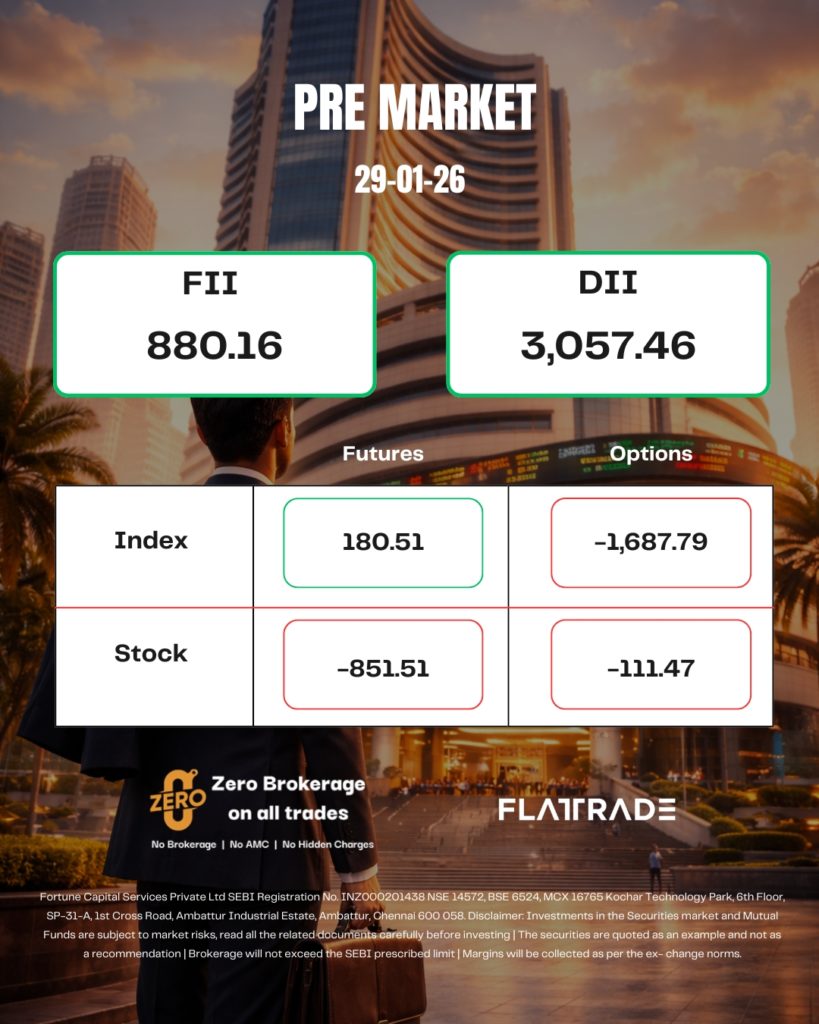

PRE MARKET

Gift Nifty indicates a negative start for the broader index in India, with a loss of 63.5 points or 0.25 percent. The Nifty futures were trading around the 25,363 level.

The Nasdaq rose slightly with a boost from chip stocks, while the S&P 500 closed virtually unchanged on Wednesday as investor reactions were muted after the Federal Reserve kept interest rates unchanged as expected and gave little indication when borrowing costs might fall again.

The Dow Jones Industrial Average rose 12.19 points, or 0.02%, to 49,015.60, the S&P 500 lost 0.57 points, or 0.01%, to 6,978.03, and the Nasdaq Composite gained 40.35 points, or 0.17%, to 23,857.45.

Asia’s runaway stock markets took a breather on Thursday as mixed earnings out of the tech sector stirred caution ahead of Apple’s results, while the dollar looked shaky despite verbal support from both U.S. and European officials.

Japan’s Nikkei went up +0.03 percent, while Hong Kong’s Hang Seng and the Taiwanese weighted index went down -0.15 and -0.53 percent, respectively.

STOCKS IN NEWS

Rail Vikas Nigam

The Rail Vikas Nigam-GPT joint venture emerged as the lowest bidder from Northern Railway for a project worth Rs 1,201.35 crore. The project involves the design and construction of 11 new rail-cum-road bridges over the River Ganga, located 50 metres downstream of the existing old Malviya Bridge near Kashi Railway Station. The bridges will accommodate four railway tracks on the lower deck and a six-lane road on the upper deck, including railway and road approaches, along with associated OHE and general electrical works, in the Lucknow Division of Northern Railway at Varanasi, Uttar Pradesh.

Wipro

The AI-powered technology services and consulting company has partnered with Factory, a leading agent-native software development platform and a portfolio company of Wipro Ventures, to help enterprises operationalize agent-native development across their engineering organizations. Wipro Ventures, the corporate investment arm of Wipro, also announced its participation in Factory’s recent funding round.

Vedanta

Vedanta has decided to exercise the oversubscription option in the offer-for-sale to the extent of 1.4 crore shares of Hindustan Zinc, in addition to the base offer size of 3.35 crore shares, on January 29. With this, the total offer size will increase to 4.75 crore shares, representing 1.13 percent of the paid-up equity.

Cupid

The healthcare and consumer products company has received CE (EU IVDR) certification for two in-vitro diagnostic (IVD) products—the CupiKIT HIV 1&2 antibody test kit and the CupiKIT Hepatitis B surface antigen (HBsAg) test kit. These approvals enable Cupid to market the certified products across the European Economic Area (EEA) and other CE-recognized international markets.

Max Financial Services

The Board of Directors of Max Financial Services has granted in-principle approval for a potential amalgamation between the company and Axis Max Life Insurance (AMLI), a subsidiary of the company. Shareholders of the company will be issued shares in AMLI based on a share entitlement ratio (to be determined), subject to approvals from Axis Bank, Axis Securities, and Axis Capital, which collectively hold a 19.02 percent stake in AMLI.

Source – Moneycontrol