POST-MARKET REPORT

The Nifty extended its decline to a seventh straight session, its longest losing streak since February 2023, as IT and energy stocks faced sharp sell-offs. The Sensex also endured a volatile day, fluctuating by 900 points.

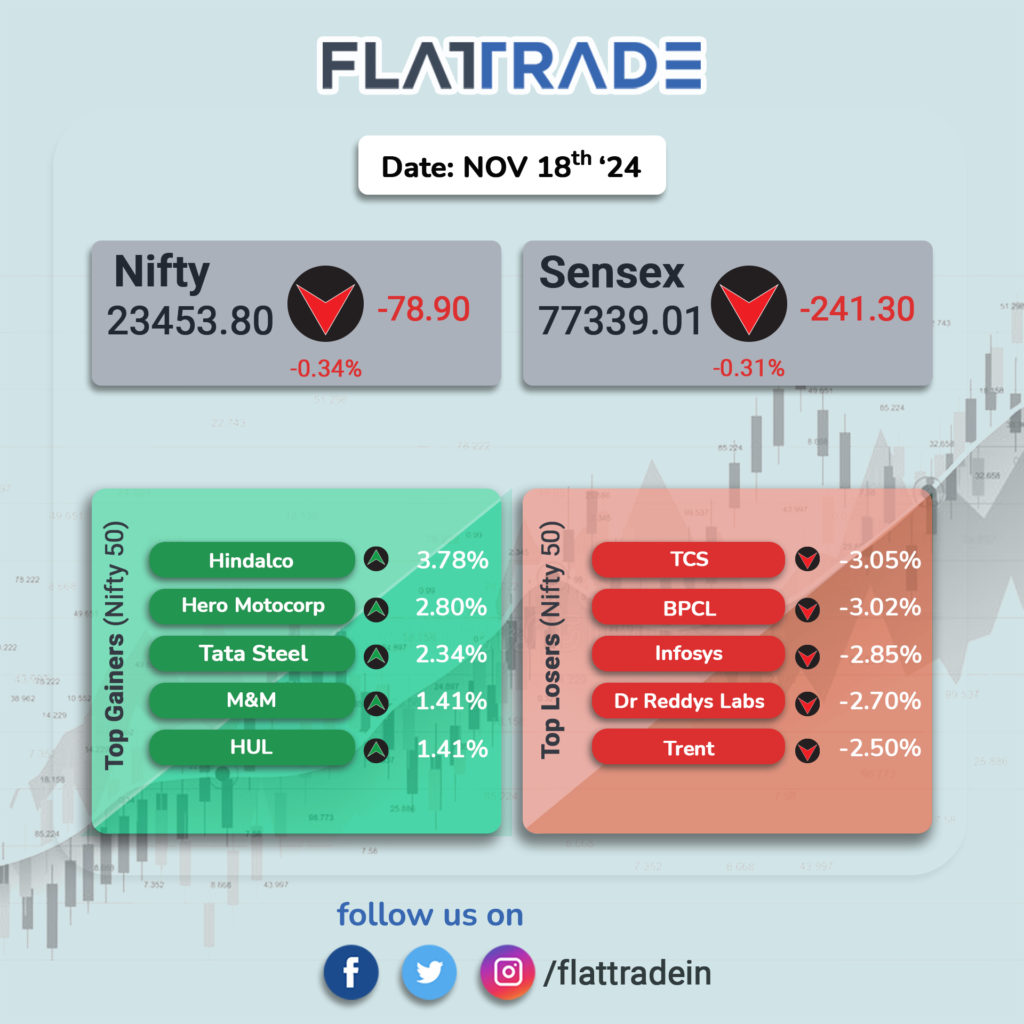

At close, the Sensex was down 241 points or 0.3 percent at 77,339, and the Nifty was down 79 points at 23,454. About 1,560 shares advanced, 2,361 shares declined, and 124 shares remained unchanged.

Among sectors, IT, healthcare, and energy shed 0.8-2.3 percent, while metal, banking, and auto rose 0.4-2 percent.

BPCL, TCS, Infosys, Trent, and Dr Reddy’s Labs were the biggest losers on the Nifty 50 index, falling 2.5-3 percent. Meanwhile, Hindalco, Hero MotoCorp, Tata Steel, HUL, and M&M were the top gainers, rising 1.5-4 percent.

In the broader market, the BSE Midcap index fell 0.2 percent and the BSE Smallcap index was down by 0.7 percent.

STOCKS TODAY

Muthoot Finance: Shares of India’s largest gold financier Muthoot Finance are higher by nearly 8% on the back of a strong quarterly profit growth, the MFI crossing the Rs 1 lakh crore AUM milestone, and a robust demand for gold loans in light of RBI’s restrictions on unsecured lending. Its gold loan AUM too is at a record high.

Crompton Greaves Consumer Electrical: Crompton Greaves Consumer Electrical shares rose 4 percent after the company reported an increase in its consolidated net profit and revenue for the quarter ended September. The company posted a 26 percent YoY increase in consolidated net profit, reaching Rs 125 crore, while revenue from operations rose 6.4 percent on-year.

Hero MotoCorp: Hero MotoCorp shares rose over 3 percent after brokerages like Jefferies, Nomura, and Nuvama Institutional Equities reiterated their ‘Buy’ ratings, citing rural demand recovery, upcoming launches, and margin improvements as key growth drivers.

NALCO: NALCO, along with other metal players, saw its shares surge as China decided to reduce or cancel export tax rebates for select products made of aluminium and copper. Any reduction in Chinese exports could tighten the global supply of these products and may increase prices since China is the world’s largest producer of aluminium as well as alumina.

Brainbees Solutions: Brainbees Solutions shares rose 10 percent as the company narrowed its losses in Q2FY25 to Rs 63 crore from Rs 119 crore in the year-ago period. The company posted a revenue of Rs 1,900 crore in Q2FY25, a 26 percent increase from Rs 1,500 crore generated in the same quarter last year.

IGL: City gas distribution companies such as MGL shares crashed after the government cut the Administered Price Mechanism (APM) allocation to CGD players by 20 percent for the second month in a row. IGL has reported 10 percent additional cuts, respectively, over the ~20 percent cut which was announced earlier on October 16.