POST MARKET

Benchmark indices Nifty and Sensex ended the session on a weak note as sentiment to a fresh hit after U.S. President Donald Trump warned of a “substantial” hike in duties on Indian exports, citing continued purchases of Russian oil.

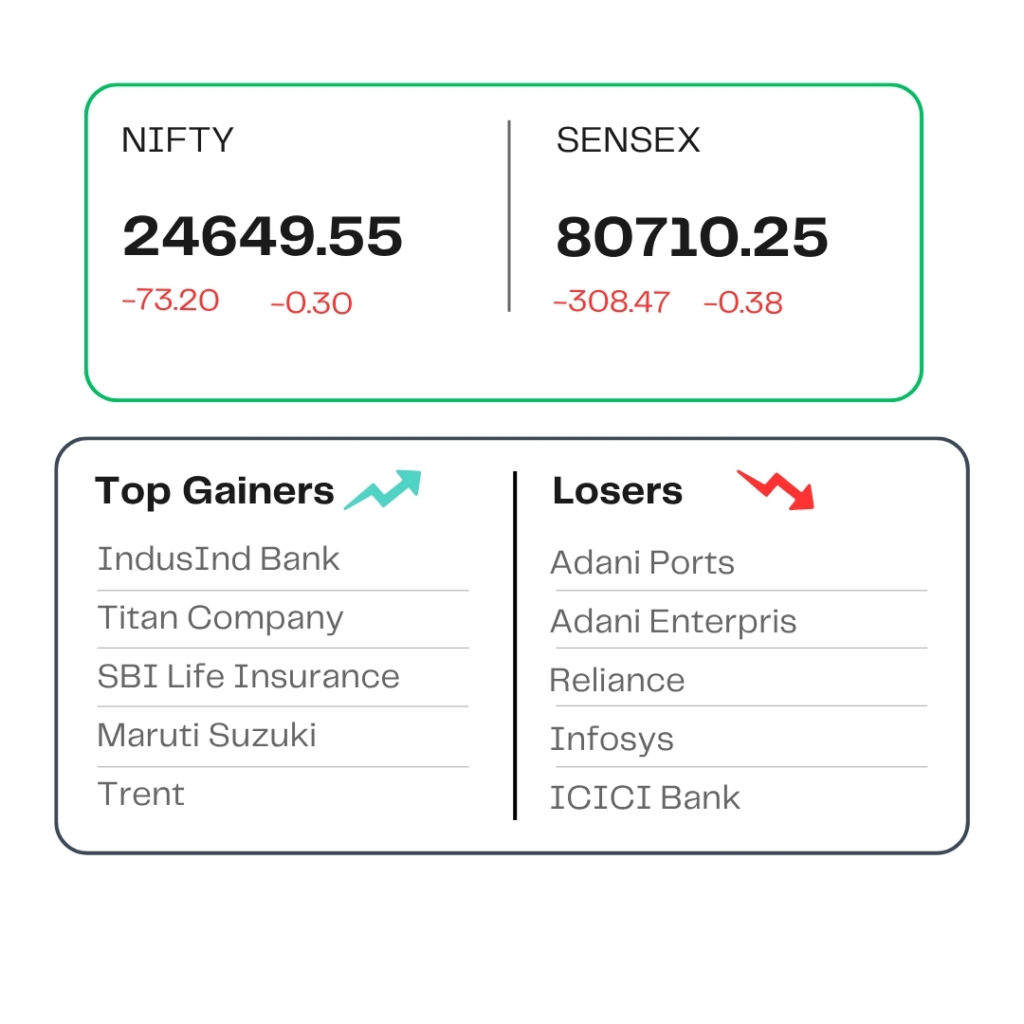

At close, the Sensex was down 308.47 points or 0.38 percent at 80,710.25, and the Nifty was down 73.20 points or 0.30 percent at 24,649.55. About 1708 shares advanced, 2184 shares declined, and 143 shares remained unchanged.

Infosys, Adani Enterprises, Adani Ports, Reliance Industries, and ICICI Bank were among the top losers on the NSE, while gainers were Titan Company, Maruti Suzuki, SBI Life, Trent, and IndusInd Bank.

Among sectors, the auto index is up 0.4 percent, while bank, IT, oil & gas, FMCG, and pharma are down 0.5 percent each.

Among the broader market indices, BSE Midcap and smallcap indices ended with marginal losses.

STOCKS TODAY

Crizac

Crizac shares tumbled over 3 percent. Crizac reported a net profit of Rs 46 crore for Q1 FY26. This marks a rise of over 10 percent on-year from the Rs 41 crore net profit reported in Q1 FY25. However, the net profit fell more than 8 percent sequentially from the Rs 50 crore reported in Q4 FY25. The firm’s revenue from operations meanwhile, rose 30 percent on-year, but fell 38 percent sequentially to Rs 209 crore.

Tata Investment Corporation

Tata Investment Corporation shares rose 4.5% intraday on multiple positive triggers like positive June quarter results, a 1:10 stock split, and Tata Capital filing updated draft papers for IPO. Tata Investment Corporation Ltd on August 4 reported a 12% increase in consolidated profit after tax at Rs 146 crore in the first quarter ended June 30, 2025, on higher dividend income.

Oswal Pumps

Oswal Pumps shares meanwhile, gained more than 5 percent to hit an intraday high of Rs 788 apiece. Oswal Pumps on August 4 reported a net profit of Rs 95 crore for Q1 FY26. This marks a 34 percent on-year increase from the Rs 70 crore net profit reported in the corresponding quarter of the previous financial year. The firm’s revenue from operations, meanwhile, rose 37 percent on-year to Rs 514 crore in Q1 FY26.

Marico

Shares of FMCG major Marico slipped by over a percent after the company reported an 8.2 percent year-on-year rise in consolidated net profit to Rs 513 crore for the April–June quarter of FY26. The FMCG major’s revenue from operations rose 23.3 percent to Rs 3,259 crore, driven by broad-based growth across its product portfolio. Operating margin declined sharply to 20.1 percent from 23.7 percent a year earlier, reflecting higher costs.

Triveni Turbine

Shares of Triveni Turbine slumped as much as 9 percent intraday after the company posted a weak set of earnings for the June quarter, marred by sluggish domestic and export performance. In Q1 FY26, the turbine maker’s consolidated revenue dropped 20 percent year-on-year to Rs 371.3 crore, down from Rs 463.3 crore in the same period last year.

Source – Money Control