POST MARKET

Indian equity indices extended their gaining streak for a second day, on October 16, supported by broad-based buying that helped the test four-month highs despite a last-hour profit booking.

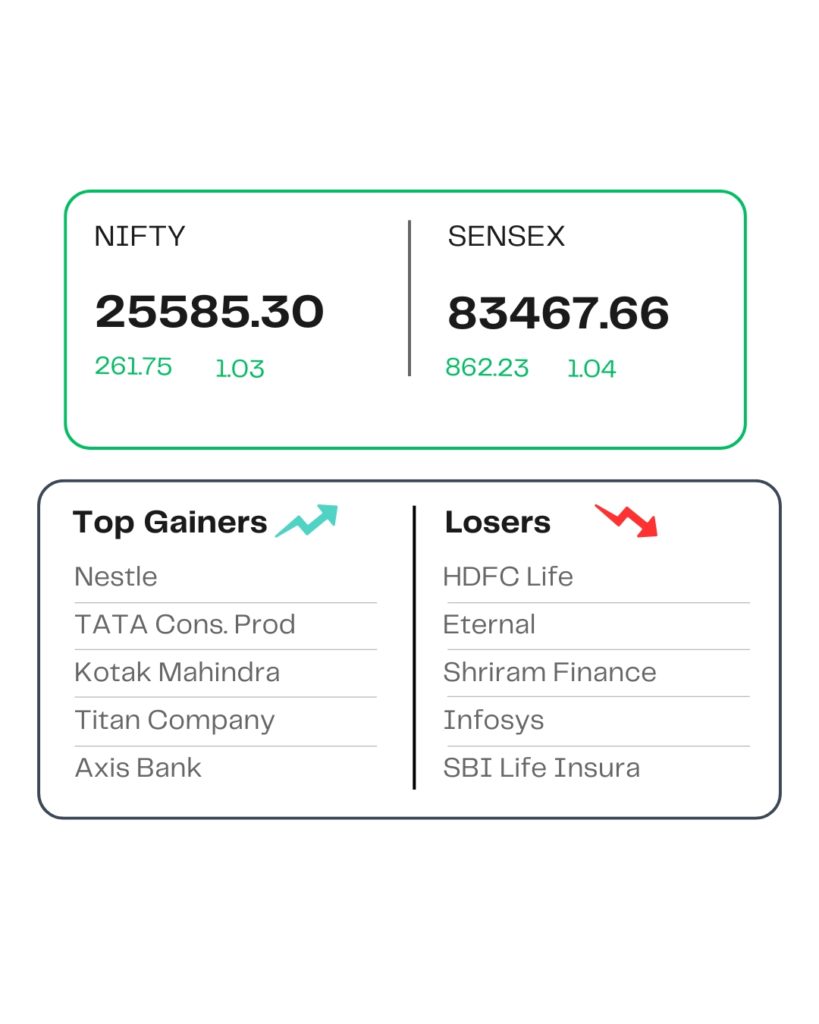

At close, the Sensex was up 862.23 points or 1.04 percent at 83,467.66, and the Nifty was up 261.75 points or 1.03 percent at 25,585.30. About 2206 shares advanced, 1712 shares declined, and 136 shares remained unchanged.

The biggest Nifty gainers were Nestle India, Tata Consumer, Titan Company, Kotak Mahindra Bank, Axis Bank, while losers included HDFC Life, Shriram Finance, Sun Pharma, Jio Financial, and Eternal.

Except PSU Bank (down 0.4%), all other sectoral indices ended in the green with auto, bank, consumer durable, realty, FMCG, oil & gas up 0.5-1.7 percent.

Among the broader market indices, the BSE midcap index rose 0.3 percent and the smallcap index added 0.4 percent.

STOCKS TODAY

HDFC Life Insurance

The shares of HDFC Life Insurance Company dropped around 2.4 percent to hit an intraday low of Rs 726 apiece on October 16 after the company released its results for the July-September quarter of the financial year 2026.

Axis Bank

Axis Bank shares rose 2.28 percent after the lender reported Improvements have been substantial, including a credit cost decline and better-than-estimated net interest margin resilience, in its September quarter results, helping the Bank Nifty index climb past the 57,200 mark.

Bharat Electronics

BEL shares went up almost one percent after the company secured additional orders worth Rs 592 crore. The major orders received include tank subsystems and overhauling, communication equipment, combat management systems, ship data networks, the train collision avoidance system (Kavach), laser dazzlers, jammers, upgrades, and spares.

HDB Financial Services

The newly listed shares of HDB Financial fell almost 1 percent after the company released its results for the July-September quarter of the financial year 2026. The stock, which debuted on stock markets in July, has now fallen more than 12 percent since listing.

Source – Money Control