POST MARKET

Indian equity indices ended on a positive note in the volatile session on May 14. Banking stocks remained under pressure, while IT, media, metal, and realty provided support at the lower levels.

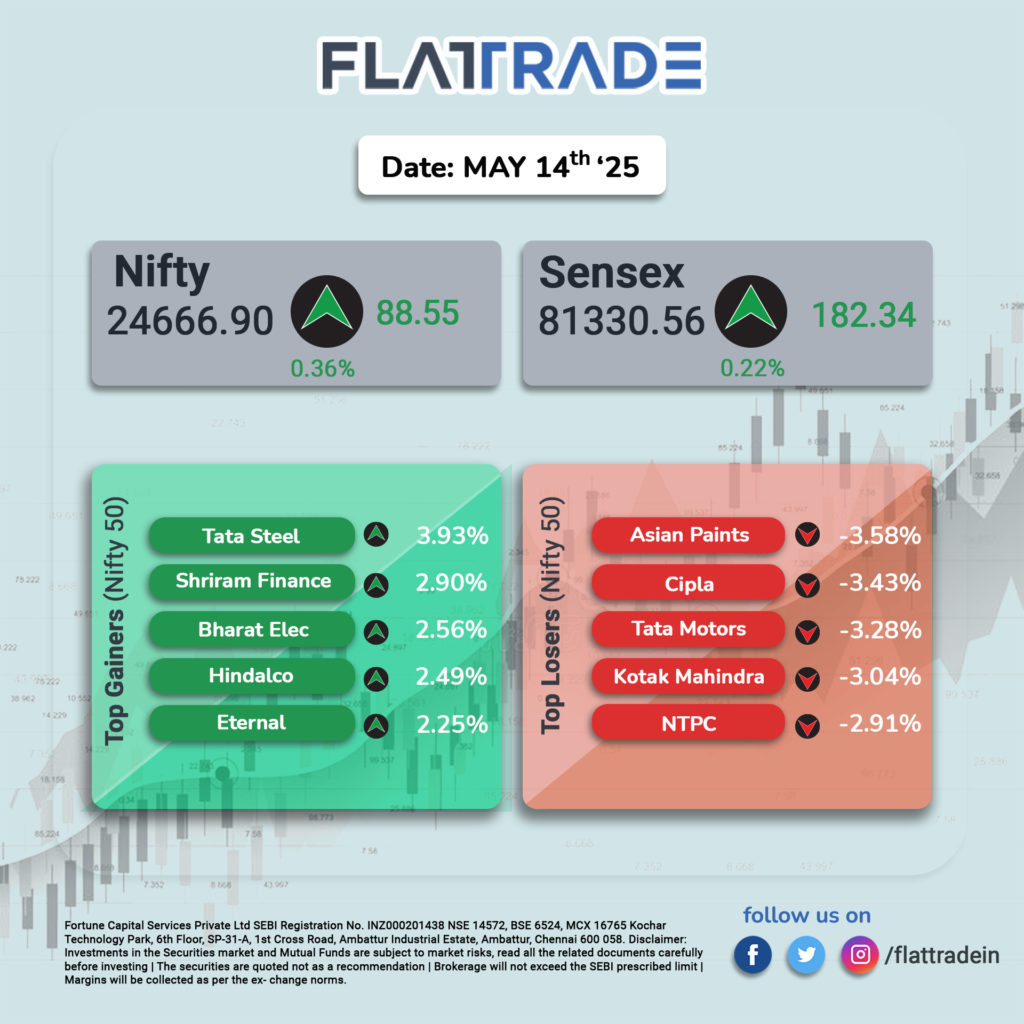

At close, the Sensex was up 182.34 points or 0.22 percent at 81,330.56, and the Nifty was up 88.55 points or 0.36 percent at 24,666.90. About 2749 shares advanced, 1085 shares declined, and 134 shares remained unchanged.

Tata Steel, Shriram Finance, Bharat Electronics, Hindalco Industries, Eternal were among major gainers on the Nifty, while losers included Asian Paints, Cipla, Tata Motors, Kotak Mahindra Bank, NTPC.

Among sectors, except banks, all other sectoral indices ended in the green with realty, oil & gas, telecom, media, IT, and metal indices up 1-2.5 percent.

Broader indices outperformed the main indices, withthe BSE Midcap index rising 1 percent and the Smallcap index rising 1.6 percent.

STOCKS TODAY

Cipla

Shares of the Pharma company dipped up to 2 percent on margin concerns despite a strong Q4 with profit rising 30 percent. A key pressure point for Cipla is the anticipated loss of exclusivity for Revlimid by Q4 FY26, a product that currently plays a major role in driving the company’s US business.

GRSE

Garden Reach Shipbuilders & Engineers (GRSE) shares rallied over 18 percent to touch a 10-month high in today’s session. This comes after a strong quarter where profit doubled and revenue from operations climbed by 61.7 percent year-on-year (YoY) to Rs 1,642 crore in Q4FY25.

Bharti Airtel

The company’s shares jumped 3 percent after the company reported stronger-than-expected Q4 results, posting a 77 percent surge in adjusted net profit for the March quarter. Brokerages remained largely optimistic about the telecom giant’s outlook.

Raymond

A diversified group’s share price dropped nearly 66 percent on Wednesday as the stock turned ex-date for the demerger of its real estate arm, Raymond Realty. Following the demerger, shareholders will now own equity in both Raymond Ltd and the newly formed Raymond Realty.

Jindal Stainless

Its shares extend gains and climb another 4 percent today. Prabhudas Lilladher is bullish on Jindal Stainless and has recommended a ‘Buy’ rating on the stock. Analysts believe the firm has the potential to exceed the guided 9–10 percent volume growth, owing to strong traction in exports and robust domestic demand.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.