POST MARKET

Benchmark indices ended flat, as investors turned cautious ahead of likely developments around the US-India trade deal expected later this evening.

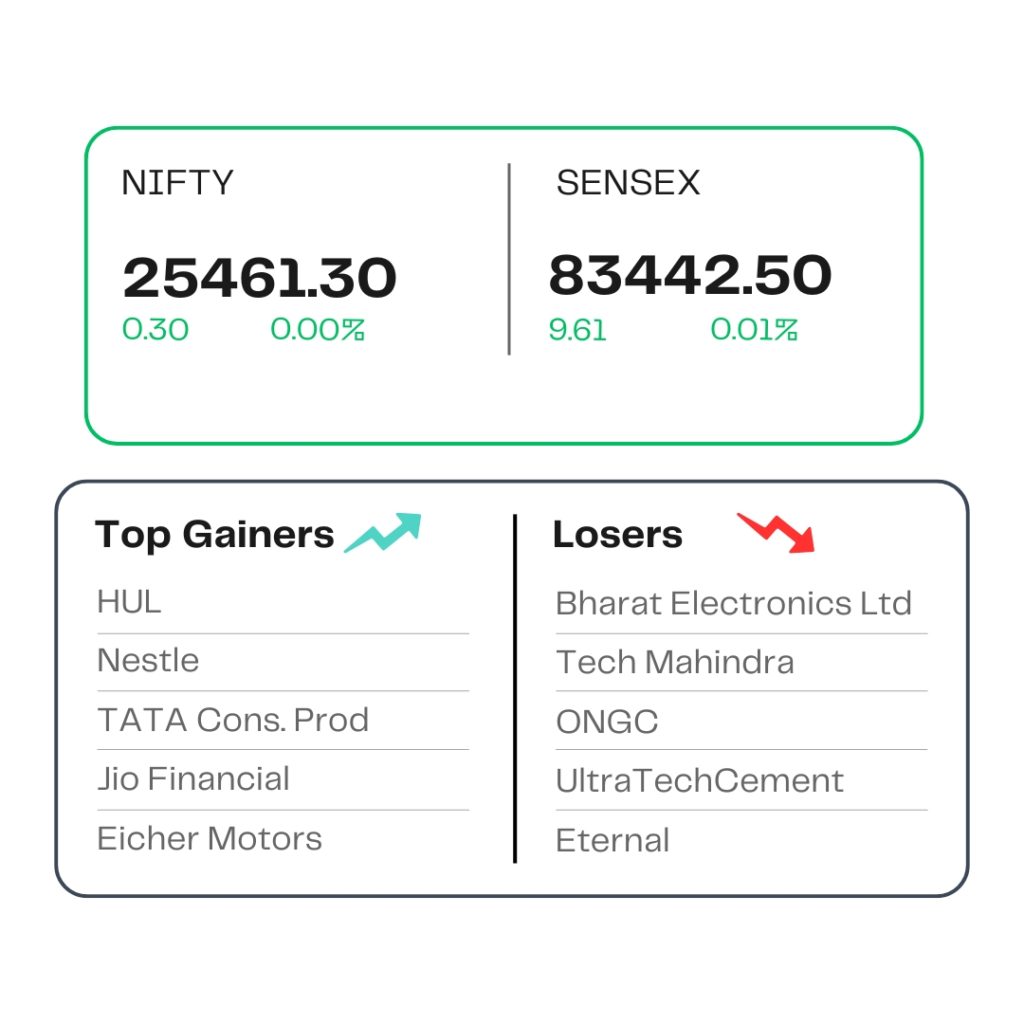

At close, the Sensex was up 9.61 points or 0.01 percent at 83,442.50, and the Nifty was up 0.30 points at 25,461.30. About 1617 shares advanced, 2294 shares declined, and 182 shares remained unchanged.

Tech Mahindra, Bharat Electronics, UltraTech Cement, ONGC, and Eternal were among the major losers on the Nifty, while losers were HUL, Tata Consumer, Nestle India, Jio Financial, and Eicher Motors.

Among sectors, the FMCG index rose 1.6 percent, the oil & gas index gained 0.4 percent, while the media index went down 1 percent, IT and Metal index down 0.7 percent each.

The broader market indices saw a downfall, with, Nifty Midcap index down 0.27 percent, while the smallcap index was down 0.4 percent.

STOCKS TODAY

Senco Gold

Shares hit the 5 percent upper circuit on July 7 after the company reported a strong Q1performance, driven by festive demand and showroom expansion. Total revenue rose 28 percent year-on-year, with retail revenue up 24 percent and same-store sales growth (SSSG) at 19 percent.

Nykaa

Stock rose 2 percent after it shared a business update for the first quarter that suggests stable growth momentum, even as external headwinds weighed on sales events. The company expects its consolidated revenue to grow at the lower end of the mid-20 percent range in Q1, while overall GMV growth is projected to surpass that, continuing its multi-quarter run of solid performance.

Trent

Shares of Tata Group’s apparel giant Trent gained over a percent to snap its two-day losing streak after Bernstein maintained an Outperform rating on the counter. The brokerage noted that the company’s Q1 update confirmed a 20 percent year-on-year revenue growth, but believes this should not be seen as the new normal.

Info Edge India

Shares fell over 5 percent on Monday, after its Q1 business update showed an 11.2 percent rise in standalone billings to Rs 644.2 crore. Recruitment billings grew 9 percent, while the real estate segment saw a 16 percent increase year-on-year.

Jubilant Foodworks

Shares declined 4 percent on July 7 after brokerages remained unenthused with the company’s Turkey like-for-like sales growth for Q1FY26. However, the company’s consolidated revenue increased 17 percent to Rs 2,261.4 crore in the June quarter.

Source – Money Control