POST MARKET

The Indian equity indices ended on flat note, as banking stocks took a pause after a strong four-day rally.

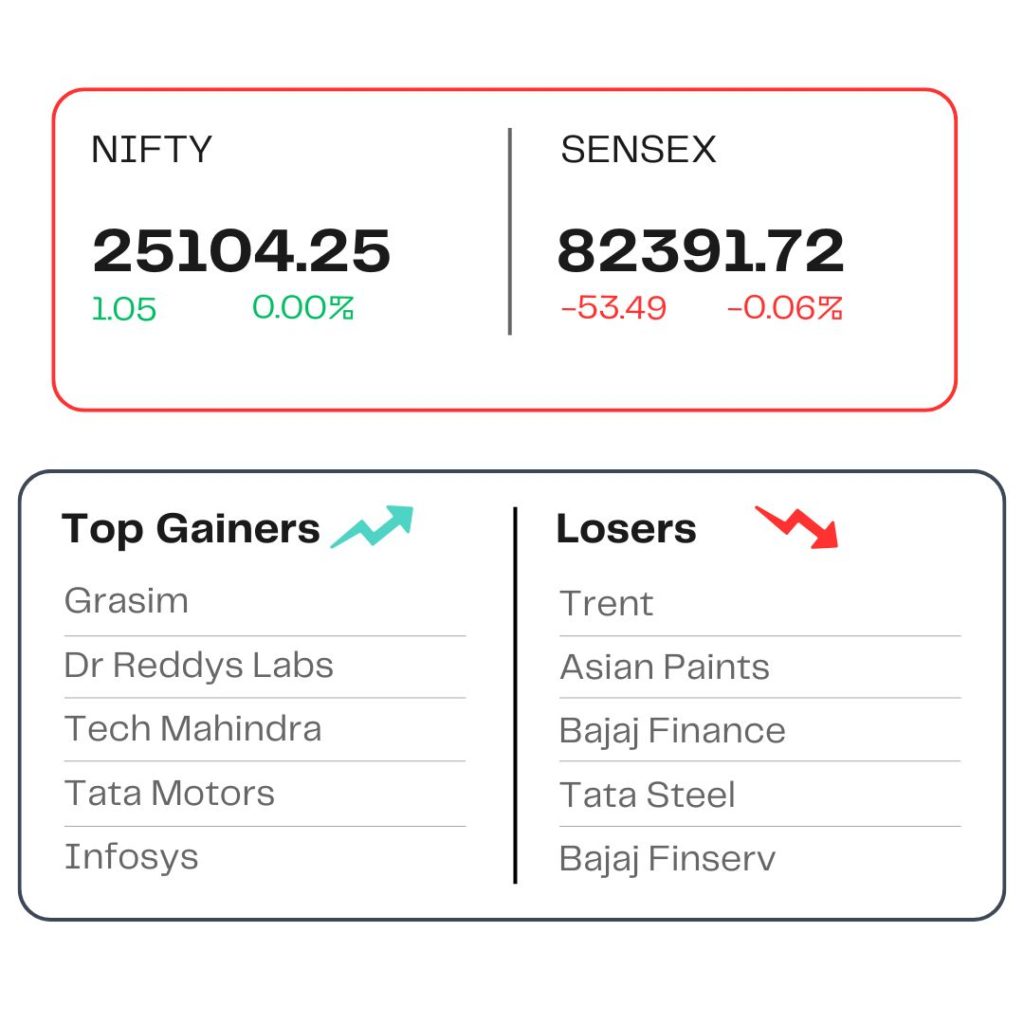

At close, the Sensex was down 53.49 points or 0.06 percent at 82,391.72, and the Nifty was up 1.05 points at 25,104.25. About 2160 shares advanced, 1723 shares declined, and 136 shares remained unchanged.

Top Nifty gainers were Grasim Industries, Dr Reddy’s Labs, Tech Mahindra, Tata Motors, Infosys, while losers were Trent, Asian Paints, Bajaj Finance, Tata Steel, and Bajaj Finserv.

On the sectoral front, realty index shed 1 percent, while IT index rose 1.7 percent, Media index added 1 percent, and Power index gained nearly 1 percent.

The broader market indices ended mixed with, BSE midcap index ended flat, while BSE smallcap index was up 0.3 percent.

STOCKS TODAY

Grasim Industries

A key player in the cement sector, Grasim Industries, saw its shares rally nearly 4 percent on June 10 after global brokerage Morgan Stanley upgraded the stock rating to ‘Overweight’ from ‘Equal-weight’ and raised its target price to ₹3,500 from the earlier ₹2,975.

ITD Cementation

ITD Cementation share price surged 6.36 percent to hit a fresh 52-week high, after winning Rs 893 crore contract for Odisha jetty project. The company in an exchange filing said it secured a new order for the construction of berth and breakwater structures linked to greenfield captive jetty development in Odisha.

Zee Entertainment Enterprises

Shares of Zee Entertainment Enterprises were higher by over 2.85 percent after the media group signed a strategic partnership with content start-up Bullet to launch a micro-drama app focusing on short-format entertainment. The stock went up today, marking its second consecutive gain.

United Spirits

Shares of United Spirits rose 2% on June 10 to hit a five-month high after a report said the firm’s parent Diageo is looking to sell stake in IPL team Royal Challengers Bengaluru. Reports suggesed that, no decision is final and they may decide against selling the team.

Avenue Supermarket

Retail giant Avenue Supermarts Ltd (D Mart) shares sank 2.37 percent on Tuesday, after a block deal involving Rs 634 crore took place on the bourses. The parent of a supermarket chain saw 16 lakh shares, representing 0.21 percent of the total outstanding equity, change hands in a large trade. The price traded at was Rs 4,000, representing a 4.2 percent discount compared to the previous session’s closing price of Rs 4,179.10

Source – Money Control