POST MARKET

Markets witnessed some respite on the final trading day of the week, gaining nearly a percent amid mixed cues. After a flat start, the Nifty saw a noticeable surge during the early hours of trade, followed by a range-bound move till the close.

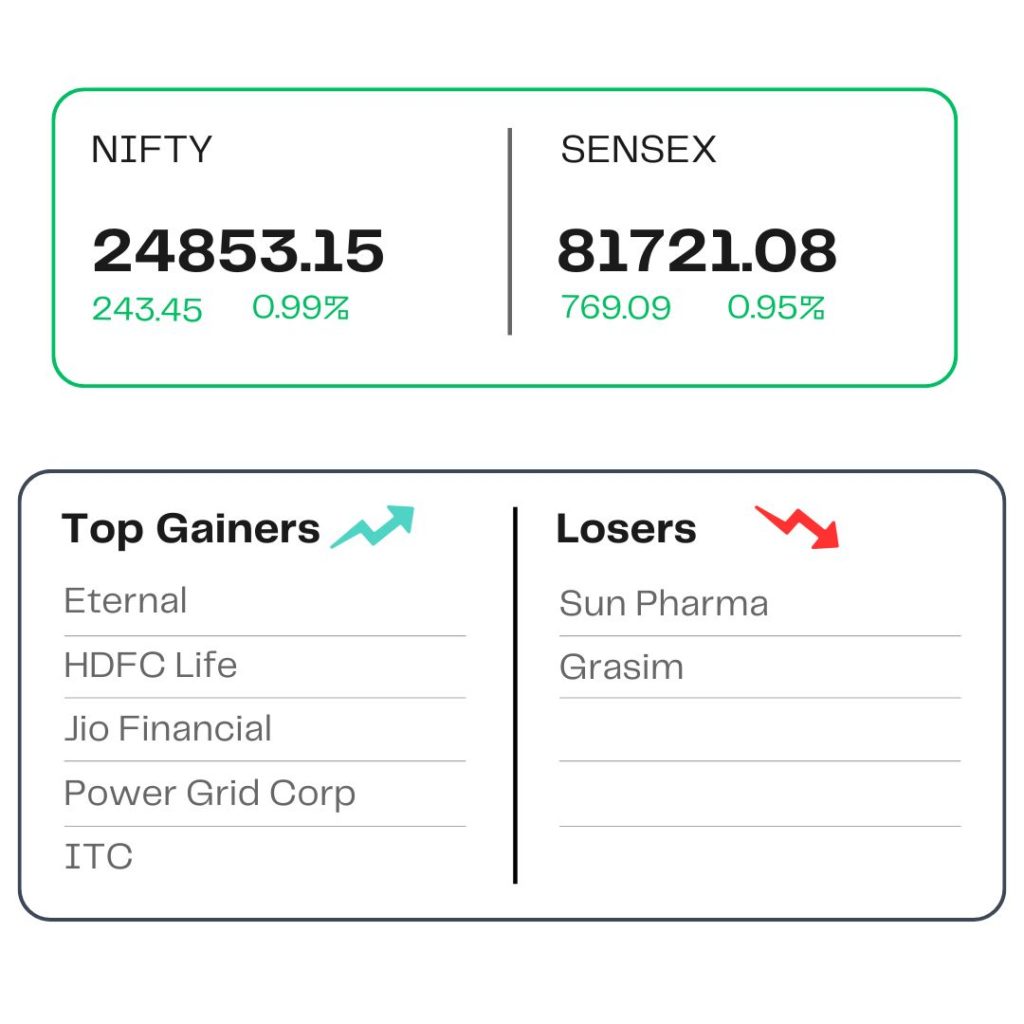

At close, the Sensex was up 769.09 points or 0.95 percent at 81,721.08, and the Nifty was up 243.45 points or 0.99 percent at 24,853.15. About 2222 shares advanced, 1571 shares declined, and 154 shares remained unchanged.

Eternal, HDFC Life, Jio Financial, Power Grid Corp and ITC were among major gainers on the Nifty, while losers were only Sun Pharma and Grasim.

Among sectoral indices, Nifty FMCG led the rally with a 1.6 percent gain, followed by Nifty Private Bank and Nifty IT, which rose 1 percent each. Nifty Bank added 0.8 percent, while Nifty Metal and Nifty PSU Bank advanced 0.7 percent and 0.5 percent, respectively. On the flip side, Nifty Pharma was the only notable laggard, slipping 0.4 percent.

Broader indices also ended in gains, with both small-cap and mid-cap rising nearly a percent each.

STOCKS TODAY

Paras Defence

The shares of Paras Defence sharply jumped over 1 percent, this is after the company announced that it has formed a joint venture with Israel’s Heven Drones to form a company for the production of cargo drones. The shares closed at Rs 1,633 apiece, recovering all losses that were recorded earlier during the day.

Bondada Engineering

Bondada Engineering shares jumped 10 percent to hit the upper circuit on May 23 after the company announced that it had won a project worth Rs 9,000 crore from the government of Andhra Pradesh. The shares of the company remained locked in the upper circuit at Rs 425.05 apiece.

Max Estates

Shares of Delhi-NCR based real estate developer Max Estates surged nearly 7 percent, after the company reported a net profit of Rs 17.34 crore for Q4FY25, marking a significant improvement from the Rs 1.45 crore net loss reported a year ago. The shares of the company tested the highest level seen in more than 3 months.

ITC

The FMCG share saw a strong buying interest, climbing 3 percent to an intraday high of Rs 439 per share, breaking a four-day losing streak. The company on Thursday reported a 2 percent year-on-year rise in standalone net profit before exceptional items and tax at Rs 6,416.85 crore for the January-March period of FY25, up from Rs 6,287.57 crore in the same quarter last year.

Waaree Energies

Shares of solar PV module manufacturer Waaree Energies are lower by over 8 percent in early trade on May 23, fearing a big dent to its export revenue after the US House of Representatives advanced President Trump’s tax and spending bill, setting the stage for an end to many subsidies for the renewable power sector.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.