Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.06% at 20,229.50, signalling that Dalal Street was headed for positive start on Friday.

Asian shares were trading higher after investors’ optimism was boosted due to better-than-expected industrial production and retail sales data. The Nikkei 225 index jumped 1.34% and the Topix rose 1.25%. China’s CSI 300 index gained 0.16% and the Hang Seng soared 1.56%.

The Indian rupee fell 5 paise to 83.04 against the US dollar on Thursday.

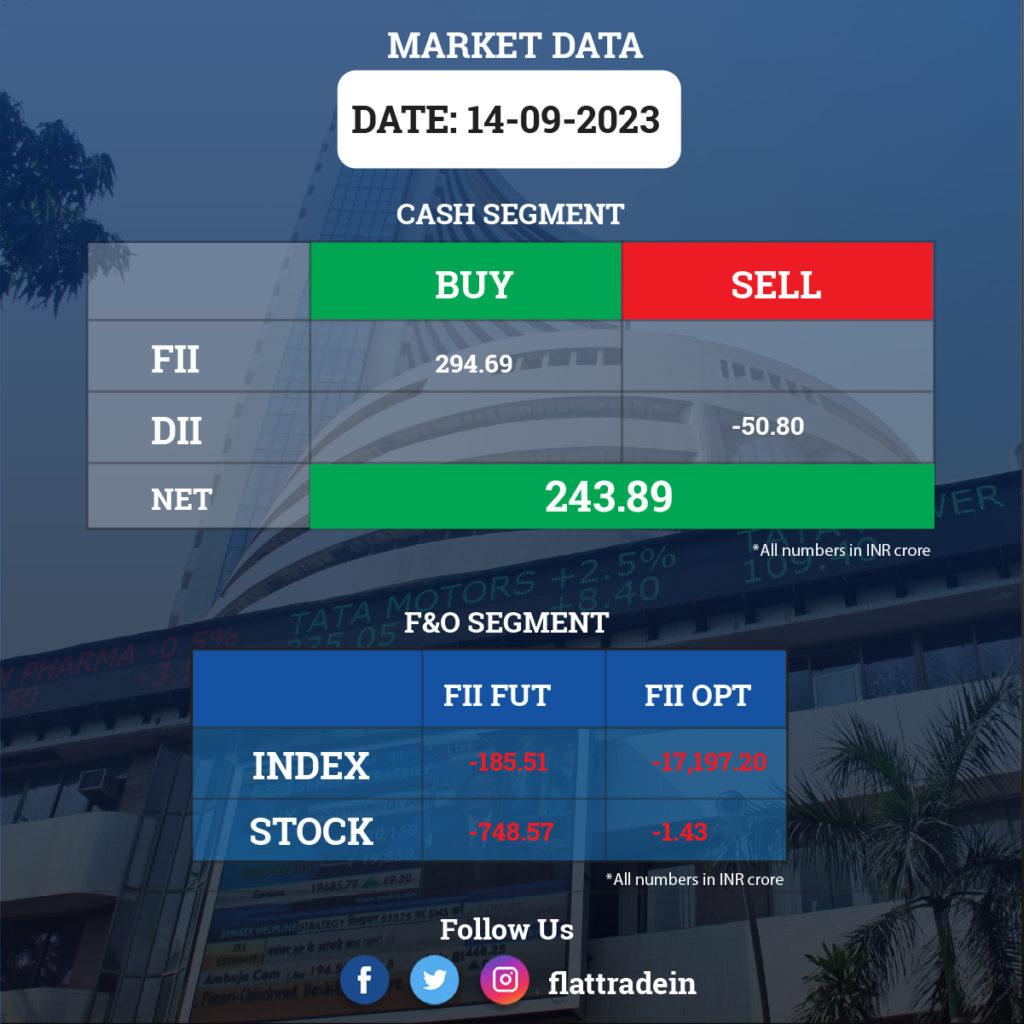

FII/DII Trading Data

Stocks in News Today

NTPC: The state-owned power generation company has signed a supplementary joint venture agreement with Uttar Pradesh Rajya Vidyut Utpadan Nigam (UPRVUNL), to take up joint development of two thermal projects in Uttar Pradesh. The company and UPRVUNL had signed a JV agreement in 2008 for formation of a company named Meja Urja Nigam (MUNPL).

