POST-MARKET REPORT

Indian benchmark indices closed in the red on Wednesday, weighed down by weak sentiment ahead of the release of crucial inflation data in the US.

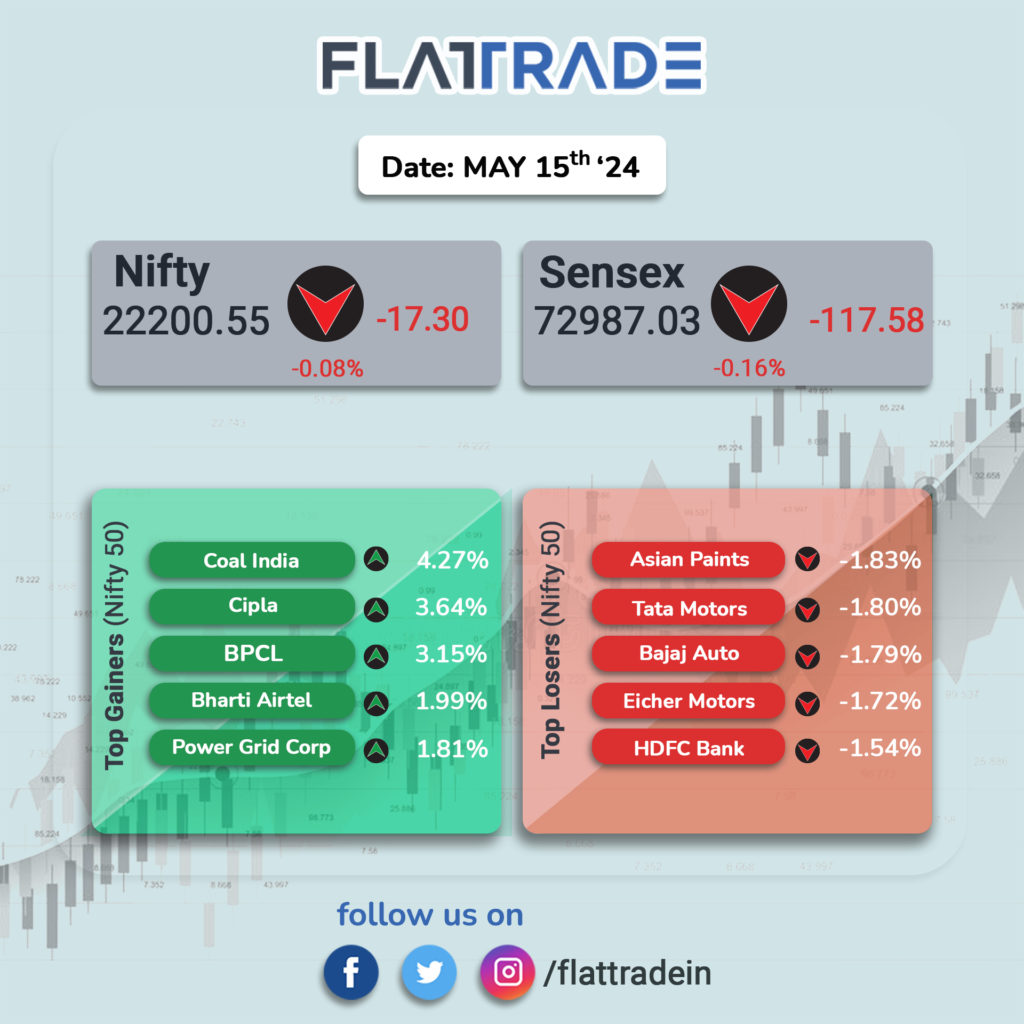

At close, Sensex was down 117.58 points, or 0.16%, at 72,987.03 while the Nifty 50 was down 17.30 points, or 0.03%, at 22,200.55.

Gainers and Losers on Nifty: 22 of the 50 stocks on the Nifty 50 were trading in the green. Coal India, Cipla, BPCL, Power Grid Corp., and Bharti Airtel, were the top gainers, while Asian Paints, Eicher Motors, Tata Motors, Bajaj Auto, and HDFC Bank, were the top drags.

Gainers and Losers on Sensex: 17 of the 30 stocks on the BSE Sensex were trading in the red. Asian Paints, HDFC Bank, Tata Motors, Sun Pharma, and JSW Steel, were the top drags, while Power Grid Corp., Bharti Airtel, NTPC, Mahindra & Mahindra, and Larsen & Toubro, were the top gainers.

Sectoral indices performance: Among sectoral indices, the Nifty PSU Bank Index led gainers, up 1.4%, followed by Nifty Realty and oil & gas, both up 1%. Nifty FMCG Index was the top loser, down 1%, with Nifty Auto down 0.5%. Nifty Bank and Nifty Private Bank indices slipped 0.3% each.

Broader indices today: The broader market indices were trading in the green, with the BSE SmallCap gaining 0.98%, and the BSE MidCap was up 0.64%.

STOCKS TODAY

Cipla: Shares of Cipla soared 3.5 percent after three block deals in the counter took place on the exchanges. Around 2.04 crore shares, making up a 2.52 percent stake in the drugmaker changed hands in the three block deals. Cipla later confirmed that its promoters, the Hamied family sold a 2.5 percent stake in the drugmaker.

Power Finance Corp: Power Finance Corp shares surged 3.8 percent after the company reported an 18.4 percent year-on-year jump in its net profit to Rs 4,135 crore for the March quarter. The firm’s revenue grew 20 percent to Rs 12,243.7 crore. The asset quality also improved as net non-performing assets (NPAs) came down to 0.85 percent and gross NPA was down to 3.34 percent.

Siemens: Shares of Siemens surged 6.4 percent on May 15 to hit a 52-week high of Rs 7,240 apiece on the National Stock Exchange (NSE) after the company’s March quarter results beat street estimates, aided by strong margin performance and higher other income leading to a sharp beat on profit. According to analysts, Siemens is better placed to benefit from robust railway/metro capex, especially on large system order potential.

Jyothy Lab: The FMCG firm’s shares tumbled 3.8 percent even as it reported a 32.5 percent jump in its consolidated net profit at Rs 78 crore for the fourth quarter ending March 31, 2024, as against Rs 59 crore in the year-ago period. Its revenue from operations stood at Rs 660 crore in the quarter under review, compared to Rs 617 crore in the year-ago period.

Thirumalai Chemicals: The stock tumbled 4.8 percent to Rs 254 per share on May 15 after the company’s net loss amounted to Rs 20.47 crore in the quarter ended March 2024 as against a net loss of Rs 12.84 crore during the previous quarter ended March 2023. However, sales rose 22.18 percent YoY to Rs 526.52 crore in Q4FY24.

Archean Chemical: Shares of the company slipped over 3.8 percent to Rs 596 per share after the company reported a 56.4 percent YoY fall in net profit to Rs 59.64 crore in Q4FY24. Net sales also saw a 25.9 percent YoY decline to Rs 283.39 crore in Q4FY24 as compared with Q4FY23.

Andhra Paper: Shares of the paper and pulp manufacturers dropped 2.4 percent to Rs 502.05 per share on the BSE on May 15. The fall came a day after the company announced its March quarter results for FY24 (Q4FY24), along with a stock split and dividend announcement.