POST MARKET

Benchmark equity indices continued the losing streak for a third consecutive session on July 11 over concerns of the impact of Trump tariffs and selling in IT shares after the TCS Q1FY26 earnings.

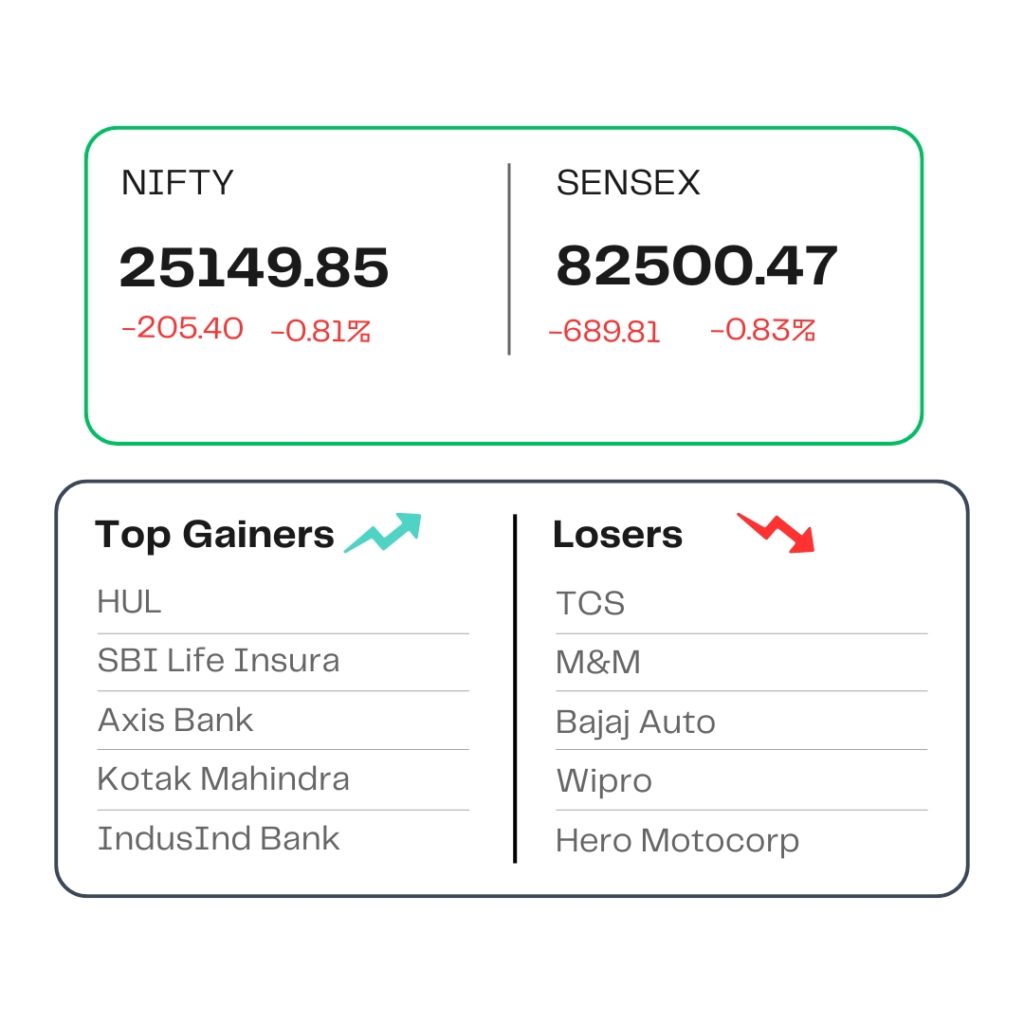

At close, the Sensex was down 689.81 points or 0.83 percent at 82,500.47, and the Nifty was down 205.40 points or 0.81 percent at 25,149.85. About 1510 shares advanced, 2341 shares declined, and 150 shares remained unchanged.

The biggest Nifty losers were TCS, Bajaj Auto, M&M, Hero MotoCorp, Wipro, while gainers were HUL, SBI Life Insurance, Kotak Mahindra Bank, Axis Bank, IndusInd Bank.

Except FMCG, pharma, all other sectoral indices ended in the red with auto, IT, media, oil & gas, consumer durables, capital goods, realty, telecom down a percent each.

The broader markets were also in the red, with the Nifty Midcap 100 index tumbling 0.8 percent, while the Nifty Smallcap 100 index sank around one percent.

STOCKS TODAY

IREDA

Indian Renewable Energy Development Agency (IREDA) slipped 6 percent after its asset quality took a sharp hit in the June quarter, overshadowing strong loan growth and denting investor sentiment. The state-run lender reported a 35.7 percent year-on-year drop in net profit to Rs 247 crore, largely due to a rise in bad loans.

Bharti Airtel

Shares slipped over 2 percent after UBS downgraded the stock amid expensive valuations. The brokerage is expecting a 10 percent ARPU hike over FY25-28, with later years largely being driven by secular factors. Even the FY26 tariff hike faces the risk of being delayed or coming in with a lower magnitude than anticipated.

RPP Infra

RPP Infra shares rose as much as 5 percent on July 11 after the company announced that it had secured orders worth Rs 365.85 crore in Rajasthan. The company said the order was awarded to RPP-BCC IV, a joint venture in which RPP Infra holds a 51 percent stake.

Hindustan Unilever

Stock jumped up to 5 percent on July 11 after the company announced Priya Nair as its new MD & CEO, succeeding Rohit Jawa, who steps down after a two-year stint. Nair, currently President of Beauty & Wellbeing, will be the first woman to lead HUL in its 92-year history. She oversees a €13.2 billion global portfolio, including brands like Dove, Sunsilk, Clear, and Vaseline.

Mankind Pharma

Shares of Mankind Pharma gained as much as 6 percent on July 11, before paring almost all gains, after brokerage firm Jefferies increased its price target on the healthcare firm, projecting a potential upside of 18 percent from its previous closing price.

Source – Money Control