Market Opening - An Overview

GIFT Nifty Futures on the NSE IX were trading 0.26% higher at 19477.50, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were trading lower as investors were on the sidelines awaiting US inflation data and earning report from big tech companies this week. The Nikkei 225 index fell 0.81% and the Topix dropped 0.42%. The Hang Seng lost 0.72% and the CSI 300 index shed 0.65%.

The Indian rupee rose 13 paise to close at 83.12 against the US dollar on Friday.

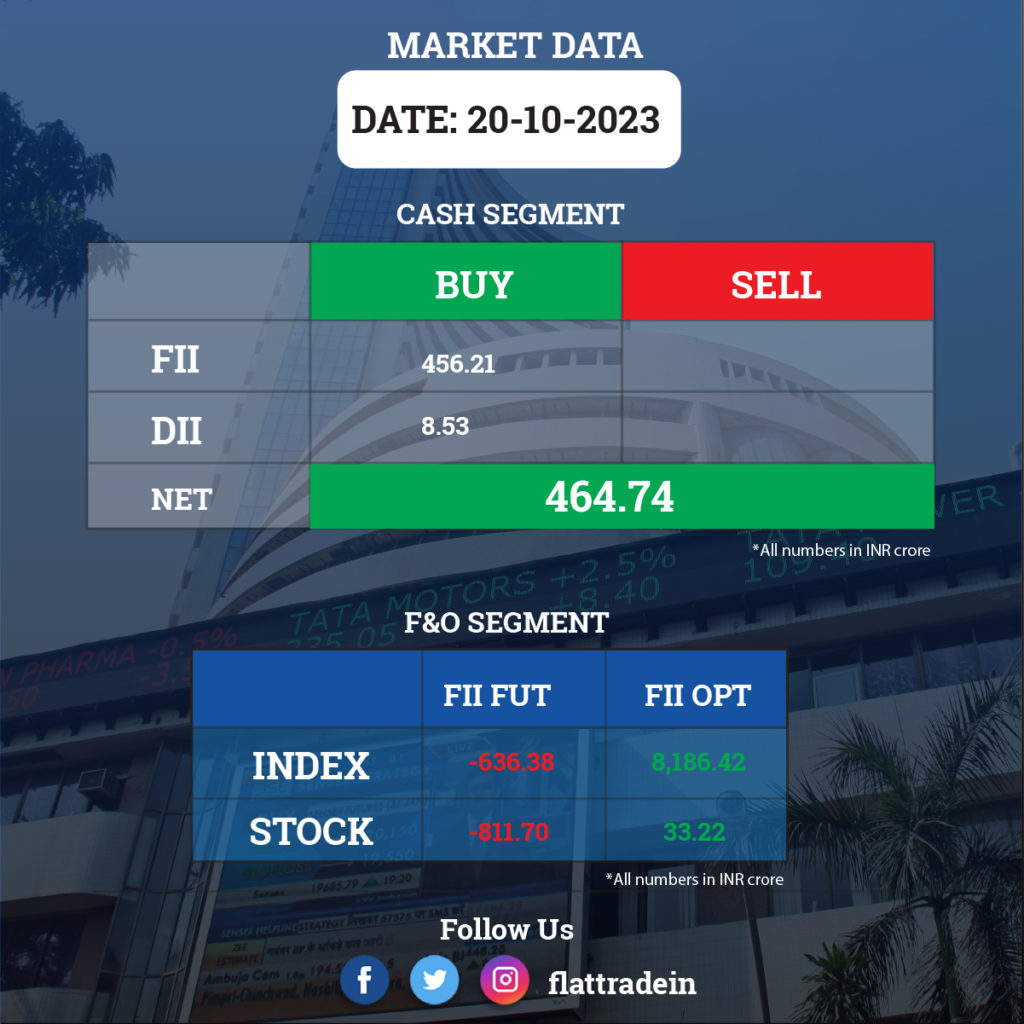

FII/DII Trading Data

Stocks in News Today

ICICI Bank: The private sector lender has recorded a 35.8% YoY growth in standalone profit at Rs 10,261 crore for the quarter ended September FY24. Net interest income for the quarter under review was at Rs 18,308 crore, up 23.8% YoY. Net interest margin rose 22 bps YoY to 4.53%. Total income for the quarter increased 31% on year to Rs 40,697 crore. Net NPA ratio was 0.43%, lower than 0.61% a year ago.

