POST MARKET

Indian equity indices ended lower on the second consecutive session on August 6 amid volatility after the Reserve Bank of India (RBI) delivered on expected lines, keeping key interest rates unchanged with a ‘neutral’ stance.

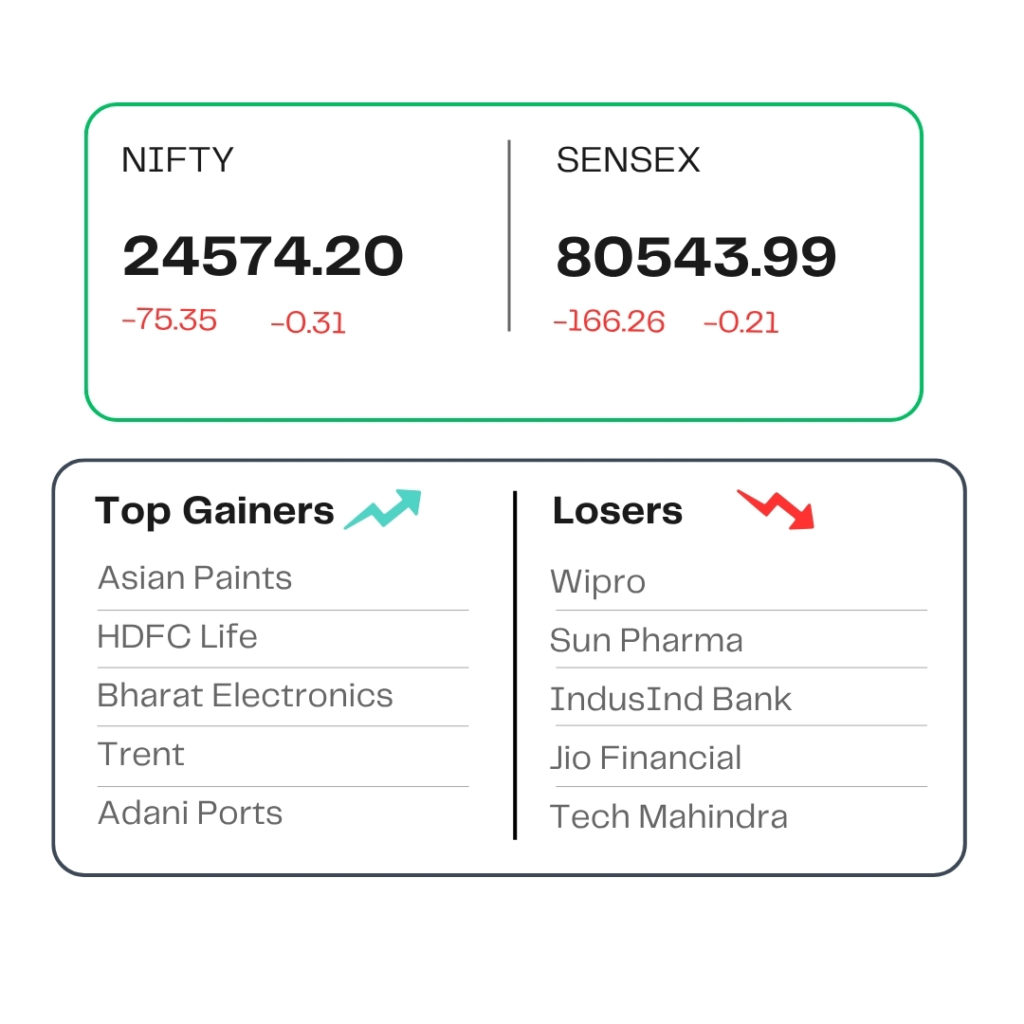

At close, the Sensex was down 166.26 points or 0.21 percent at 80,543.99, and the Nifty was down 75.35 points or 0.31 percent at 24,574.20. About 1292 shares advanced, 2594 shares declined, and 144 shares remained unchanged.

The biggest Nifty losers were Wipro, Sun Pharma, Jio Financial, IndusInd Bank, Tech Mahindra, while gainers included Asian Paints, HDFC Life, Trent, Adani Ports and Bharat Electronics.

Except PSU Bank (up 0.6 percent), all other sectoral indices ended in the red with Information Technology, Media, Realty, Pharma, and FMCG down 1-2 percent.

The broader market indices underperformed, with, BSE midcap and smallcap indices down 1 percent each.

STOCKS TODAY

NSDL

Shares rose as much as 17 percent and made a healthy stock market listing on Wednesday at a premium of 10 percent over its issue price, following a strong 41 times subscription to its Rs 4,011-crore initial public offer (IPO). The initial share sale of National Securities Depository Ltd (NSDL) was opened for public subscription between July 30 – August 1.

Berger Paints

Shares declined 2 percent on August 6 as it reported an 11 percent YoY profit decline in the first quarter of FY26. The company posted a net of Rs 315.04 crore in Q1 FY26, while its profit in Q1FY25 stood at Rs 354.03 crore in Q1FY26. The company’s revenue grew by 3.5 per cent YoY in Q1FY26, as its revenue in the corresponding quarter of the preceding fiscal year stood at Rs 3,091 crore.

Britannia Industries

Shares of the company slipped over 4 percent on trade on August 6, following its muted earnings show for the quarter ended June 30, 2025. Britannia Industries reported a 3 percent rise on-year in consolidated net profit at Rs 520.13 crore for the June quarter of FY26. The biscuit maker had reported a net profit of Rs 504.88 crore in the June quarter a year ago.

Astra Microwave Products

Shares surged as much as 4 percent after the company received an order worth Rs 135 crore from the Defence Research and Development Organisation (DRDO) for the upgradation of the ground-based radar system. The execution of the order is scheduled to be completed within a period of 18 months.

CCL

Shares fell as much as 6 percent on August 5 after the company reported a flat net profit for the June quarter, despite strong revenue growth. The stock later pared losses to end 1.75 percent lower at Rs 910.60 on the BSE. The Andhra Pradesh-based instant coffee maker posted a 36.5 percent year-on-year jump in revenue for the first quarter of FY26 at Rs 1,055 crore.

Source – Money Control