POST MARKET

Indian benchmark indices ended on a flat note in the volatile session on April 29. Stocks failed to hold on to the intraday gains but ended little changed.

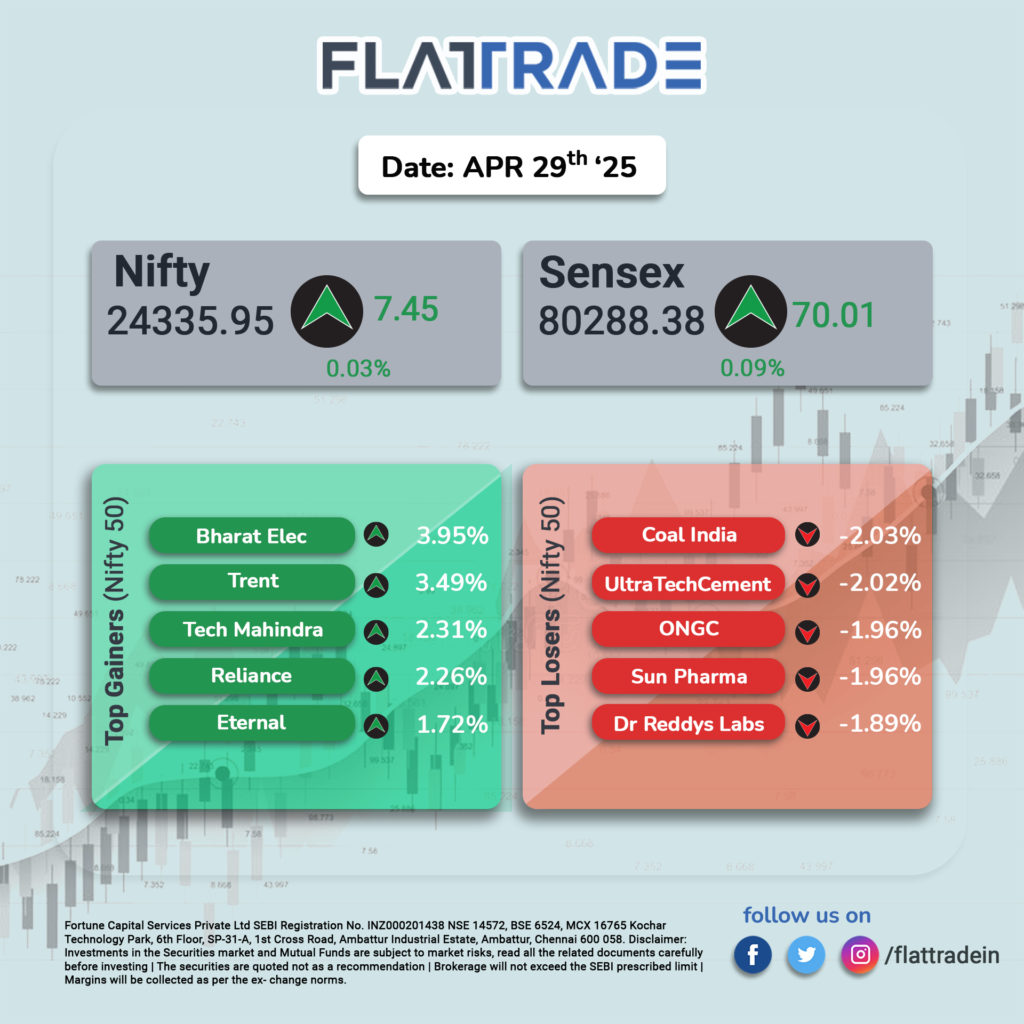

At close, the Sensex was up 70.01 points or 0.09 percent at 80,288.38, and the Nifty was up 7.45 points or 0.03 percent at 24,335.95. About 1766 shares advanced, 2012 shares declined, and 125 shares unchanged.

Bharat Electronics, Tech Mahindra, Reliance Industries, Eternal, and Trent were among the major gainers on the Nifty, while losers were Sun Pharma, ONGC, Coal India, UltraTech Cement, and Dr Reddy’s Labs.

On the sectoral front, capital goods, consumer durables, IT, oil & gas added 0.5-1 percent, while metal, power, telecom, and pharma shed 0.5-1 percent.

The broader market indices also ended flat with modest gains. The BSE Midcap index rose 0.2 percent, while the BSE Smallcap index rose less than 0.1 percent.

STOCKS TODAY

TVS Motors

Two-wheeler player TVS Motor Company’s shares sank four percent in trade on Tuesday, April 29, despite reporting a solid earnings show for the January-March period of FY2025. However, brokerages remained mixed on the outlook. The shares closed at Rs 2697.00 per share.

Tata Technologies

Shares of the subsidiary of Tata Motors declined over 6 percent after shares worth Rs 1094 crores exchanged hands in a block deal window. As much as 1.6 crore shares of the company, making up a 3.95 percent stake changed hands in the large deal, at a price of Rs 683 per share. This represents a three percent discount to the previous session’s close of Rs 705.60 apiece.

Whirlpool

The company’s hares surged up to 10 percent on April 29, after it was reported that several lending private equity firms were approached regarding the potential acquisition of a 31 percent stake at the company. Its US parent company is planning to reduce its ownership to just 20 percent holding while maintaining a strategic presence in the market.

Bajaj Finance

Even, though Bajaj Finance shares were under selling pressure in the early trade ahead of the board meeting on Tuesday, the shares remained almost the same with only around 0.1 percent change. The board will announce the results for the March quarter today and is likely to consider dividends, stock split, and bonus shares.

UCO Bank

The shares jumped over 4 percent, after the bank reported a net profit of Rs 652 crore for the March quarter of FY25, marking a rise of nearly 24 percent on year, while the interest income surged over 15 percent YoY to Rs 6,745 crore. UCO Bank also announced a dividend of Rs 0.39 per equity share for FY25, for which the record date to determine the eligibility is yet to be announced.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.