POST MARKET

The benchmark equity indices gave up early gains and settled lower on Wednesday amid profit booking, as investors turned cautious ahead of a key US trade tariff deadline on July 9.

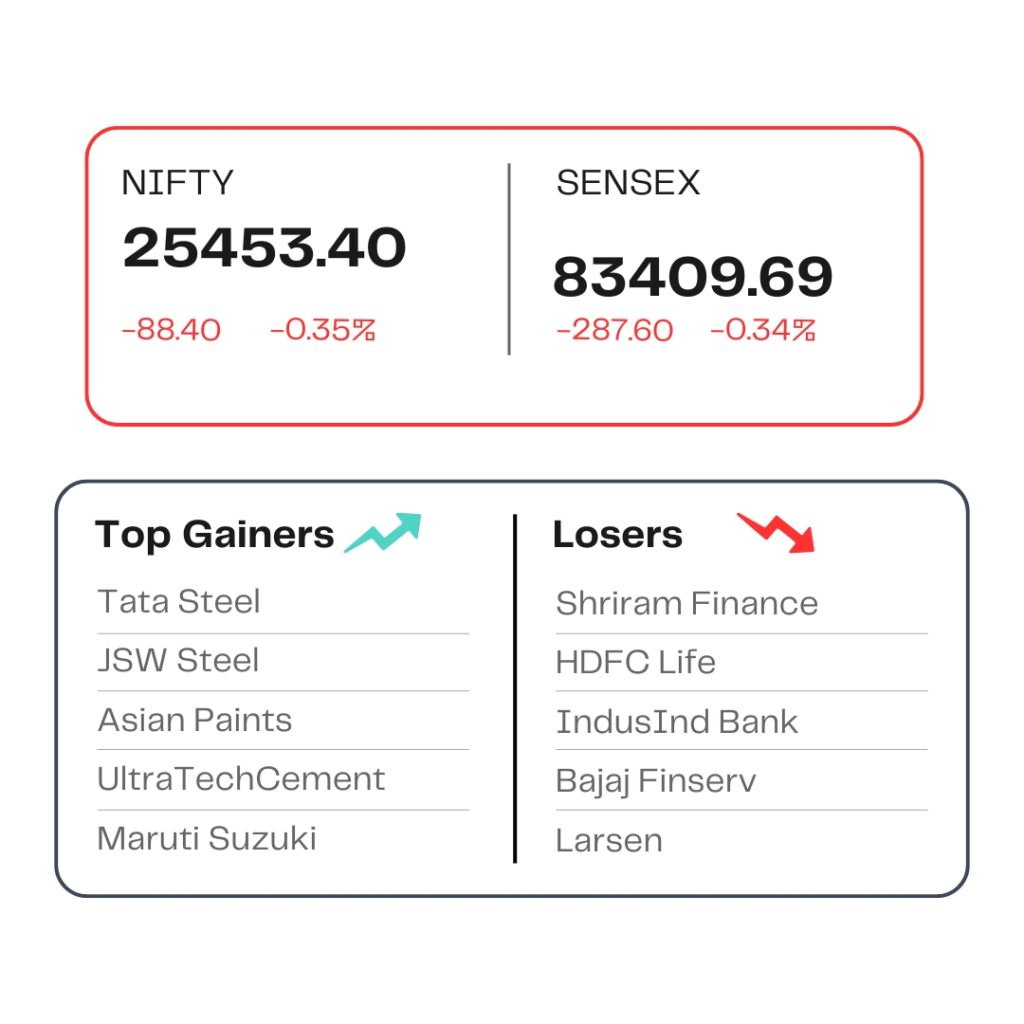

At close, the Sensex was down 287.60 points or 0.34 percent at 83,409.69, and the Nifty was down 88.40 points or 0.35 percent at 25,453.40. About 1716 shares advanced, 2125 shares declined, and 167 shares unchanged.

Biggest Nifty losers were Shriram Finance, Bajaj Finserv, IndusInd Bank, HDFC Life, L&T, while gainers were Tata Steel, JSW Steel, UltraTech Cement, Maruti Suzuki, Asian Paints.

Among sectors, metal index up 1.4 percent, Consumer Durables added 1 percent, while PSU bank, capital goods, realty, media, power down 0.4-1.4 percent.

The broader market indices lowered with, both the BSE midcap and smallcap index down by 0.2 percent each.

STOCKS TODAY

HDB Financial

HDB Financial shares listed at a decent premium of about 13 percent over its IPO price on the National Stock Exchange (NSE) on Wednesday, July 2. The shares then rose 0.63 percent to close at Rs 840.25 apiece. The listing of the shares of the subsidiary of HDFC Bank was better than the expectations in the grey market which had priced in a 8-10 percent gains on the listing day for the allotted investors.

Tata Communications

The shares of Tata Communications jumped nearly 5 percent on July 2 after Macquarie issued a bullish note for the stock. Macquarie initiated coverage on Tata Communications with an ‘Outperform’ rating and a target price of Rs 2,300 per share. This implies an upside potential of over 30 percent from the previous closing price.

RITES

Shares of state-owned RITES Ltd rose over 6 percent on Wednesday after the engineering consultancy firm announced securing two new orders, including one from Africa and another from Indian Railways. The stock climbed 7.44 percent to hit an intraday high of Rs 299.8 on the NSE, rebounding after two straight sessions of decline. It opened 2.13 percent higher.

Raymond Realty

Realty stocks extended their losing streak for the fifth straight session on July 2, with the Nifty Realty index slipping further in line with broader market weakness. Raymond Realty, Prestige Estates Projects and DLF were among the major laggards.

RBL Bank

The shares of RBL Bank tumbled over 2 percent on July 2 after the lender denied a report claiming that Dubai government-owned Emirates NBD Bank PJSC is looking to acquire a minority stake in the lender. The shares of the bank snapped a four-day gaining streak to trade at Rs 253.87 apiece.

Source – Money Control