POST MARKET

Indian benchmark indices Nifty and Sensex ended marginally lower in the volatile session on April 30. The market faced pressure primarily due to growing geopolitical tensions along the India-Pakistan border, which weighed on investor sentiment and led to cautious trading throughout the day.

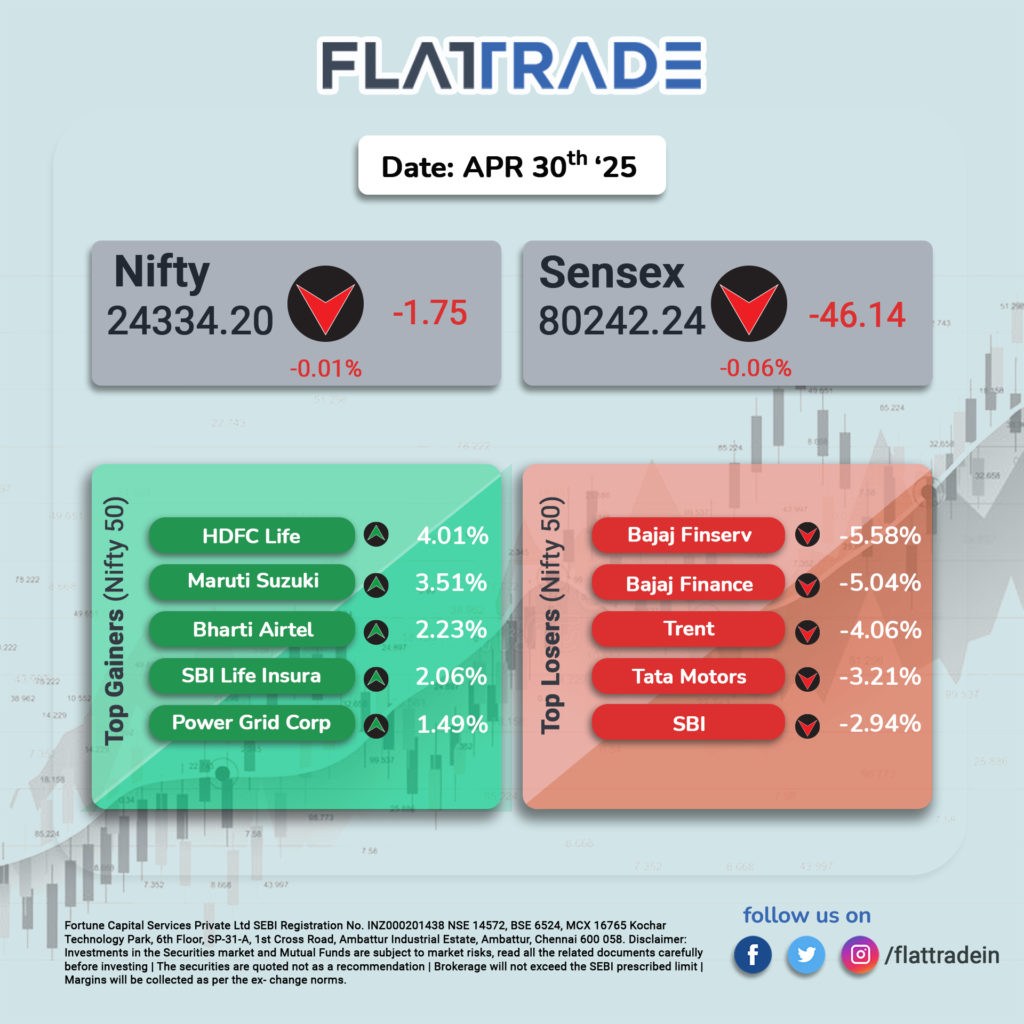

At close, the Sensex was down 46.14 points or 0.06 percent at 80,242.24, and the Nifty was down 1.75 points or 0.01 percent at 24,334.20. About 938 shares advanced, 2828 shares declined, and 141 shares unchanged.

Maruti Suzuki, HDFC Life, Bharti Airtel, SBI Life Insurance, Power Grid Corp were among major gainers on the Nifty, while losers were Bajaj Finserv, Bajaj Finance, Trent, Tata Motors, SBI.

Among sectors, Realty index up nearly 2 percent and Telecom index up 1 percent, while media, PSU Bank indices down 2 percent each and IT, Bank, consumer durables, capital goods down 0.5 percent each.

The broader market indices performed weak as, BSE Midcap index fell 0.7 percent and BSE Smallcap index shed 1.7 percent.

STOCKS TODAY

Avenue Supermarkets

The company, operating under the brand D-Mart, experienced a downturn in today’s trading session, with its shares falling by 3.25% to a price of Rs 4,174.30. This movement positions the stock as a notable mover within the NIFTY NEXT 50 index.Despite today’s decline, Avenue Supermarts’ last traded price stands at Rs 4,174.30, reflecting its position within the NIFTY NEXT 50 index and overall financial health.

Bharti Hexacom

Shares of the company reached an all-time high of Rs 1,705.00 on the NSE during today’s session. Currently, the stock is ended at Rs 1685.00, marking a 5.48% increase. This surge highlights significant positive movement for the company’s stock and continues to be a noteworthy performer in the market.

Paras Defence

Paras Defence shares extended gains to third straight session to rise nearly 10 percent on Wednesday ahead of the March quarter results. A meeting of the board of directors of the company is scheduled to be held today, which will also consider stock split and dividend. The shares closed at Rs 1331.00 per share.

SBI

Shares of State Bank of India declined over 3 percent, amid the reports that the country’s largest public sector lender is considering various fundraising options, including a Follow-on Public Offer (FPO), rights issue, or Qualified Institutional Placement (QIP), during the current financial year ending March 2026. The final decision on the proposed capital raise is expected on May 3, when either the government or the Reserve Bank of India (RBI) is likely to give its nod. The lender is also scheduled to announce its quarterly financial results on the same day.

BlueJet Healthcare

The pharmaceutical company shares saw a 4 percent jump since morning bell, after domestic brokerage Motiilal Oswal initiated coverage on the firm. Motilal Oswal issued a ‘Buy’ rating and posits that the firm is “ascending the value chain”.

IndusInd Bank

Private lender IndusInd Bank’s shares sank three in early trade on Wednesday, April 30, after the CEO and Managing Director tendered his resignation amid the ongoing concerns regarding the discrepancies in the bank’s derivatives portfolio. This comes after RBI granted only a one-year extension to Kathpalia’s tenure as IndusInd Bank’s CEO, despite the lender asking for a three-year term.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.