Kotak Mahindra Bank: The private sector lender has recorded a 24% YoY growth in standalone profit at Rs 3,191 crore for the quarter ended September FY24. Net interest income grew 23.5% YoY to Rs 6,297 crore, while Net interest margin (NIM) was 5.22% in the September quarter. Operating profit grew 29% YoY to Rs 4,610 crore in Q2FY24. Net non-performing assets ratio as of September end was 0.37% in Q2FY24, compared to 0.55% in Q2FY23. The current account savings account (CASA) ratio as of September end stood at 48.3%.

One 97 Communications (Paytm): The fintech major has narrowed its losses to Rs 290 crore in Q2FY24, compared with Rs 571 crore in the year-ago period. Revenue from operations during the quarter under review jumped 32% YoY to Rs 2,518.6 crore as against Rs 1,914 crore in the year-ago period. The gross merchandise value (GMV) from the payments segment surged 41% YoY to Rs 4.5 lakh crore. The merchant paying subscriptions for devices reached 92 lakh at the end of the September quarter. In the loan distribution business, revenue from financial services and others increased 64% YoY to Rs 571 crore.

JSW Energy: The company posted an 82.6% YoY growth in consolidated profit at Rs 850.2 crore for the quarter ended September FY24 driven by robust contribution from the acquired renewable energy portfolio, merchant sales and hydro truing up impact. Revenue from operations grew by 36.5% YoY to Rs 3,259 crore for the quarter. The company has appointed Ashok Ramachandran as COO effective October 20.

IDBI Bank: The company reported a 60% YoY rise in net profit for the quarter ended September to Rs 1,323.27 crore. Total income from operations increased by over 14% YoY to Rs 6,924.18 crore in Q2FY24. Net interest income rose 12% YoY to Rs 3,066.49 crore in Q2FY24. Net non-performing assets ratio in Q2FY24 stood at 0.39%, down from 1.16% a year ago. Net interest margin for the quarter at 4.33%, was down 4 basis points year-on-year.

Yes Bank: The private sector lender has reported a net profit of Rs 225 crore for quarter ended September FY24, 47.4% YoY rise. Total income from operations increased by 25% YoY to Rs 7,921 crore in Q2FY24. Net interest income declined 3.3% YoY to Rs 1,925 crore, while net interest margin improvd 39 bps YoY to 4.89% during the quarter. Net non-performing assets ratio in Q2FY24 was 0.9%, compared to 3.6% in the same period a year ago. Provisions and contingencies for the reported quarter was Rs 500 crore, compared to Rs 583 crore a year ago.

Central Bank of India: The public sector lender’s net profit jumped to Rs 605 crore in the quarter ended September 2023 from Rs 318 crore in the year-ago period on the back of strong loan growth. Total advances increased 17% to Rs 2.31 lakh crore led by a robust growth in both the corporate and retail segments. Net interest income (NII) increased 10% to Rs 3028 crore, while Net interest margin (NIM) stood at 3.43% during the reported quarter. Total expenses increased 29% to Rs 6,881 crore due to higher operating expenses, but a tax writeback of Rs 42 crore during the quarter boosted the bank’s profit.

Ipca Laboratories: The manufacturing facility at Ratlam, Madhya Pradesh has received Establishment Inspection Report from the USFDA classifying it as Voluntary Action Indicated (VAI). The said facility is considered to be in a minimally acceptable state of compliance with regard to current good manufacturing practice (CGMP). The US health regulator conducted an inspection of the Ratlam facility from June 5-13.

L&T Finance Holdings: The company registered a 46% increase in net profit at Rs 595 crore in Q2FY24, up 46% year-on-year, helped by strong performance in retail loans segment. The company recorded its highest ever quarterly retail disbursements of Rs 13,499 crore, up 32% YoY. Retail portfolio mix now stands at 88% of the total loan book against the company’s target of 80% by 2026.

Poonawalla Fincorp: The company’s consolidated net profit surged multifold times to Rs 860 crore in the quarter ended September 2023 from Rs 163 crore in the eyar-ago period. The rise in profits were due to company’s sale of its housing finance business and a robust loan disbursement during the reported quarter. During the quarter under review, the company more than doubled its disbursement to Rs 7,807 crore. Assets under management increased 54% to Rs 20,215 crore.

JSW Steel: The company’s board has approved the proposal to acquire the remaining 10% stake in JSW USA by Periama from Green Suppliers and Services Pte Limited. On completion of the transaction, JSW USA will become a wholly owned subsidiary of the company.

