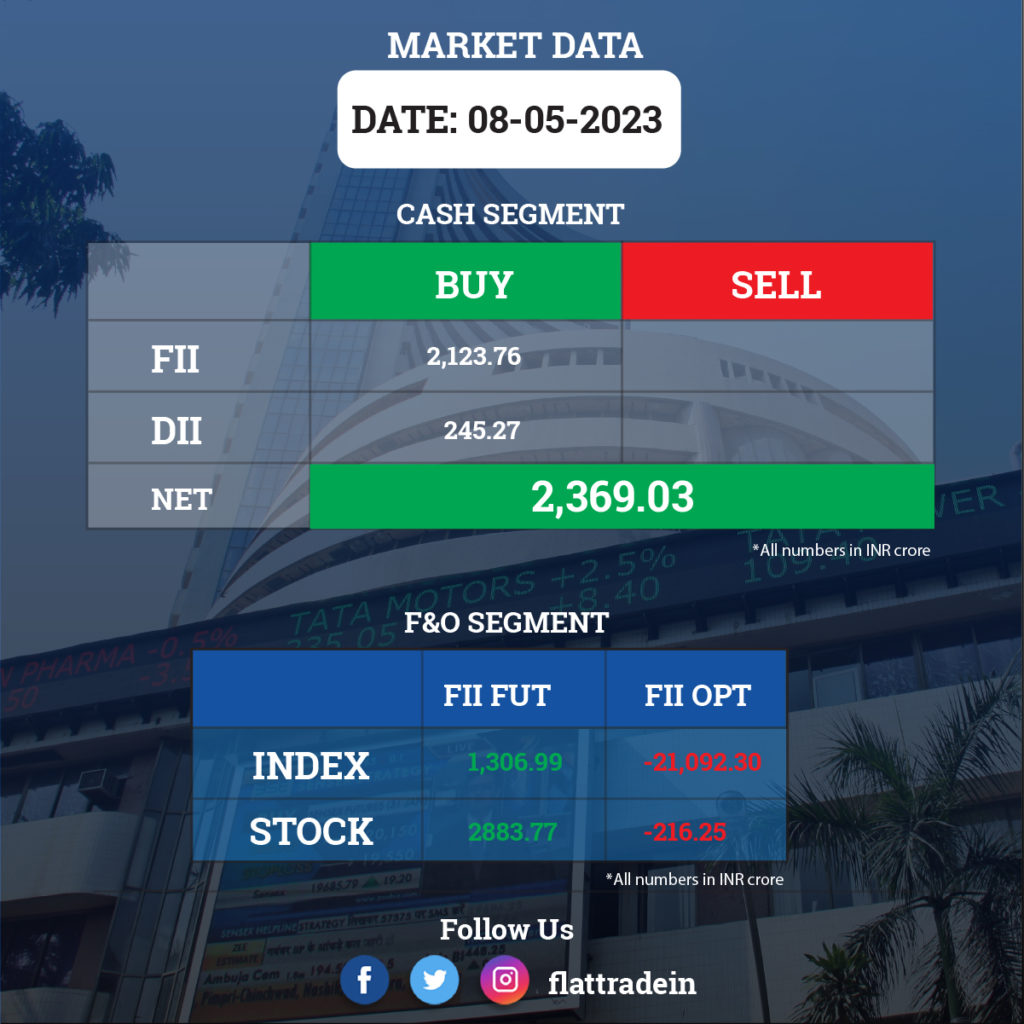

FII/DII Trading Data

Upcoming Results

Apollo Tyres, Lupin, Raymond, Nazara Technologies, SRF, Indraprastha Gas, Nuvoco Vistas Corporation, Rain Industries, Birla Corporation, Godrej Agrovet, Castrol India, Westlife Foodworld, Chalet Hotels, Poly Medicure, Shanthi Gears, Matrimony.com, Elantas Beck India, Eveready Industries India, Five-Star Business Finance, Ganesh Housing Corporation, Hatsun Agro Product, JM Financial, Jaiprakash Power Ventures, KSB, Latent View Analytics, Man Infraconstruction, Manorama Industries, Reliance Infrastructure, Shipping Corporation of India, Stovec Industries, Suven Life Sciences, TD Power Systems will report their quarterly earnings.

