POST MARKET

Indian equity indices ended on a negative note on November 25, dragged down by banking and information technology stocks.

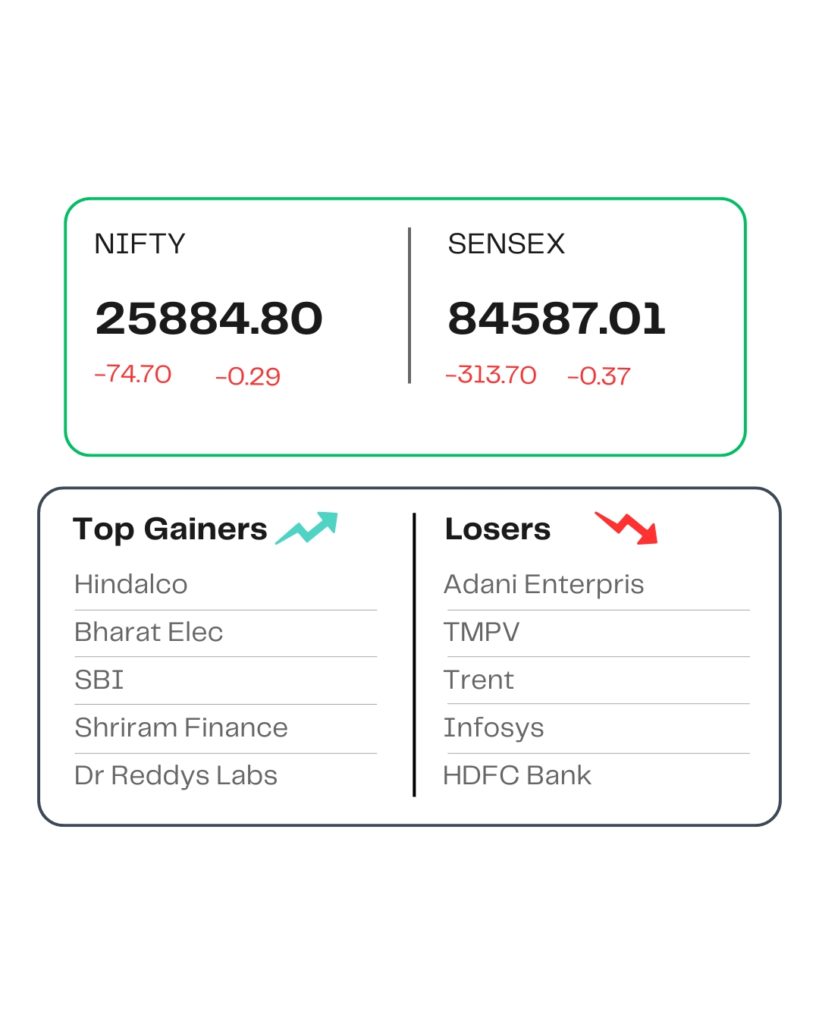

At close, the Sensex was down 313.70 points or 0.37 percent at 84,587.01, and the Nifty was down 74.70 points or 0.29 percent at 25,884.80. About 2022 shares advanced, 1972 shares declined, and 149 shares remained unchanged.

On the sectoral front, metal, pharma, PSU Bank, and realty added 0.5-1%, while consumer durables, IT, and media shed 0.5% each.

Hindalco Industries, SBI, Bharat Electronics, Shriram Finance, and HDFC Life were among the major gainers on the Nifty, while losers included Adani Enterprises, TMPV, Infosys, HDFC Bank, and Trent.

Among the broader market indices, the BSE Midcap and smallcap indices ended higher.

STOCKS TODAY

Brigade Enterprises

The shares of real estate company Brigade Enterprises rose over 4 percent, pushing the Nifty Realty index into the green to snap a five-session losing streak. This comes after Reserve Bank of India (RBI) Governor Sanjay Malhotra said there is scope to further reduce policy interest rates.

Spandana Sphoorty Financial

The shares of Spandana Sphoorty Financial jumped almost 1.2 percent after the company announced the appointment of former HDFC exec Venkatesh Krishnan as its Managing Director and CEO, effective from November 27.

Karnataka Bank

Karnataka Bank shares extended their steep gains for a third straight session on Tuesday, closing 8.8 percent higher. The stock has now risen nearly 24 percent over three days, fuelled by buying interest after Cupid Ltd’s promoter Aditya Kumar Halwasiya acquired shares in the mid-sized private lender late last week.

BEL

Bharat Electronics Ltd (BEL) shares went up 1.58 percent after the defence ministry announced that the company and France’s Safran Electronics & Defence have signed a joint venture cooperation agreement to produce the highly agile modular munition extended range (HAMMER) precision-guided air-to-ground weapon in India.

Source – Money Control