POST MARKET

The Indian equity indices Sensex and Nifty declined on Monday, dragged down by selling pressure in information technology stocks and geopolitical concerns.

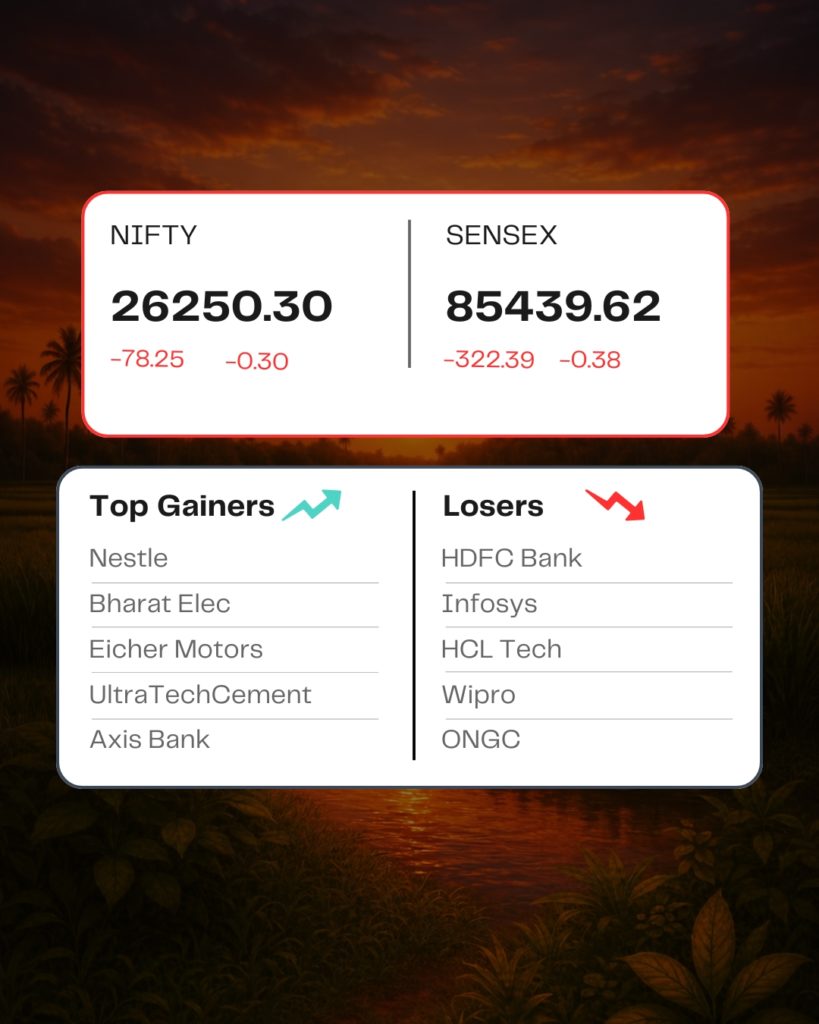

At close, the Sensex was down 322.39 points or 0.38 percent at 85,439.62, and the Nifty was down 78.25 points or 0.30 percent at 26,250.30.

Biggest Nifty losers included HDFC Bank, HCL Technologies, Infosys, Wipro, ONGC, while gainers were Nestle India, Bharat Electronics, Eicher Motors, Asian Paints, Tata Steel.

Among sectors, IT, oil & gas, telecom down 0.5-1 percent, while realty index jumped 2 percent, consumer durables index rose 1 percent, and metal and FMCG indices added 0.5% each.

Among the broader market indices, the BSE Midcap and smallcap indices ended on a flat note.

STOCKS TODAY

HAL

Hindustan Aeronautics Ltd shares went up 2.4 percent, after the United States carried out operation ‘Absolute Resolve’, carrying out airstrikes on targets across Venezuela and capturing its President and First Lady. This came after months of mounting military and economic pressure.

PC Jeweller

Shares of PC Jeweller rose over 7 percent on Monday after the company reported a strong business update for the third quarter ended December 31, where the company reported a 37 percent growth in standalone revenue for the December quarter of FY26, driven by healthy consumer demand during the ongoing festival and wedding season.

Union Bank

Union Bank of India shares gained upto 4 percent to a fresh 52-week high of Rs 162.99 apiece. This comes after the company’s total gross advances grew 7.13 percent YoY to Rs 10.17 lakh crore, while deposits rose 3.36 percent YoY to Rs 12.23 lakh crore.

Waaree Energies

Shares of Waaree Energies fell 5.34 percent on Jan 5. Earlier last month, NSE announced the introduction of futures and options (F&O) contracts on four individual securities, effective December 31, 2025. Other additions are Bajaj Holdings and Investment, Premier Energies, and Swiggy.

HDFC Bank

The company saw 2.31 percent downfall on January 05, after the company reported a 9 percent YoY rise in average advances under management (advances grossing up for inter-bank participation certificates, bills rediscounted and securitisation/assignment) to Rs 28.64 lakh crore in Q3 FY26, from Rs 26.28 lakh crore in Q3 FY25.