POST MARKET

Benchmark indices failed to build on early gains and ended lower for a second consecutive session on July 10, as investors remained worried over US President Trump’s tariff moves, ahead of TCS Q1FY26 earnings.

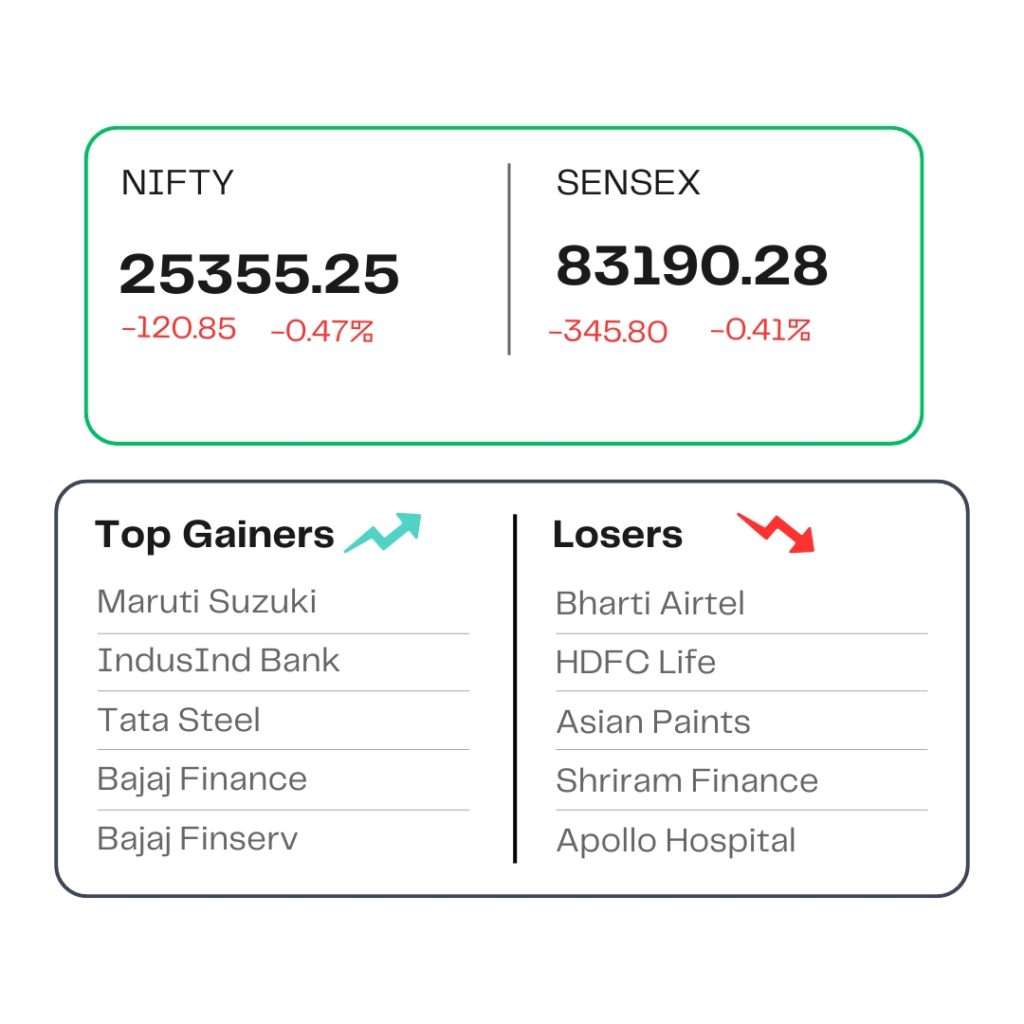

At the close, the Sensex was down 345.80 points or 0.41 percent at 83,190.28, and the Nifty was down 120.85 points or 0.47 percent at 25,355.25. About 1919 shares advanced, 1947 shares declined, and 140 shares remained unchanged.

Except metal, realty, all other indices ended lower with pharma, telecom, IT, PSU Bank, FMCG down 0.5 percent each. IT stocks were cautious ahead of TCS Q1 results.

Bharti Airtel, HDFC Life, Asian Paints, Apollo Hospitals, and Shriram Finance were among the major losers on the Nifty, while gainers were IndusInd Bank, Maruti Suzuki, Tata Steel, Bajaj Finance, and Bajaj Finserv.

On the broader front, the Nifty Midcap and Smallcap indices dropped 0.29 percent and 0.28 percent, respectively.

STOCKS TODAY

ACME Solar

Shares of ACME Solar Holdings extended their gaining streak for the fourth straight session on July 10 and rose nearly 10% to a near seven-month high of Rs 288.90. The stock has gained nearly 15% in the past four sessions. At 2:05 pm, the stock was trading 7.3% higher at Rs 282.3 and was the top performer in the Nifty 500.

IREDA

Shares of Indian Renewable Energy Development Agency(IREDA) has rose over 2 percent on Thursday, after the its June quarter earnings announcement due later in the day. The state-run lender had earlier shared a business update, offering a glimpse into its operational performance for the first quarter of FY26.

Coforge

Coforge shares dropped over 2%, amid a broader downturn in the IT sector. This came as analysts expect a soft earnings season for the pack, amid global uncertainties following US President Donald Trump’s tariff flip-flops.

Crizac

Crizac shares rallied 10% to hit the upper circuit at Rs 338 apiece, a day after the stock debuted on the stock markets. Crizac shares had listed at Rs 281 apiece on NSE on July 9, marking a premium of nearly 15 percent over its IPO price of Rs 245 apiece. The shares of the student recruitment solutions provider then rallied 9 percent to end the debut session at Rs 306 apiece.

Prestige Estate Projects

Shares of Prestige Estates Projects rose over 2.5 percent, after global and domestic brokerages issued upbeat views on the real estate developer, citing its strongest-ever quarterly performance and robust outlook. Morgan Stanley maintained an Overweight rating with a target price of Rs 1,700, while Nuvama raised its target to Rs 2,009 and reiterated a Buy call.

Source – Money Control