Stocks in News Today

Pidilite Industries: The adhesive manufacturing company has recorded an 11.3% year-on-year growth in consolidated profit at Rs 283.03 crore for the quarter ended March FY23 on good operating numbers. Revenue from operations rose 7.3% to Rs 2,689.25 crore in the same period. The board recommended a dividend of Rs 11 per share for the fiscal 2023. Meanwhile, the company has decided to discontinue operations of the Sargent Art Division in a phased manner. Further, NK Parekh has stepped down as the non-executive vice-chairman of the company, and Apurva N Parekh has been designated as the executive vice-chairman, these changes come into effect from May 8, 2023.

Kalpataru Power Transmission: The company’s consolidated revenue rose 18.07% YoY to Rs 4,882 crore in Q4FY23. Ebitda was up 9.93% YoY to Rs 332 crore in Q4FY23. Consolidated net profit rose 45.79% Yoy to Rs 156 crore in Q4FY23. The company has declared a final dividend of Rs 7 per share for the fiscal 2023. The board has approved raising Rs 300 crore via non-convertible debentures in one or more tranches.

Carborundum Universal (CUMI): The company’s consolidated revenue was up 38% YoY at Rs 1,199.62 crore in Q4FY23. Ebitda rose 71.59% to Rs 190.33 crore in Q4FY23 over Q4FY22. Consolidated net profit soared 140.43% YoY to Rs 137.12 crore in Q4FY23. The board approved a final dividend of Rs 2 per share for the fiscal 2023.

Mahanagar Gas: The natural gas distribution company has recorded a 56.2% quarter-on-quarter growth in net profit at Rs 268.81 crore for the March FY23 quarter, driven by healthy operating performance. Revenue fell 3.6% sequentially to Rs 1,610.5 crore, with volumes declining 1.16% QoQ. Numbers, barring topline, were above estimates. The company announced a final dividend of Rs 16 per equity share.

Canara Bank: The state-owned lender reported a 74% jump in March quarter consolidated net profit to Rs 3,336.51 crore, helped by higher core income and lower provisions. The bank had reported a net profit of Rs 1,918.80 crore in the year-ago period. The lender’s core net interest income grew 23% to Rs 8,617 crore and other income grew 7% to Rs 4,776 crore. Its gross non-performing assets ratio improved to 5.35% from 7.51% in the year-ago period. The bank’s board has recommended a dividend of Rs 12 per share.

Kansai Nerolac Paints: The company’s consolidated revenue was up 12.82% YoY to Rs 1,733.59 crore in Q4FY23. Ebitda doubled year-on-year to Rs 168.12 crore in Q4FY23. Consolidated net profit was up 279.18% YoY to Rs 93.77 crore in Q4FY23. The company declared a dividend of Rs 2.70 per share for the fiscal 2023. The board approved issue of bonus shares in the ratio 1:2, taking the share capital from 53.89 crores share to 80.83 crore shares. Shigeki Takahara has resigned as a non-executive director, with effect from June 26, and will be replaced by Pravin D Chaudhari.

Birlasoft: The company said its consolidated revenue was up 0.36% QoQ at Rs 1,226.38 crore in Q4FY23. EBIT stood at Rs 146 crore in the reported quarter as against a EBIT loss of Rs 136 crore in the preceding quarter. Consolidated net profit was at Rs 112.16 crore in Q4FY23 as against a net loss of Rs 16.36 crore in the preceding period. The company has declared a dividend of Rs 2 per share.

Andhra Paper: The paper and pulp manufacturer has clocked a 168% year-on-year growth in profit at Rs 153.9 crore for the quarter ended March FY23, driven by healthy topline and operating numbers. Revenue from operations grew by 38.55% to Rs 590 crore compared to the year-ago period.

