POST MARKET

Indian equity markets extended the winning run for the fifth consecutive session on August 20, led by IT, FMCG, and realty names, marking the longest gaining streak in the last two months.

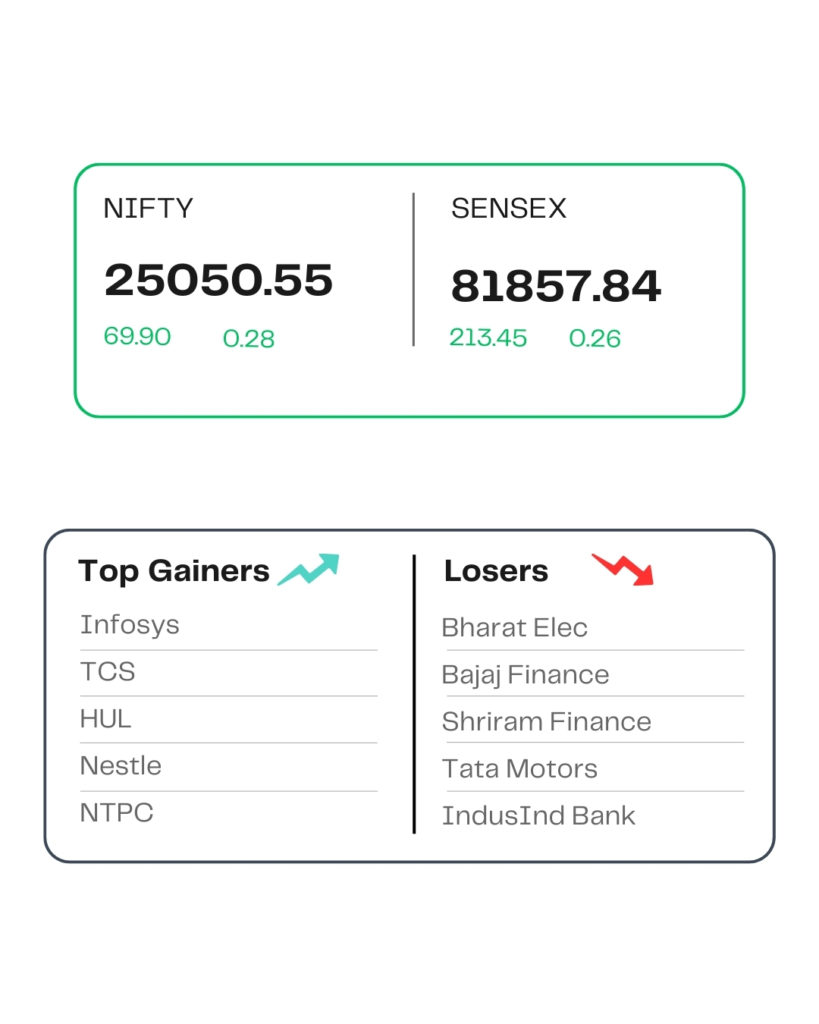

At close, the Sensex was up 213.45 points or 0.26 percent at 81,857.84, and the Nifty was up 69.90 points or 0.28 percent at 25,050.55. About 2210 shares advanced, 1685 shares declined, and 155 shares remained unchanged.

Infosys, HUL, TCS, Nestle India, NTPC were among the major gainers on the Nifty, while losers were Shriram Finance, Bajaj Finance, Bharat Electronics, Tata Motors, IndusInd Bank.

Among sectors, FMCG, IT, and realty rose 1-2.6%, while the media index fell 2%, pharma, private bank down 0.4% each.

The broader indices also extended their gains on the third straight session, with BSE midcap and smallcap indices adding 0.3 percent each.

STOCKS TODAY

PG Electroplast

The stock surged 6 percent but settled with mild losses on August 20 after the company signed a definitive agreement with PAX India, a subsidiary of PAX Global Technology, to manufacture Point-of-Sale (POS) devices in India.

Ola Electric

Ola Electric shares have been moving higher on the bourses over the past two days, aided by heavy volumes. The stock of the electric two-wheeler manufacturer zoomed 18 percent on August 20 as 0.3% equity changed hands in 10 blocks, according to data.

Aurobindo Pharma

The stock fell over 4 percent after reports suggested that the company has emerged as the front-runner to acquire Prague-based generic drugmaker Zentiva for $5-5.5 billion (Rs 43,500-47,900 crore) from Advent International. If this deal goes through, it will be the largest-ever acquisition by an Indian pharmaceutical company, both domestically and internationally.

HUL

The stock surged 2 percent on August 20, extending its rally to a third straight session. The stock of the fast-moving consumer goods (FMCG) company has surged 7 percent during the period on hopes of a consumption boost.

Phoenix Mills

The stock jumped 4 percent after the company said the Competition Commission of India cleared its plan to buy out Canada Pension Plan Investment Board’s 49 percent stake in Island Star Mall Development for Rs 5,449.16 crore, giving PML full ownership and sole control of the subsidiary.

Source – Money Control