POST MARKET

The Indian benchmark indices Sensex and Nifty settled marginally lower on Monday; however, they pared early losses, supported by value buying in select sectors such as consumer durables, FMCG and IT.

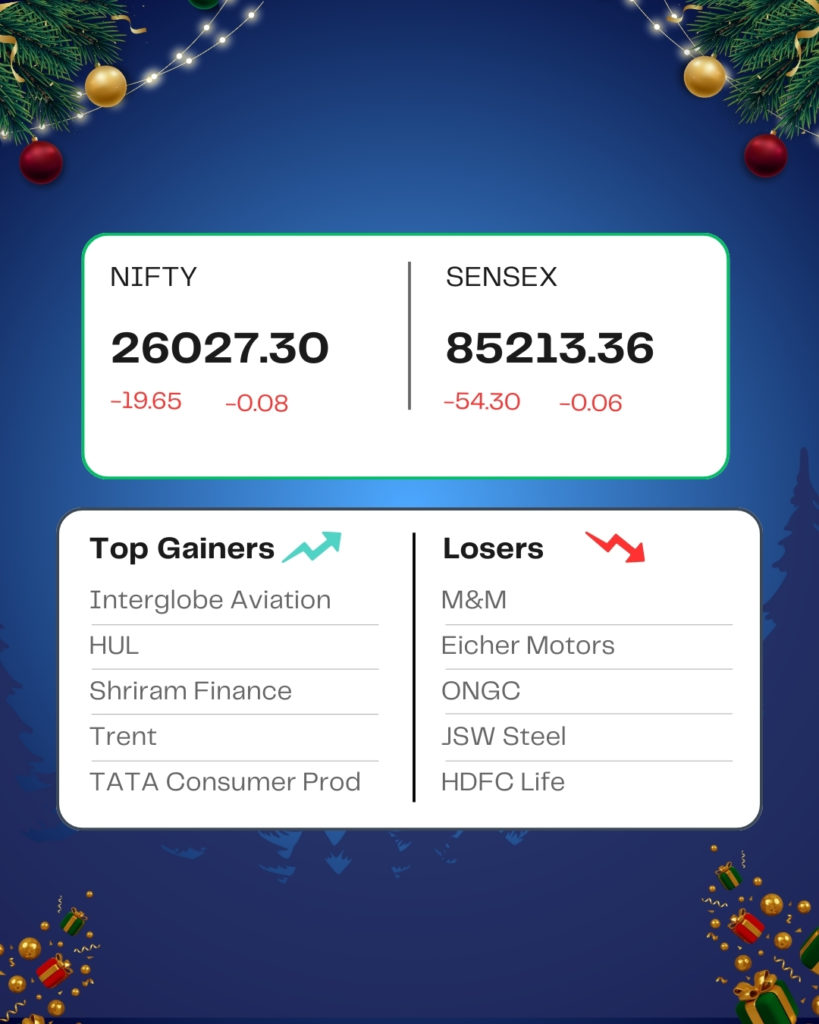

At close, the Sensex was down 54.30 points or 0.06 percent at 85,213.36, and the Nifty was down 19.65 points or 0.08 percent at 26,027.30. About 2067 shares advanced, 1864 shares declined, and 139 shares remained unchanged.

Interglobe Aviation, ITC, HCL Technologies, HUL, and Trent were among the top gainers on the Nifty, while losers included ONGC, M&M, HDFC Life, Eicher Motors, and JSW Steel.

On the sectoral front, PSU Bank, media, IT, FMCG, and Consumer Durables rose 0.3-1%, while auto, pharma, and telecom shed 0.5-1%.

Among the broader market indices, the BSE midcap index ended flat, while the smallcap index rose 0.4%.

STOCKS TODAY

Urban Company

The shares of Urban Company dropped 3.76 percent on December 15 after the three-month shareholder lock-in period came to an end. Around 4.15 crore shares or 3 percent of the company’s stake will free up for trade as the lock-in comes to an end today.

Refex Industries

The shares of Refex Industries sharply jumped more than 17 percent after falling nearly 34 percent in three sessions. This comes as the company issued a clarification on searches conducted by the Income Tax department on its premises. The company also said that its business operations are completely unaffected by the search operations and are continuing without any interruption.

M&M

The shares of automakers and auto component manufacturer Mahindra & Mahindra dropped 1.9 percent, along with other auto company shares, pushing the Nifty Auto index down nearly 1 percent. The reason for this is Mexico’s 50 percent tariff on Indian goods.

Hindustan Zinc

The shares of Hindustan Zinc rose almost 1 percent on December 15, extending significant gains for the fifth consecutive session on the back of soaring silver prices. The company is a big beneficiary of rising silver and zinc prices, with the first decile of the global zinc mining cost curve.

Source – Money Control