POST MARKET

Indian benchmark indices inched higher on Friday, led by domestic rate-sensitive financials, after the Reserve Bank of India lowered the key interest rate by 25 basis points.

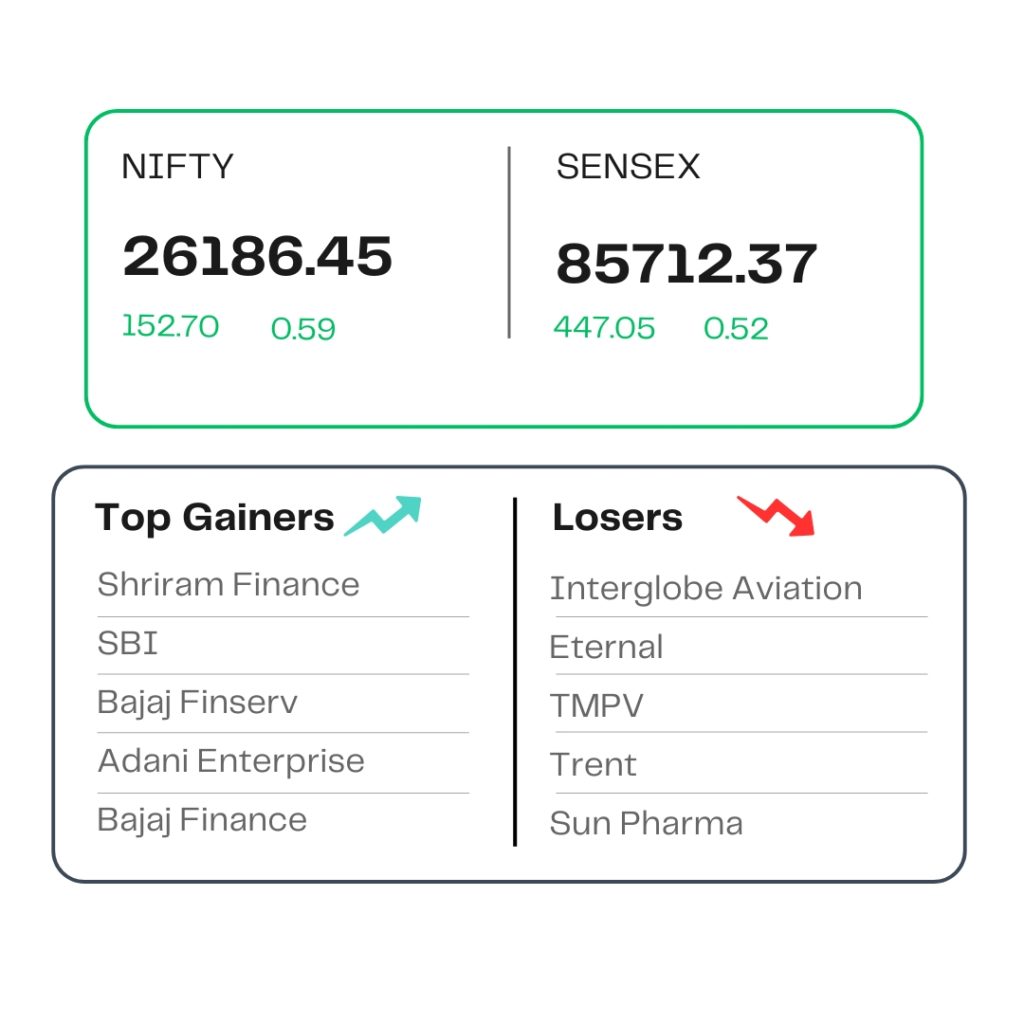

Sensex closed 447.05 points or 0.52 percent higher at 85712.37, and the Nifty ended 152.70 points or 0.59 percent higher at 26186.45.

On the sectoral front, Finance and trading rose by over 1 percent, while banks and agriculture rose by 0.85-0.6 percent, while electricals and FMCG declined.

Shriram Finance, SBI, Bajaj Finserv, Adani Enterprises, and Bajaj Finance were among the top gainers, while the top losers included Interglobe Aviation, Eternal, TMPV, Trent, and Sun Pharma.

Among the broader market indices, the BSE Midcap index went up 0.2%, while the smallcap index declined by over 0.6%.

STOCKS TODAY

HCL Tech

The shares of Indian IT company gained 1.6 percent along with other Indian IT companies, pushing the Nifty IT index higher in the green to extend gains for the third consecutive session. This comes amid rising expectations of a rate cut by the US Federal Reserve.

Interglobe Aviation

The shares of InterGlobe Aviation, the parent company of IndiGo, went down 1.27 percent, extending significant losses as the airline continued to seea massive number of flight cancellations across the country. Some of the losses were erased after DGCA eased some norms related to pilots’ rest, which was seen as one of the key reasons behind the airline’s massive cancellations.

HUL

The shares of Hindustan Unilever (HUL) went down almost 5 percent after the company adjusted to the demerger of its ice-cream business, Kwality Wall’s India. National Company Law Tribunal (NCLT) approved the demerger scheme on October 30.

Shriram Finance

Shares of SHriram Finance went up over 3 percent, after the Reserve Bank of India (RBI) cut the repo rate by 25 basis points to 5.25 percent in its fifth bi-monthly monetary policy of the current financial year. The move comes as the economy posted a six-quarter high growth of 8.2 percent in the second quarter.

Source – Money Control