POST MARKET

Indian equity indices ended in the red on September 2, after reversing gains as an expiry-driven pullback in financials overpowered a broad-based rally.

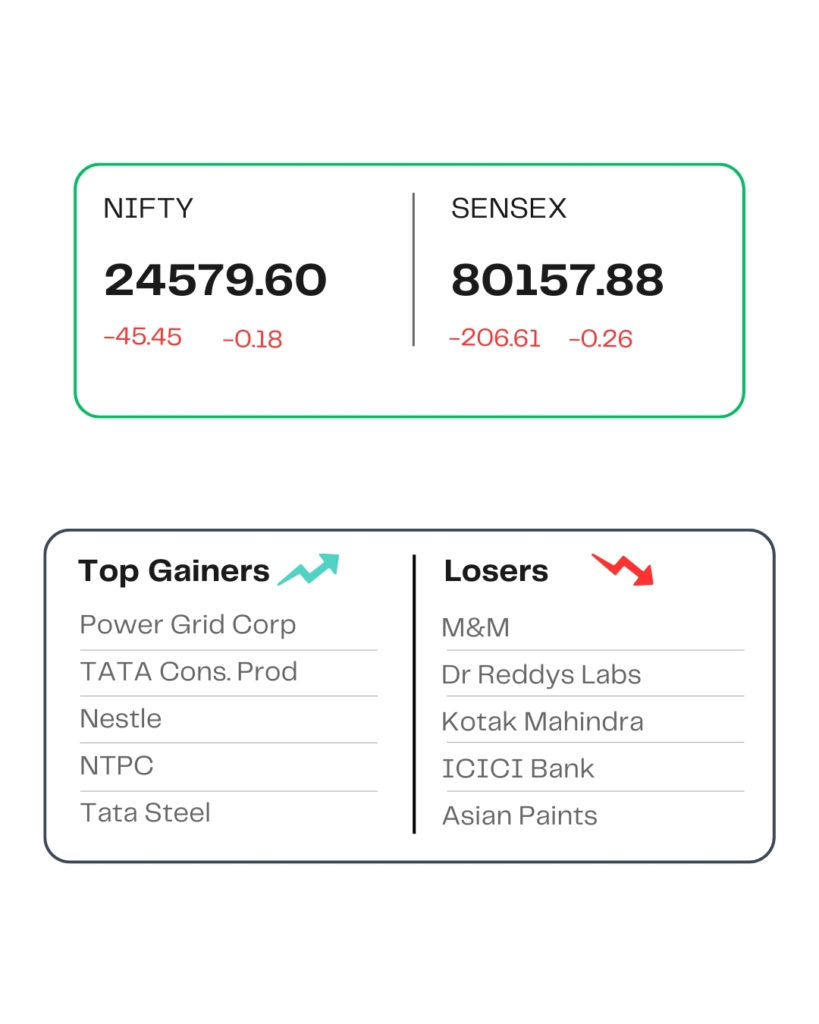

At close, the Sensex was down 206.61 points or 0.26 percent at 80,157.88, and the Nifty was down 45.45 points or 0.18 percent at 24,579.60. About 2396 shares advanced, 1539 shares declined, and 123 shares remained unchanged.

Sectoral indices were mixed, with Nifty FMCG, Media, and Energy ended with gains. On the downside, Auto and Pharma fell.

Top gainers include Power Grid Corp, TATA Cons. Prod, Nestle, NTPC, and Tata Steel, while the losers were Mahindra & Mahindra, Dr Reddy’s Labs, Kotak Mahindra, ICICI Bank, and Asian Paints.

Broader market indices ended high.

STOCKS TODAY

Apollo Tyres

The shares went up 4.32 per cent as the Automotive Tyre Manufacturers Association (ATMA), a representative body of six large tyre companies in India that accounts for over 90% of tyre production, has sought lower GST rates in the proposed GST rate rationalisation exercise later this week. ATMA asked the government not to treat it on par with luxury goods, citing its cost impact on key sectors such as transportation, agriculture, mining, and construction.

Mahindra & Mahindra

The shares of Mahindra & Mahindra (M&M) dropped 2.44 percent after a report said that an Indian tax panel has proposed to hike GST on some electric cars from the existing 5 percent to 18 percent.

OneMobikwik Systems

Shares of One Mobikwik Systems surged a noticeable 18.23 percent on September 2 after key shareholder Abu Dhabi Investment Authority (ADIA) exited its stake in the payments solutions provider via block deals a day earlier.

Phoenix Mills

Shares of mall operator and real estate player The Phoenix Mills rallied over three percent in trade on Tuesday, September 2, after domestic brokerage Motilal Oswal upgraded the counter to ‘buy,’ citing a strong growth outlook.

Source – Money Control