POST MARKET

The Indian equity indices ended on a negative note for the third straight session on December 17 amid mixed global markets, post sluggish US jobs data, persistent FII outflo,w and falling rupee amid delay in potential India-US trade deal.

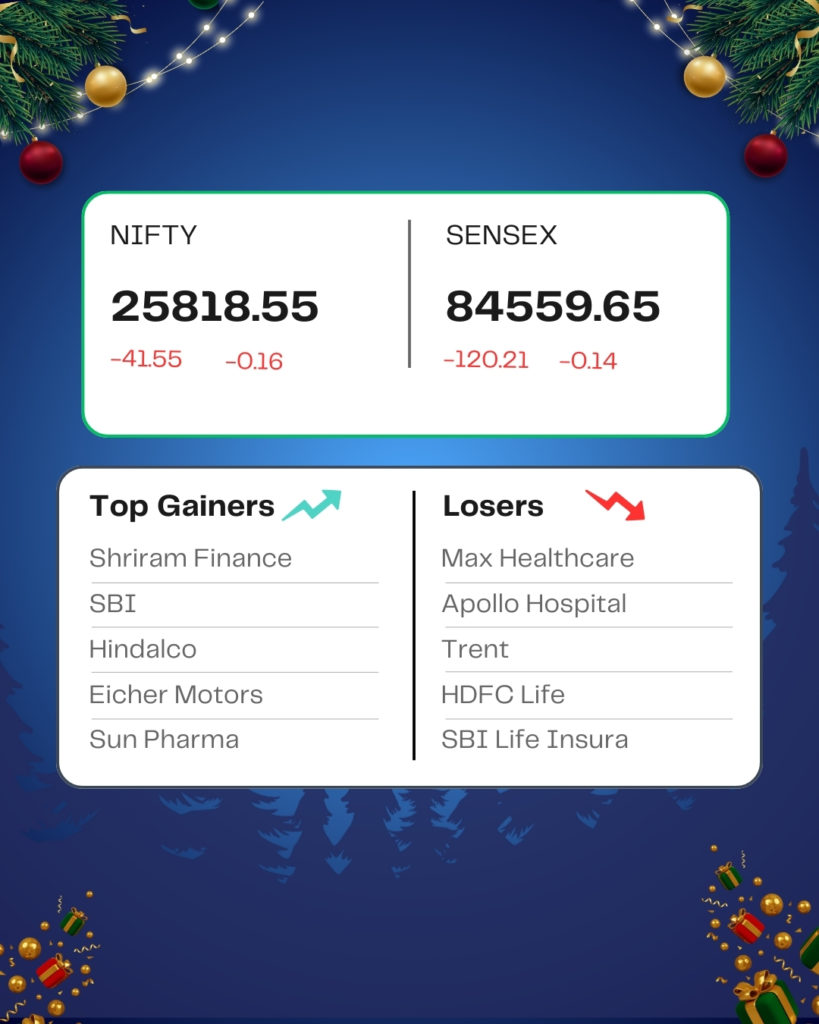

At close, the Sensex was down 120.21 points or 0.14 percent at 84,559.65, and the Nifty was down 41.55 points or 0.16 percent at 25,818.55. About 1326 shares advanced, 2498 shares declined, and 144 shares remained unchanged.

Shriram Finance, SBI, Eicher Motors, Hindalco Industries, and Tata Consumer were among the top gainers on the Nifty, while losers included Max Healthcare, SBI Life Insurance, HDFC Life, Trent, and Apollo Hospitals.

Among sectors, PSU Bank index added 1.2%, while media index shed 2%, while Private Bank, Realty, Consumer Durables, FMCG, and Healthcare were down 0.4-1%.

Among the broader market indices, the BSE Midcap index fell 0.6%, while the smallcap index shed nearly 1%.

STOCKS TODAY

Hindustan Zinc

The shares of Hindustan Zinc jumped almost 2 percent to hit a fresh record high on December 17 on soaring silver prices, breaking the previous record just set yesterday. Notably, this is the highest level seen by the stock since August 2024.

Shriram Finance

The shares of Shriram Finance jumped more than 3 percent as the company’s board is set to meet this Friday to consider fund raising via rights issue, preferential allotment, QIP or any other method. The reported deal with Japan’s Mitsubishi UFJ Financial Group (MUFG) to acquire a minority stake in the gold financier is also likely to be on the agenda.

Akzo Nobel India

Shares of Akzo Nobel India Ltd plunged sharply in early trade on Wednesday, sliding 13 percent, after a large block deal involving a significant equity stake sale likely by a promoter entity hit the market. The stock was trading at Rs 3,153.10 in early morning trade, down 12.99 percent on the day. Including Wednesday’s decline, Akzo Nobel India shares are down about 11.5 percent year-to-date.

Sammaan Capital

Shares of Non-Banking Financial Company Sammaan Capital fell by almost a percent as reports said that Delhi Police’s Economic Offences Wing (EoW) has registered a fresh FIR as part of its ongoing investigation linked to the former promoters of the firm.

IOB

Shares of Indian Overseas Bank (IOB) fell almost 6.5 percent, a day after the government said it will sell up to 3% stake in the state-owned bank through an Offer For Sale (OFS) at a floor price of Rs 34 per share. At the current market price, the government would be able to garner about Rs 2,000 crore by offloading up to 3% stake in the bank.

Source – Money Control