POST MARKET

Indian equity indices ended marginally higher, extending gains for a second session in a volatile trade on August 14, reflecting caution ahead of the Trump-Putin summit, slated to take place tomorrow.

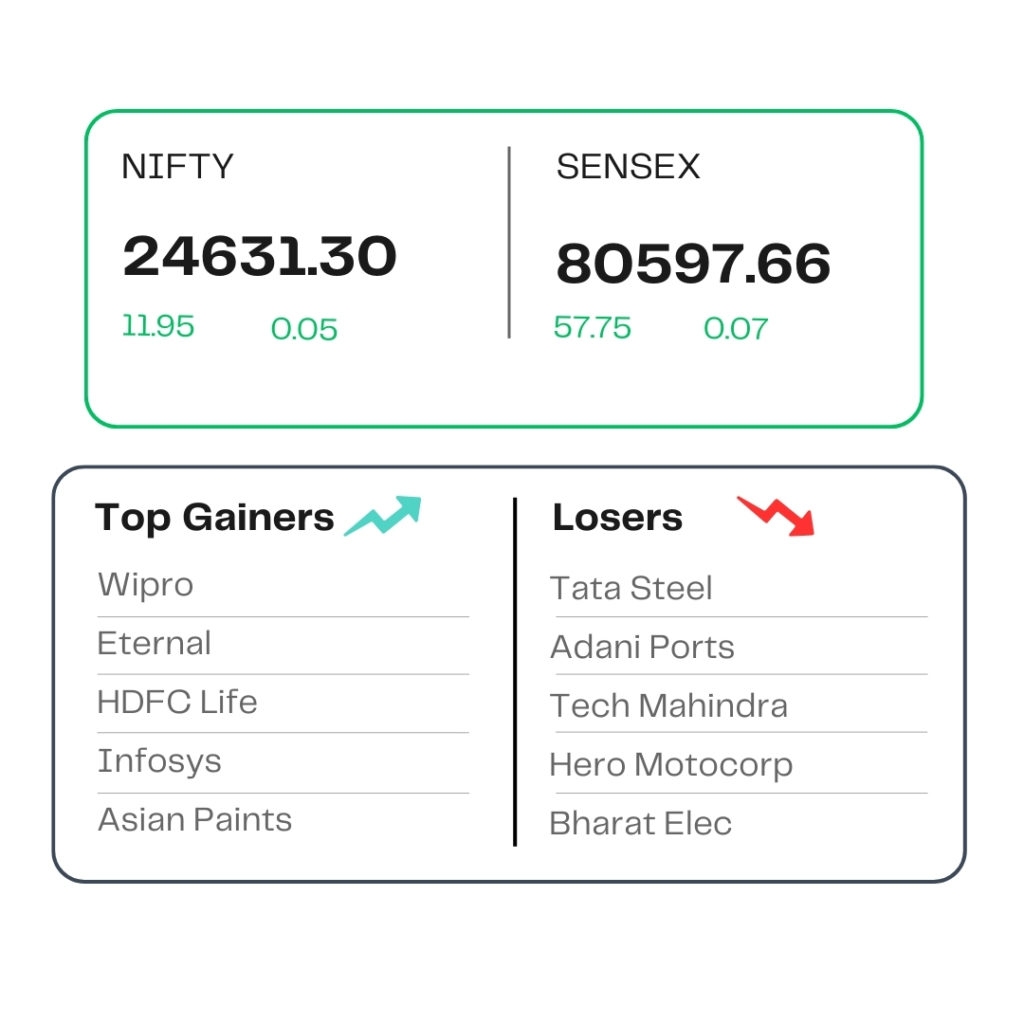

At close, the Sensex was up 57.75 points or 0.07 percent at 80,597.66, and the Nifty was up 11.95 points or 0.05 percent at 24,631.30. About 1655 shares advanced, 2221 shares declined, and 142 shares were unchanged.

Wipro, Eternal, HDFC Life, Infosys, and Asian Paints were among the major gainers on the Nifty, while losers included Tata Steel, Adani Ports, Tech Mahindra, Hero MotoCorp, and Bharat Electronics.

On the sectoral front, metal and oil & gas down 1 percent each, realty and FMCG down 0.5% each, while Consumer Durables and IT rose 0.5 percent each.

The BSE broader market indices ended marginally lower, with the midcap index down 0.2 percent and the smallcap index shedding 0.6 percent.

STOCKS TODAY

NSDL

The shares of National Securities Depository (NSDL) dropped nearly 4 percent on August 14, extending losses for the second consecutive session after the release of its Q1 results. The newly listed stock has now fallen almost 18 percent from its record high level in just three sessions.

Muthoot Finance

Shares of Muthoot Finance hit almost 10 percent upper circuit, after the company delivered a stronger-than-expected June quarter (Q1FY26) performance across all key metrics, supported by stable asset quality. Brokerages responded positively, with some upgrading the stock and projecting an upside of up to 18 percent from current levels.

Jain Irrigation Systems

Jain Irrigation Systems’ share price shed nearly 4 percent in the opening trade on August 14 despite the company securing a solar pumps order worth Rs 135 crore. Under this project, the company will supply and install 5,438 solar pumps across various districts in Maharashtra.

Jindal Steel and Power

Jindal Steel & Power shares dropped 2.10 percent. The company reported an 11.5 percent on-year rise in consolidated net profit of Rs 1,494 crore, but a 10 percent YoY fall in revenue from operations to Rs 12,294.5 crore in Q1 FY26. The shares had jumped 3 percent on August 13 after the release of the results.

Source – Money Control