POST MARKET

Indian benchmark indices ended on a negative note, as investors sold off their holdings in IT and FMCG companies on Thursday, July 24, following a series of disappointing earnings and a miss on margins.

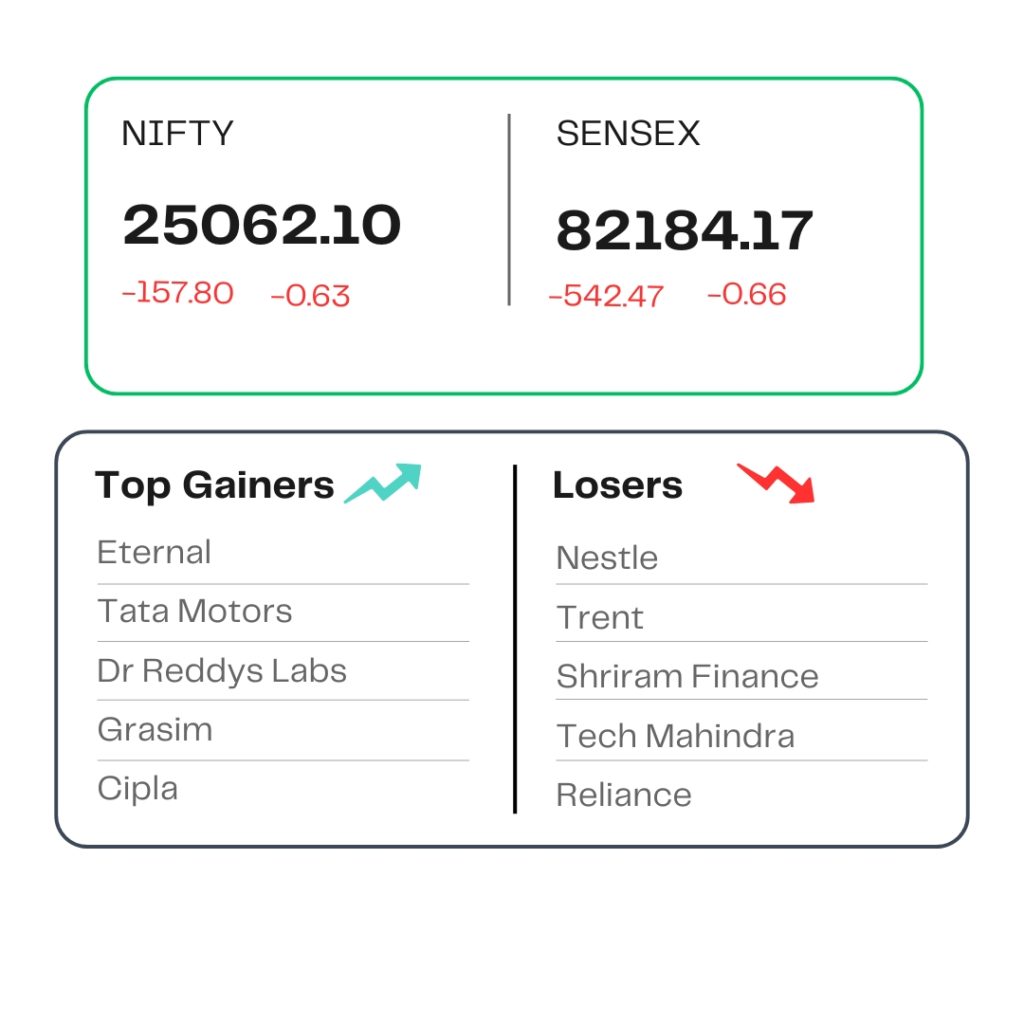

At close, the Sensex was down 542.47 points or 0.66 percent at 82,184.17, and the Nifty was down 157.80 points or 0.63 percent at 25,062.10. About 1564 shares advanced, 2324 shares declined, and 155 shares remained unchanged.

Eternal, Dr Reddy’s Labs, Tata Motors, Grasim Industries, Cipla were among major gainers on the Nifty, while losers included Trent, Nestle India, Shriram Finance, Tech Mahindra, Reliance Industries.

On the sectoral front, except PSU Bank and pharma, all the other indices ended in the red, with the IT index down 2 percent, realty and FMCG indices down 1 percent each.

Among the broader market indices, BSE Midcap and smallcap indices are down 0.4 percent each, reflecting cautious investor sentiment.

STOCKS TODAY

IEX

Shares sank 28 percent after reports suggested that the Central Regulatory Electricity Commission approved the implementation of power coupling with the Day Ahead Market (DAM). As part of the first phase of the new regulations, the Day-Ahead Market (DAM) will be coupled by January 2026. In this system, various power exchanges will take turns serving as Market Coupling Operators (MCOs) through a round-robin arrangement.

Trent

Shares fell 4 percent after global brokerage Goldman Sachs downgraded the stock and slashed its price target. The brokerage noted that while Trent’s value fashion brand Zudio continues to grow faster than the broader apparel market, the pace of market share gains may be slower than previously anticipated.

Dr Reddy’s Labs

Shares of Dr Reddy’s Laboratories gained over 2 percent after its consolidated net profit increased nearly 2 percent year-on-year to Rs 1,418 crore during the June quarter. Revenue increased 11.4 percent to Rs 8,545 crore for the period under review. Following Q1, Jefferies, CLSA, and Morgan Stanley dished out bearish calls on the stock.

Senores Pharma

Shares of the pharma company surged as much as 15 percent on July 24 after the company reported a strong set of earnings for the June quarter. The performance was led by robust revenue and profit growth, along with a broad-based expansion across key geographic markets.

Nestle India

Shares of the FMCG major fell 6 percent on July 24 after the Maggi-maker reported a 13.4% year-on-year (YoY) decline in its profit after tax for the first quarter of FY26, with the company citing elevated commodity prices and rising operational costs as key drags on profitability.

Source – Money Control