POST MARKET

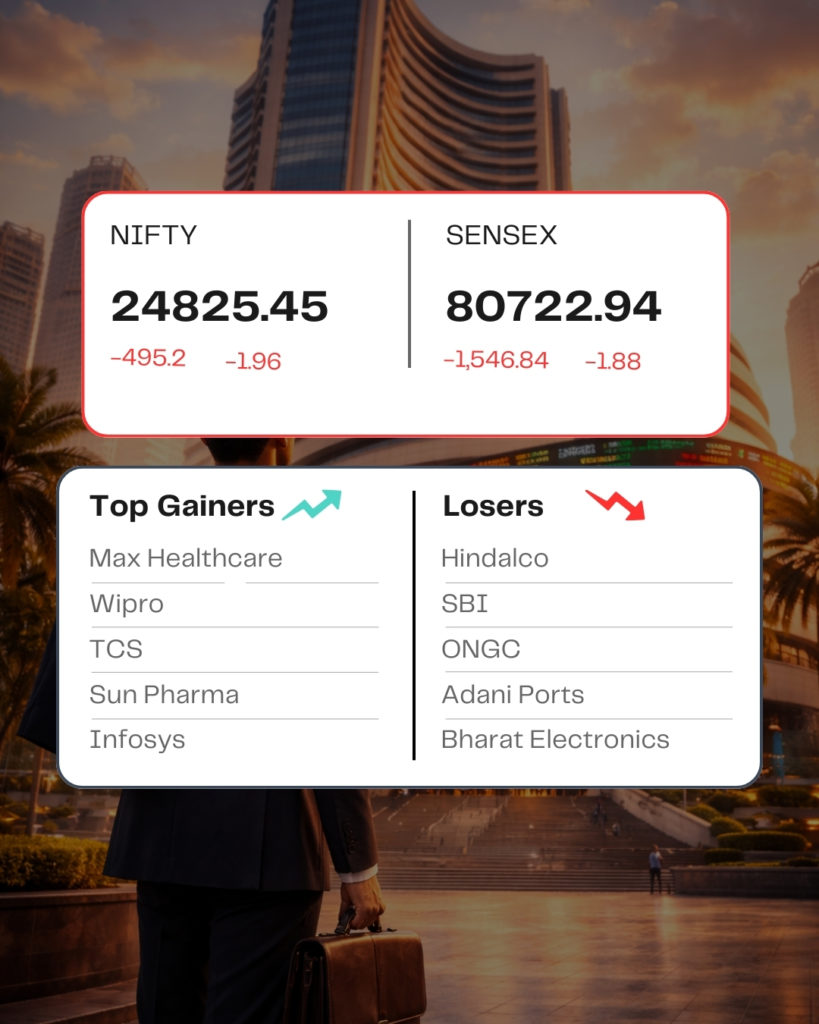

Indian equity indices ended on a negative note in the volatile session on February 1 (Budget day) with Nifty below 24,900.

At close,

Sensex ↓ down 1,546.84 points or 1.88 percent at 80,722.94

Nifty ↓down 495.20 points or 1.96 percent at 24,825.45

About 1673 shares advanced, 2299 shares declined, and 155 shares remained unchanged.

Top gainer – Wipro, TCS, Sun Pharma, Max Healthcare, Infosys

Top losers – ONGC, SBI, Hindalco Industries, Adani Ports, Bharat Electronics

Among sectors, except IT, all other indices ended in the red with the metal index shed 3.8%, PSU Bank declined 4%, oil & gas slipped 2.7%, and Capital Goods fell 3%.

Among the broader market indices, the Nifty Midcap index fell 2.2% and the smallcap indices shed 2.8%.

STOCKS TODAY

GMDC

The shares of Gujarat Mineral Development Corporation (GMDC) surged over 7 percent on February 1 after Finance Minister Nirmala Sitharaman spoke about rare earth magnets and plans establish rare earth corridors to promote mining, research and manufacturing, while presenting the Union Budget 2026.

MTAR Technologies

Defence share MTAR Tech rose over 13 percent on February 1 ahead of the Union Budget, driven by expectations of a higher capital expenditure allocation for the sector. Defence spending rises to ₹5.94 lakh crore, with defence capex up 21% YoY and modernisation allocation surging 24%

ITC

The shares of ITC dropped almost 3.5 percent on the Budget day as an additional excise duty on cigarettes and tobacco products and a health cess on pan masala, over and above the highest 40 per cent GST rate, came into effect from today.

Easy Trip Planners

The shares of Easy Trip Planners gained almost 5.5 percent on February 1 after Finance Minister Nirmala Sitharaman proposed to reduce the TCS rate on the sale of overseas tour programme packages.

Apollo Hospitals Enterprises

The shares of hospitals jumped 1.3 percent on February 1 after the Finance Minister proposed to launch a scheme to support states in establishing five regional medical hubs to promote India as a hub for medical tourism services.

Source – Moneycontrol