POST MARKET

The Indian equity indices ended on a positive note on January 12, in a volatile session, snapping a five-day losing streak.

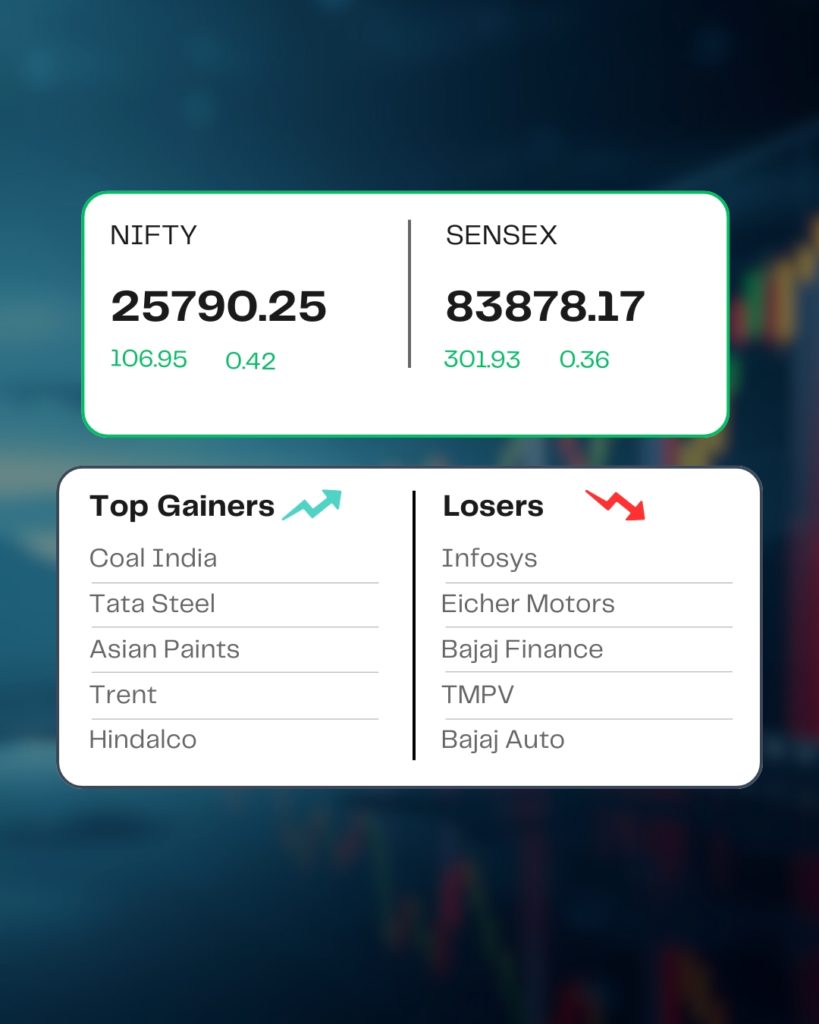

At close, the Sensex was up 301.93 points or 0.36 percent at 83,878.17, and the Nifty was up 106.95 points or 0.42 percent at 25,790.25. About 1365 shares advanced, 2561 shares declined, and 158 shares were unchanged

Among sectors, the metal index rose 2%, the PSU Bank index added 0.7%, the FMCG index gained 0.6%, while capital goods, pharma, media, and realty indices shed 0.5-1.5 percent.

Coal India, Trent, Asian Paints, Tata Steel, and JSW Steel were among the major gainers on the Nifty, while losers included Eicher Motors, Infosys, Bajaj Finance, Tata Motors Passenger Vehicles, and Bajaj Auto.

Among the broader market indices, the BSE Midcap index shed 0.4% and the smallcap index fell 0.7%.

STOCKS TODAY

BHEL

Bharat Heavy Electricals Limited stocks fell for the third straight day, ending over 2.5 percent lower on Monday due to fears after a report said that the government may allow Chinese companies to bid for government contracts, particularly in infrastructure, power, and manufacturing.

IREDA

The shares of Indian Renewable Energy Development Agency (IREDA) jumped 3.91 percent after the company reported a standalone net profit of Rs 584.91 crore for the October-December quarter of FY26. This marks a 37.5 percent year-on-year (YoY) increase from the Rs 425.38 crore net profit reported in the same period of the previous financial year.

Premier Energies

Renewable energy player Premier Energies’ share went up 4.37 percent as the company is looking to more than double its annual cell and module manufacturing capacity to 10.6 gigawatt and 11.1 gigawatt, respectively, as part of its Rs 11,000-crore expansion plan, to meet domestic demand, a company official said.

GMDC

Gujarat Mineral Development Corporation Limited shares ended almost 2.5 percent higher as US Ambassador Sergio Gor announced India will be part of the US-led initiative Pax Silica, a rare earth association. Pax Silica is the US Department of State’s flagship effort on AI and supply chain security, advancing a new economic security consensus among allies and trusted partners.

Avanti Feeds

The shares of Avanti Feeds ended higher by over 2 percent along with export-oriented companies on January 12 after US Ambassador Sergio Gors’ comments on the India-US trade deal boosted markets.

Source – Money Control