POST MARKET

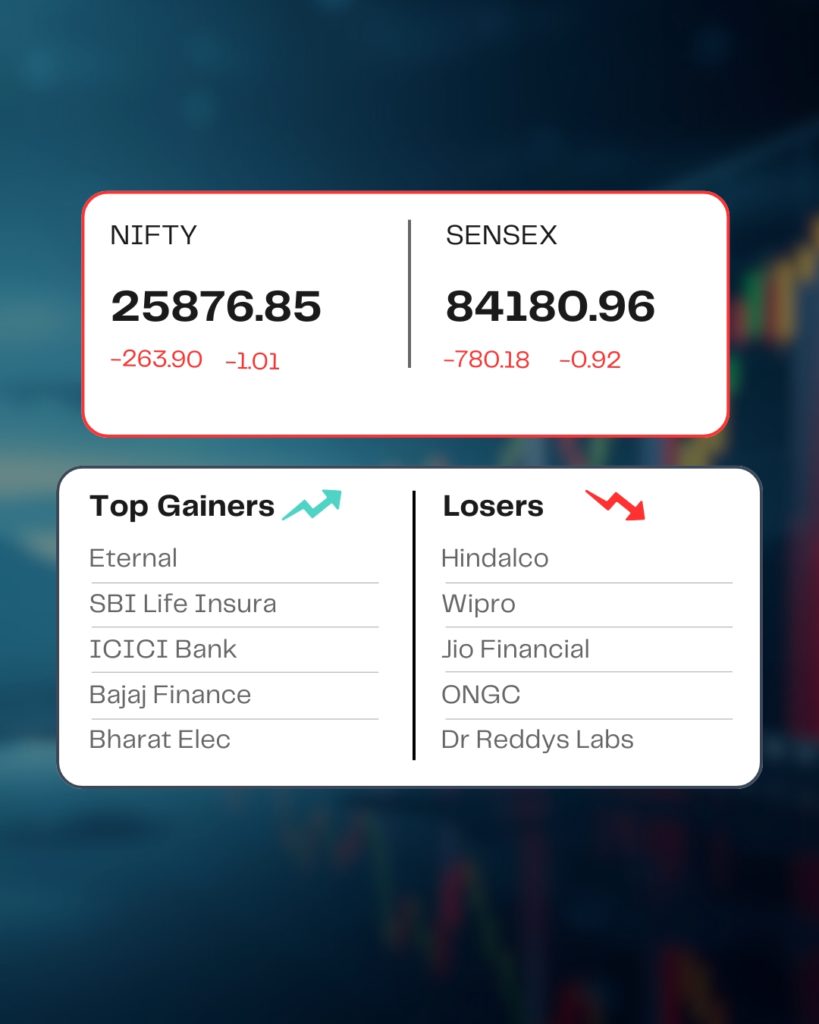

Indian equity markets ended on a weak note on January 8 with Nifty below 25,900.

At close, the Sensex was down 780.18 points or 0.92 percent at 84,180.96, and the Nifty was down 263.90 points or 1.01 percent at 25,876.85. About 974 shares advanced, 2870 shares declined, and 137 shares were unchanged.

All the sectoral indices ended lower with metal, oil & gas, power, PSU Bank, and capital goods shedding 2-3 percent.

The biggest Nifty losers were Hindalco Industries, ONGC, Jio Financial, Wipro, Tech Mahindra, while gainers included ICICI Bank, Eternal, SBI Life Insurance, Bharat Electronics.

Among the broader market indices, the BSE Midcap and smallcap indices fell 2% each.

STOCKS TODAY

BHEL

Bharat Heavy Electricals Limited (BHEL) shares ended on an 8.78 percent lower circuit limit on January 8 trade after a report said that India plans to scrap curbs on Chinese firms bidding for government contracts. The Finance Ministry may lift restrictions on Chinese bidders for government contracts.

Aditya Birla Sun Life AMC

Aditya Birla Sun Life Asset Management shares on Thursday fell over 4 percent after markets regulator Sebi accused Bank of America (BofA) unit of violating insider trading norms and breaching internal information barriers, commonly known as “Chinese walls”, in connection with a March 2024 share sale of the company.

TCS

Tata Consultancy Services led the It stocks decline, slipping as much as over 3 percent. The company is expected to report about 4.2 percent year-on-year revenue growth for the December quarter, slower than the 5.6 percent growth reported in the same period last year.

NALCO

National Aluminium Company Limited (NALCO) shares went down over 5.5 percent, extending losses for the second consecutive session after a six-day rally. Sharp fall in metal prices, along with profit booking, were among the key factors behind the sharp decline.

IDFC First Bank

Shares of IDFC First Bank climbed 1.75 percent as the lender reduced interest rates on savings account deposits across several balance slabs, effective January 9, marking cuts of up to 200 basis points for certain deposit ranges.

Source – Money Control