POST MARKET

Indian equity indices ended higher and extended their meandering, directionless consolidation phase for the sixth consecutive session.

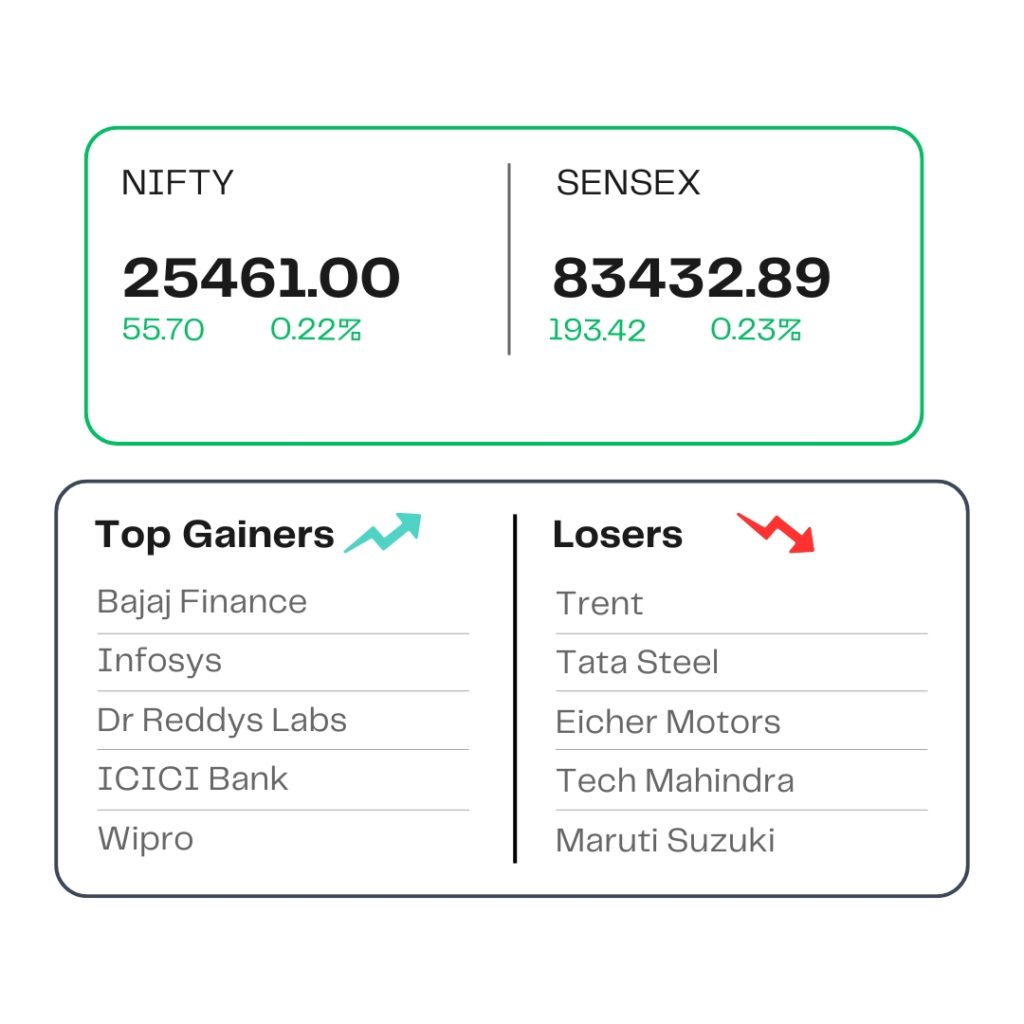

At close, the Sensex was up 193.42 points or 0.23 percent at 83,432.89, and the Nifty was up 55.7 points or 0.22 percent at 25,461. About 1962 shares advanced, 1612 shares declined, and 102 shares unchanged.

Bajaj Finance, Infosys, Dr Reddy’s Labs, ICICI Bank, HUL were among major gainers on the Nifty, while losers included Trent, Tata Steel, Eicher Motors, Tech Mahindra and IndusInd Bank.

Except auto, telecom, metal, all other sectoral indices ended in the green with bank, pharma, oil & gas, IT, realty, media up 0.4-1 percent.

The broader market indices closed higher with, the BSE midcap and smallcap indices ending marginally higher.

STOCKS TODAY

Paras Defence

Defence stocks saw a significant surge on July 4 after the Defence Acquisition Council (DAC) approved capital acquisition proposals worth approximately Rs 1.05 lakh crore. Paras Defence shares jumped 10% to hit the upper circuit after adjusting to stock split.

Marico

FMCG player Marico Ltd’s shares jumped 2% as its business update for the quarter ended June 30, 2025 impressed investors. “During the quarter, the sector exhibited consistent demand patterns, marked by improving trends in rural markets and steady urban sentiment. We expect gradual improvement in the quarters ahead, supported by easing inflation, a favourable monsoon season and policy stimulus,” said the FMCG player.

Sapphire Foods

Sapphire Foods shares rallied over 9% intraday on July 4 after a report said that Yum! Brands, the American owner of popular food chains KFC and Pizza Hut, is in talks to facilitate the merger of its two franchisee partners in India, Devyani International Ltd (DIL) and Sapphire Foods.

Angel One

Angel One shares declined 6% after the brokerage reported a sharp drop in its gross client acquisition for June. According to the company’s exchange filing, gross client acquisition fell 41.5 percent year-on-year to 5.5 lakh in June. On a month-on-month basis, however, the number rose 9.3 percent.

HDB Financial Services

After two days of recording notable gains since debuting on the stock markets, HDB Financial Services shares lost steam and traded in the red on July 4. The shares of the company dropped 2%. The newly-listed stock has now snapped a two-day gaining streak, during which it rallied 17 percent from its issue price.

Source – Money Control