POST MARKET

Indian equity indices ended the session on a weak note, after a sharp selloff in bank, pharma, and metal stocks. The drop comes after a draft notice revealed US President Donald Trump’s plan to slap 50 percent tariffs on Indian goods.

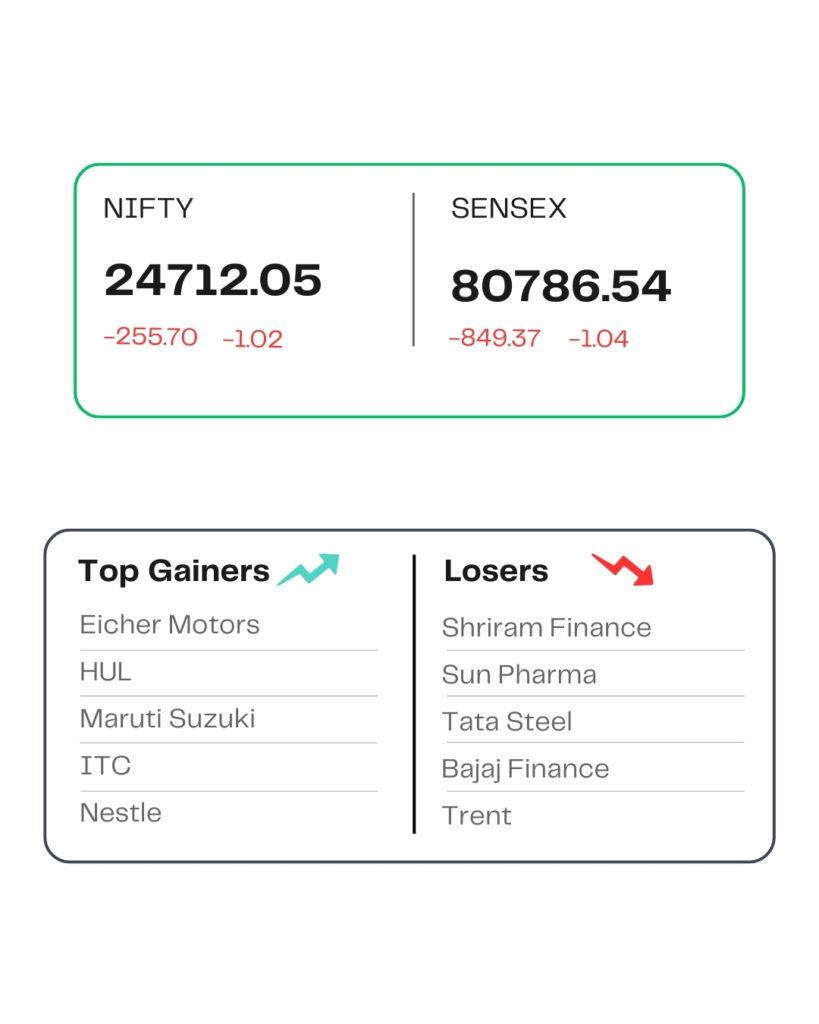

At close, the Sensex was down 849.37 points or 1.04 percent at 80,786.54, and the Nifty was down 255.70 points or 1.02 percent at 24,712.05. About 1167 shares advanced, 2751 shares declined, and 125 shares were unchanged.

The biggest Nifty losers were Shriram Finance, Sun Pharma, Tata Steel, Bajaj Finance, Trent, while gainers included Eicher Motors, HUL, Maruti Suzuki, Nestle India, and ITC.

Except FMCG, all other sectoral indices ended in the red with PSU Bank, metal, pharma, oil & gas, consumer durables, realty, telecom down 1-2%

Among the broader market indices, the BSE midcap index shed 1.3 percent, and the smallcap index fell 1.7 percent.

STOCKS TODAY

Vodafone Idea

Vodafone Idea shares plunged over 9% as investors likely offloaded positions after the Telecom Ministry clarified the company’s AGR dues. Minister of State for Communications Pemmasani Chandra Sekhar had said that there is no plan under consideration to extend further relief other than what has already been extended.

Titan Company

Shares of Titan Company slipped 1.44%, even as Bernstein initiated coverage with an outperform rating on the stock, citing positive levers for growth. The drop comes amid a weak market mood after Donald Trump signalled an additional 25 percent tariff on India. The international brokerage has assigned a price target of Rs 4,200 per share. This implies an upside potential of 15 percent from the last closing price of Rs 3,651.

Godrej Properties

Godrej Properties’ stock dropped more than 3% after the Donald Trump-led US administration issued a draft order over the implementation of an additional 25 percent tariff on Indian imports, effective from August 27. While real estate companies are mostly domestic market-oriented, Trump tariffs can inflate the cost of raw materials associated with the industry, which in turn may put pressure on the margins of these companies.

Sun Pharma

Sun Pharma shares dropped more than 3% after US President Donald Trump said that he will reduce drug prices in the US by a whopping “1,400-1,500 percent”. He also reiterated his threat to slap higher tariffs on pharma imports. BofA Securities has downgraded Sun Pharma shares to ‘underperform’ from its earlier ‘neutral’ rating, and cut its target price for the stock to Rs 1,570 apiece.

Maruti Suzuki

These shares closed around 2% higher. Prime Minister Narendra Modi today flagged off the e-Vitara, Maruti Suzuki India’s maiden battery electric vehicle (BEV), from the carmaker’s Hansalpur plant in Gujarat. Maruti has invested Rs 21,000 crore in its Hansalpur plant, which has an annual production capacity of 7,50,000 units.

Source – Money Control