POST MARKET

Indian equity indices snapped a three-day losing streak to end higher, as value buying in select sectors lifted investor sentiment.

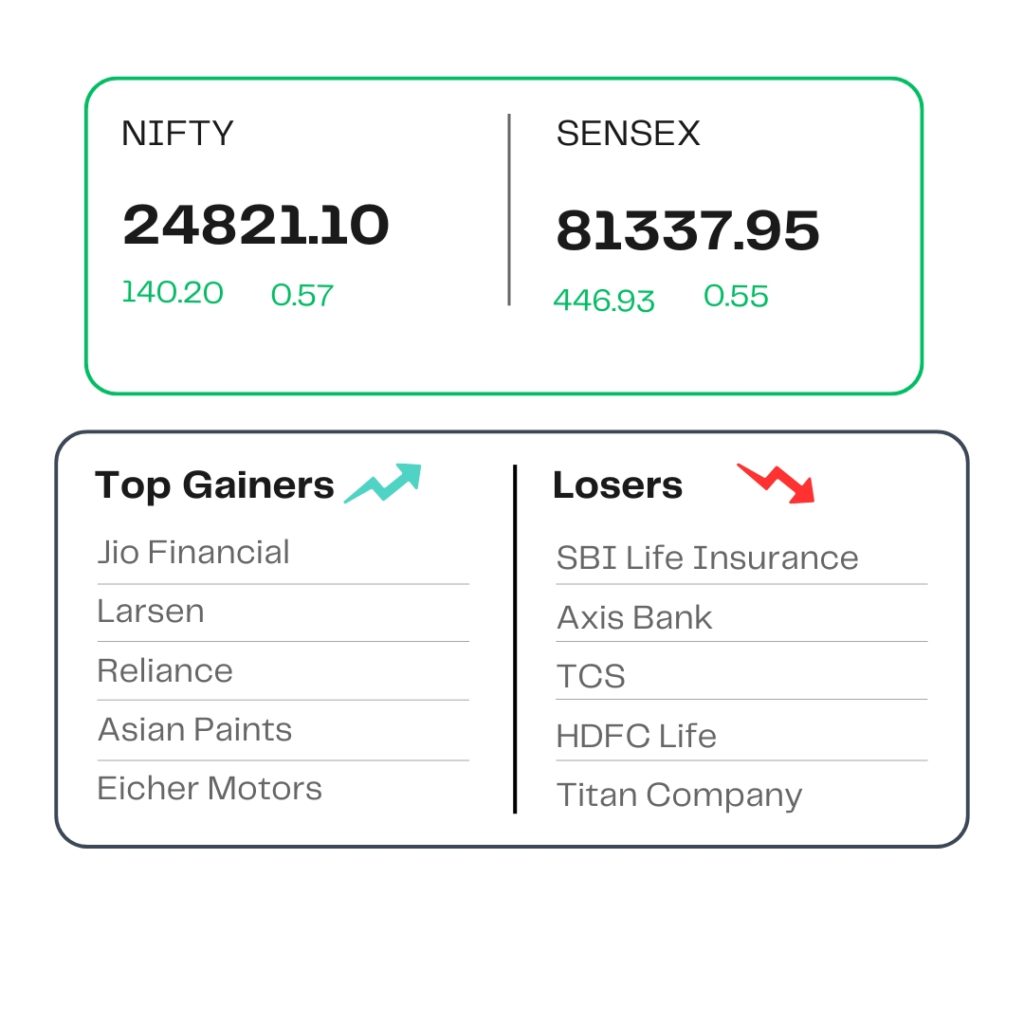

At close, the Sensex was up 446.93 points or 0.55 percent at 81,337.95, and the Nifty was up 140.20 points or 0.57 percent at 24,821.10. About 2399 shares advanced, 1451 shares declined, and 141 shares remained unchanged.

Biggest Nifty gainers included Jio Financial, Reliance Industries, L&T, Asian Paints, Eicher Motors, while losers were SBI Life Insurance, TCS, Axis Bank, HDFC Life, Titan.

All the sectoral indices ended in the green with Realty, Pharma, and Oil & Gas up 1 percent each.

The broader markets outperformed, snapping a multi-session spiral, indicating strong buying interest across all market capitalizations. The BSE midcap index rose 0.8 percent and the smallcap index added 1 percent.

STOCKS TODAY

IndusInd Bank

Shares of private lender IndusInd Bank gained 2% intraday after it reported better-than-expected results for the first quarter. The lender reported a 68 percent decline in standalone net profit at Rs 684 crore, hurt by a decline in loans and a rise in provisions for potential bad loans. On a consolidated basis, net profit fell 72 percent year-over-year to Rs 604 crore.

BEL

Shares of Bharat Electronics fell 3% intraday after the company’s profit jumped 25 percent year-on-year, but witnessed a sequential decline. The state-run defence electronics firm reported a standalone net profit of Rs 969.13 crore for the quarter ended June 2025, up 25 percent from Rs 776.14 crore a year ago. Revenue from operations also edged higher by 5.2 percent to Rs 4,416.83 crore compared to Rs 4,198.77 crore in the same period last year. The stock later recovered all losses to close in the green.

Adani Power

Adani Power shares rose nearly 4% after the Adani Group company said its board will mull a stock split on August 1. Adani Power will also declare its June quarter results on August 1.

Paras Defence

Paras Defence shares dropped nearly 6% intraday to trade at Rs 664 apiece. This comes a day after the stock dropped 10 percent to remain locked at the lower circuit after releasing its results for the first quarter of the financial year 2026. The company’s net profit rose marginally on-year, but fell nearly 25 percent sequentially to Rs 14.87 crore during the quarter under review.

PNC Infratech

PNC Infratech share price rose over 6.5 percent on July 29 after the company bagged an order worth Rs 2,957 crore from South Eastern Coalfields for handling, transport, and other mining services.

Source – Money Control