Adani Energy Solutions: The company has received smart meter LOAs worth Rs 17,000 crore. The company added 219 circuit kilometers to operational network and also sold 2,446 million units, up 9.53% year-on-year. Adani Green Energy announced the resignation of Ahlem Friga-Noy as nominee director w.e.f. October 23.

Zydus Lifesciences: The USFDA has approved the company’s New Drug Application (NDA) for ZITUVIO (Sitagliptin) tablets which contains the active ingredient sitagliptin, a dipeptidyl peptidase-4 (DPP-4) inhibitor indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus.

Power Grid Corporation of India: The company will invest Rs 119.95 crore in its Eastern Region Expansion Scheme and the project is to be commissioned within 24 months from the date of allocation by NCT.

Tata Power: Tata Power Renewable Energy Limited (TPREL), a subsidiary of Tata Power, has signed a Power Delivery Agreement (PDA) with Supreme Petrochem Limited for a 12.5 MW group captive project through a SPV – TP Saturn Limited. Located in Achegaon, Maharashtra, the plant will generate around 27.5 million units (MUs) of renewable power annually.

ONGC: With a vision to expand its business in the Renewable Energy, ONCG had participated in bidding process for acquisition of 100% equity stake of PTC Energy Limited (PEL), a wholly owned subsidiary of PTC India Limited (PTC).

Aditya Birla Fashion and Retail: The company’s unit plans to buy a 51% stake in Styleverse Lifestyle for Rs 155 crore. The acquisition is part of the company’s expansion strategy of digital-first brands.

Astral: The company has completed the acquisition of 80% shares of Gem Paints through 51% against redemption of optionally convertible debentures amounting to Rs 194 crores and 29% towards the second tranche. The remaining 20% equity stake will be acquired in the next five years.

LIC: The insurer said that it has increased its stake in Housing & Urban Development Corporation from 10.45 crore shares to 17.82 crore shares, rising the stake from 5.22% to 8.90%.

Paras Defence: The company’s board has approved the incorporation of a wholly owned subsidiary named Quantico Technologies, which will develop end-to-end solutions for Quantum Technologies (who is associated with United States and is included in the 5th Positive Indigenisation List).

Balkrishna Industries: The tyre company has reported a 9.1% YoY fall in net profit at Rs 347.4 crore in Q2FY24. Revenue from operations fell 15.2% YoY to Rs 2,253.2 crore for the quarter.

Sheela Foam: The company informed that it has completed the acquisition of 94.66% of the share capital of Kurlon Enterprise Limited for an aggregate consideration of approximately Rs 2035 crore, subject to customary post-closing adjustments, including for net working capital, debt and surplus cash.

Himadri Specialty Chemical: NCLT, Kolkata Bench, has approved the resolution plan submitted jointly by Himadri Speciality Chemical and Dalmia Bharat

Refractories for acquisition of Birla Tyres Limited under the corporate insolvency resolution process (“CIRP”) in terms of the Insolvency and Bankruptcy Code, 2016.

Arvind SmartSpaces: The Lalbhai Group company has signed a new residential apartment project in Bengaluru, with a total estimated saleable area of around 4.6 lakh square feet and a topline potential of around Rs 400 crore.

Sterling and Wilson Renewable Energy: The company said its consolidated net loss narrowed to Rs 54.51 crore in the September 2023 quarter as against a net loss of Rs 298.71 crore during the September 2022 quarter. The company’s total income rose Rs 776.73 crore from Rs 410.80 crore a year ago. Its expenses increased to Rs 826.68 crore in Q2FY24 from Rs 719.20 crore in the same period last fiscal.

CreditAccess Grameen: The NBFC-MFI on Friday reported a 98% YoY jump in net profit at Rs 347 crore as against a net profit of Rs 175 crore in the year-ago quarter. The lender’s total income rose by 53% at Rs 1,248 crore, while net interest income rose nearly 50% at Rs 772 crore. The lender’s gross loan portfolio grew 36% YoY to Rs 22,488 crore, while the customer base expanded 21% to 46.03 lakh at the end of September.

Oberoi Realty: The real estate developer has announced total bookings of 151 units in Q2FY24 against 132 units in the year-ago period. The total area booked was at 2.20 lakh square feet (sft) for the quarter against 2.33 lakh sft in the same period last year. Total booking value for the quarter was Rs 965 crore, a fall of 16.5% compared to the year-ago period.