Tata Power: The company’s subsidiary Tata Power Renewable Energy has signed a power delivery agreement (PDA) with Xpro India, through a special purpose vehicle (SPV), for the development of a 3.125 MW AC group captive solar plant. The SPV will develop, operate, and maintain the said captive solar power facility. The said plant, in Achegaon (Maharashtra) is expected to produce 7.128 million units of electricity annually and will support the use of renewable energy for Xpro India’s polymer processing business.

Bharat Forge: UAE-headquartered global aerospace and technology company Paramount announced that its manufacturing partnership with Indian industrial conglomerate, Bharat Forge and Kalyani Strategic Systems would be expanded to produce a wider range of armoured vehicles in India for Paramount’s global customers. The partnership includes the development and production of 4×4 and 6×6 infantry combat vehicles for global customers.

Alkem Laboratories: The Income Tax Department is conducting a survey at some of company’s offices and subsidiaries. The company said it is fully cooperating with the officials of the IT Department and this would have no impact on the operations of the company.

Bank of Maharashtra: The public sector lender informed that it has received total bids of Rs 760 crore for its issue of Basel III-compliant Tier 2 bonds on a private placement basis. It has accepted a bid of Rs 515 crore, including a base issue of Rs 250 crore and a green shoe option retained up to Rs 265 crore, at a coupon rate of 7.98%.

Sona BLW Precision Forgings: The board has approved an investment of $1.6 million in one or more tranches in the form of share capital in its wholly owned subsidiary in Mexico.

United Spirits: The company has filed an appeal against an order passed by the Additional Commissioner of Commercial Taxes (Enforcement) in the matter pertaining

to the applicability of GST rate on royalty income for the period from September 2017 to September 2021. The quantum of claims is Rs 57.8 crore and the company said it does not expect any financial implications

PI Industries: The company has entered into a strategic alliance with Koppert to foster advancements in sustainable agriculture practices and jointly innovate in the domain of agriculture biologicals.

Lemon Tree Hotels: The company signed licence agreements for two hotel properties in Junagadh, Gujarat, and Chitwan, Nepal, under the brands “Lemon Tree Hotel” and “Lemon Tree Resort,” respectively. The former is expected to be operational by FY25 and the latter by FY24 itself, and both the hotel properties will be managed by Carnation Hotels.

Schneider Electric Infrastructure: The company said its board has approved the appointment of Udai Singh as MD & CEO for three years with effect from September 15. In addition, Arnab Roy resigned as non-executive director of the company effective from September 14.

Strides Pharma Science: The company’s subsidiary Strides Pharma Global Pte Limited, Singapore has received tentative approval for Dolutegravir 50mg tablets from the United States Food & Drug Administration (USFDA). The product is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Tivicay tablets of ViiV Healthcare Company. The tablets used for antiretroviral therapy in HIV patients.

SeQuent Scientific: The company’s board has decided to sell its active pharmaceutical ingredient unit at Thane and has appointed Grant Thornton Bharat LLP, as Internal Auditors of the company.

Clean Science and Technology: The company has subscribed to an additional 11.70 lakh equity shares, each at a premium of Rs 588, aggregating to Rs 70 crore by way of subscription to the rights issue of Clean Fino-Chem, a wholly owned subsidiary. The additional capital will be used to fund its greenfield projects.

GMM Pfaudler: The company will acquire Canada-based Professional Mixing Equipment (MixPro) for $7 million through its U.S. subsidiary. MixPro designs manufactures innovative mixing solutions for a wide range of industrial applications.

Shoppers Stop: The retailer said that it will commence operations from its new Intune Store at Irrum Manzil Hyderabad w.e.f. September 15, 2023.

Gufic Biosciences: The company informed that it has been granted patent for an invention entitled “A Freeze Dried Parenteral Composition Of Omadacycline Tosylate And Process For Preparation” on September 14, 2023, for the term of 20 years effective from April 19, 2021.

Patel Engineering: The company along with its joint venture has been declared the lowest bidder for an irrigation project of Rs 249.96 crore from Maharashtra Krishna Valley Development Corp. to construct a pipeline distribution network in Satara. The company’s share in the contract is 40% or Rs 99.98 crore.