POST MARKET

Indian equity indices declined sharply today amid reports of increasing COVID-19 cases in Southeast Asian countries like Singapore and Hong Kong. The Nifty fell for the third consecutive session.

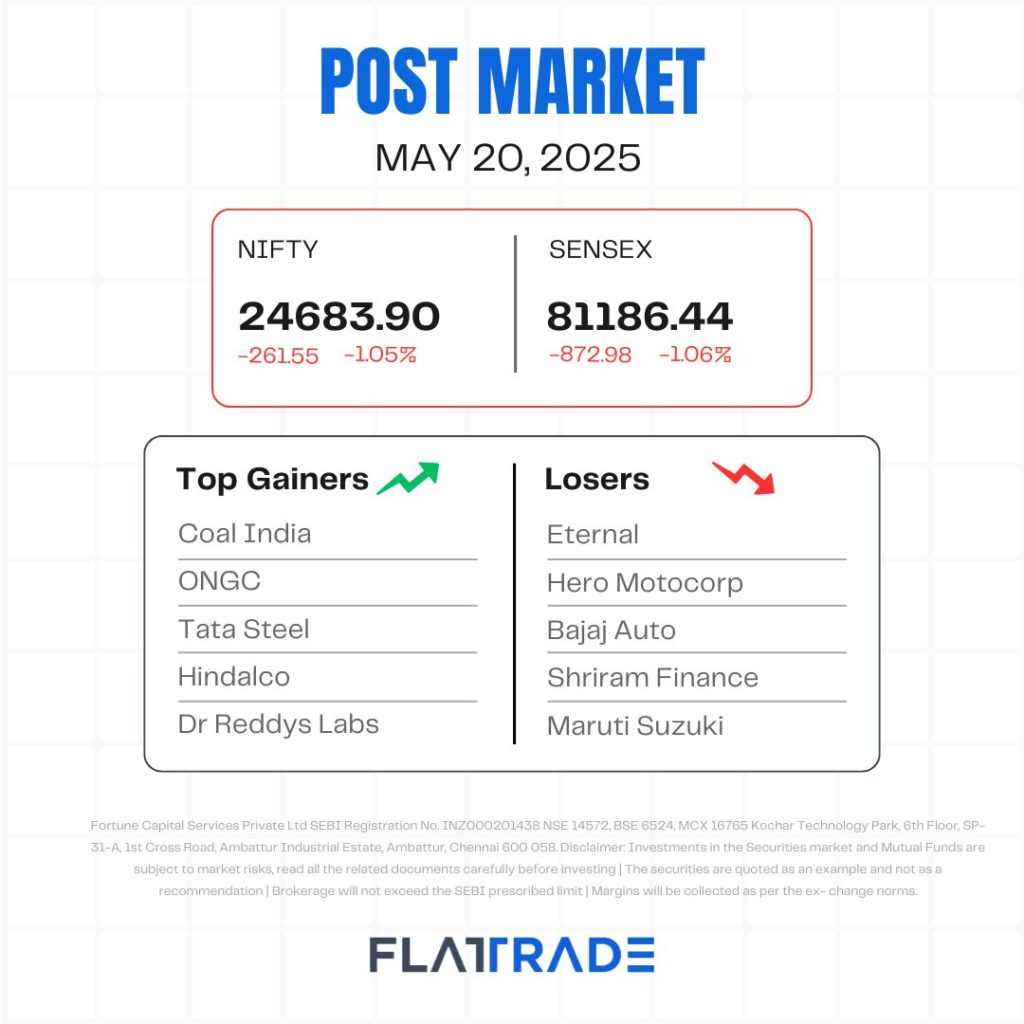

At close, the Sensex was down 872.98 points or 1.06 percent at 81,186.44, and the Nifty was down 261.55 points or 1.05 percent at 24,683.90. About 1398 shares advanced, 2415 shares declined, and 127 shares remained unchanged.

COAL India, ONGC, Tata Steel, Hindalco, Dr.Reddy’s Labs were among the major gainers on the Nifty, while losers were Eternal, Hero Motocorp, Bajaj Auto, Shriram Finance, and Maruti Suzuki.

All sectoral indices closed in red, with Auto, Healthcare, Media, and Pharma experiencing the heaviest losses, with Nifty Auto, Bank, Pharma, and FMCG indices registering losses in the range of 1-2 percent

Broader market sentiment was weak, with the Nifty Midcap and Smallcap indices ending lower by 1.3 percent and 0.8 percent, respectively, reflecting risk-off undertones.

STOCKS TODAY

Hindustan Copper

The company led the gains, rising 2.19 percent to an intraday high of Rs 231.61 on the NSE. The metal index emerged as the top sectoral performer in Tuesday’s trading session, rising over 1 percent, as investor sentiment improved following China’s announcement of a rate cut to support its economy amid trade tensions with the US.

Eternal

Shares of Eternal fell 4.21% as the company moves closer to becoming an Indian Owned and Controlled Company (IOCC). A staggering 99% of shareholders voted in favor of capping foreign ownership, a step that could lead to significant capital outflows. According to Jefferies, the stock faces potential foreign investor selloff of up to $1.3 billion, and risks being dropped from the MSCI index, both of which could weigh heavily on the stock’s near-term trajectory.

Mahindra & Mahindra

Shares of Mahindra & Mahindra declined 2% with trading volumes crossing 720,000 shares, significantly above average. The stock’s movement drew attention as part of the Nifty 50, and may signal short-term investor caution following the recent auto sector rally. While no company-specific news drove the decline, the broader sector pullback likely influenced sentiment.

Coal India

The Indian Public Sector Undertaking and the largest government-owned Coal producer, Coal India’s shares rose 2.88%, emerging among the top performers on the Nifty 50 to close with a gain of 1.55%. The trading volume surged to over 5 million shares. Coal India is in the process of listing its two subsidiaries – BCCL and CMPDI and draft papers would be filed soon with SEBI, the company said on Monday.

ONGC

Shares of ONGC closed about 1% higher with trading volumes of over 5.8 million shares. The company’s consistent financial performance and key financial ratios contribute to its standing in the market

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.