VIP Industries: The luggage and bags manufacturer has posted a net loss of Rs 4.3 crore in the March FY23 quarter, against a profit of Rs 12.4 crore in the same period last year. The company had an exceptional loss of Rs 47.21 crore relating to a loss of property, plant and equipment and inventories that were destroyed due to a major fire at a plant of a Bangladesh subsidiary in Q4FY23. Revenue grew by 27% YoY to Rs 450.6 crore.

Godrej Consumer Products: Godrej Consumer has completed the acquisition of the FMCG business of Raymond Consumer Care. On April 27, the company announced the proposed acquisition of the FMCG business of Raymond Consumer Care by way of a slump sale. RCCL is a leading player in the deodorants and sexual wellness categories in India.

Greenply Industries: The company announced a joint venture with Netherlands-based Samet BV on a 1:1 shareholding basis to manufacture and sell functional furniture hardware through a manufacturing facility in India.

Dev Information Technology: The company received an order worth Rs from Gujarat State Fertilizers & Chemicals for installation, supply, commission, implementation and maintenance of enterprise class mailing solution at the latter’s head office.

JSW Steel: The board of directors will convene on May 19 to consider a dividend on the company’s shares, raising long-term funds via qualified institutions placement of permissible securities, issuance of non-convertible senior unsecured fixed rate bonds in the international markets and issuance of redeemable non-convertible debentures, or other permissible means.

Easy Trip Planners: The company’s board approved identification and acquisition of certain entities and companies in domestic and overseas jurisdictions to drive inorganic growth. It also approved incorporation of a wholly owned subsidiary for venturing into the general insurance business.

Aarti Industries: The company’s consolidated revenue was up 15.24% Yoy at Rs 1,656 crore in Q4FY23. Ebitda fell 3.82% Yoy to Rs 252 crore in the quarter under review. Consolidated net profit was up 2.05% YoY at Rs 149 crore in Q4FY23. The board has recommended a final dividend of Rs 1.50 per share for the fiscal ended March 2023.

Apollo Pipes: The company said revenue rose 1.81% YoY to Rs 251.94 crore in Q4FY23. Ebitda was up 3.74% YoY to Rs 29.43 crore in Q4FY23. Net profit slipped 3.65% to Rs 15.03 crore in the quarter under review. The company declared a final dividend of Rs 0.60 per share for the fiscal ended March 2023.

Sterling Tools: The company’s consolidated revenue rose 24.93% Yoy to Rs 211.67 crore in Q4FY23. Ebitda jumped 29.67% YoY to Rs 22.42 crore in Q4FY23. Consolidated net profit was up 13.08% YoY to Rs 7.78 crore in Q4FY23. The board recommended a final dividend of Rs 2 per share.

Andhra Paper: The company’s revenue was up 38.56% YoY to Rs 590.16 crore in Q4FY23. Ebitda surged 179.54% YoY to Rs 228.61 crore in Q4FY23. Consolidated net profit jumped 167.93% YoY to Rs 153.9 crore in Q4FY23. The board of directors recommended a final dividend of Rs 12.50 per share.

VIP Industries: The company’s consolidated revenue rose 26.6% to Rs 450.57 crore in Q4FY23. Ebitda jumped 97.3% YoY to Rs 64.28 crore in Q4FY23. The company posted a consolidated net loss of Rs 4.26 crore as against a net profit of Rs 12.39 crore in the year-ago period as it reported an exceptional expense of Rs 47.21 crore during the quarter ended March 2023.

HFCL: The company’s consolidated revenue rose 21.13% YoY to Rs 1,432.98 crore in Q4FY23. Ebitda jumped 24.44% YoY to Rs 154.43 crore in Q4FY23. Consolidated net profit was up 9.95% YoY at Rs 71.82 crore in Q4FY23. The company has declared a dividend of Rs 0.20 per share.

Ugar Sugar Works: The company’s consolidated revenue was up 67.45% YoY at Rs 608.47 crore in Q4FY23. Ebitda rose 267.09% YoY at Rs 105.06 crore in Q4FY23. Consolidated net profit rose 339.76% YoY at Rs 65.26 crore in Q4FY23 from Rs 14.84 crore in the year-ago period. The board recommended 50% as dividend for the fiscal 2023 out of current year’s profits.