POST MARKET

The Indian benchmark indices continued their fall on their third straight session on January 7, with Nifty closing below 26,150 amid volatility led by concerns over rising geopolitical risks, FII selling, and weak Asian markets.

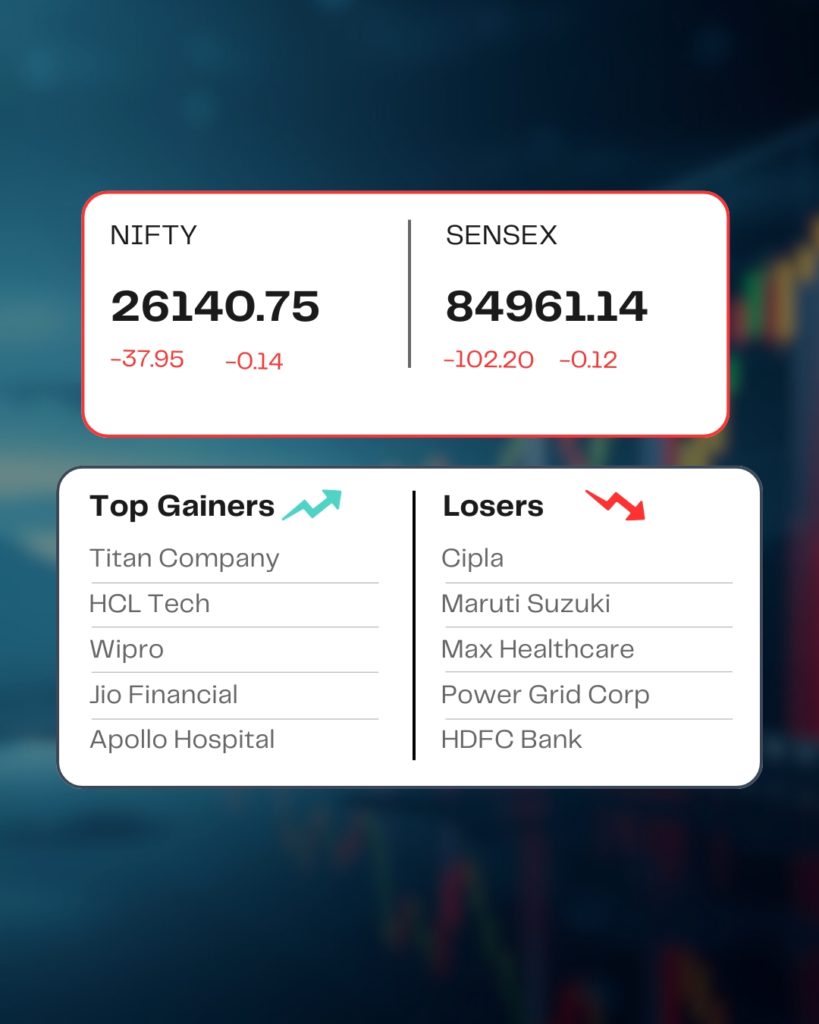

At close, the Sensex was down 102.20 points or 0.12 percent at 84,961.14, and the Nifty was down 37.95 points or 0.14 percent at 26,140.75. About 1939 shares advanced, 1886 shares declined, and 140 shares remained unchanged.

Titan Company, Tech Mahindra, HCL Technologies, Wipro, and Jio Financial were among the major gainers on the Nifty, while losers were Cipla, Maruti Suzuki, Max Healthcare, Tata Motors Passenger Vehicles, and Power Grid.

Consumer durables, IT, pharma gained 0.5-1.8%, while auto, oil & gas, realty, telecom shed 0.5 each.

Among the broader market indices, the BSE Midcap index added 0.5%, while the smallcap index rose 0.12%.

STOCKS TODAY

Senco Gold

Shares of Senco Gold went up almost 12 percent after the company released its Q3 business update. The company recorded a 51 percent year-on-year (YoY) growth in the October-December quarter of the ongoing FY26. This takes the total growth to 31 percent in the first nine months of FY26 (April-December), after 6.5 percent growth in Q2 and 28 percent in Q1.

Hindustan Zinc

The shares of Hindustan Zinc fell over 2 percent on January 7 as silver prices tumbled after a sharp rally. The futures have fallen around Rs 8,000 per kilogram each from their lifetime highs, which they had hit earlier during the day. Silver ETFs also dropped, mirroring the intraday fall in the precious and industrial metal.

CMS Info Systems

The shares of CMS Info Systems jumped 2.11 percent after the company announced that it has won a landmark Rs 1,000-crore contract from SBI, the first such direct large PSU bank cash outsourcing contract covering Rs 5,000 bank-owned ATMs across India.

Cipla

Cipla shares fell 4.28 percent after the U.S. Food and Drug Administration (USFDA) flagged multiple compliance lapses at Pharmathen International SA, the third-party contract manufacturer that supplies the drugmaker’s key generic Lanreotide injection for the US market.

Source – Money Control