POST MARKET

Indian equity indices ended on a positive note, market’s upward momentum was driven by broad-based buying across sectors, notably in auto, realty, metal, and IT stocks.

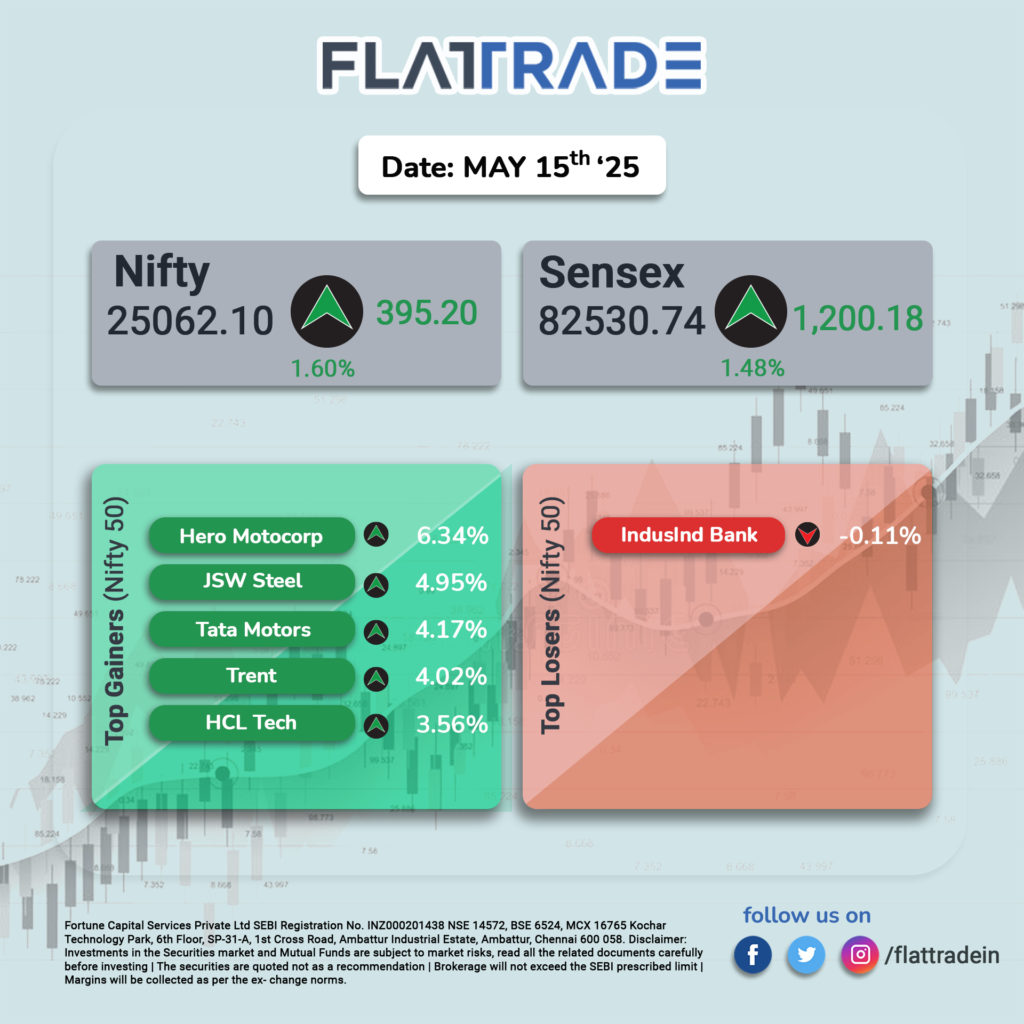

At close, the Sensex was up 1,200.18 points or 1.48 percent at 82,530.74, and the Nifty was up 395.20 points or 1.60 percent at 25,062.10. About 2511 shares advanced, 1302 shares declined, and 139 shares remained unchanged.

Hero MotoCorp, JSW Steel, Trent, Tata Motors, and HCL Technologies were among the major gainers on the Nifty, while IndusInd Bank was the major loser.

Among sectors, all the sectoral indices ended in the green with realty, oil & gas, metal, media, IT, auto, and bank up 1-2 percent

Broader indices outperformed the main indices, with the BSE midcap index adding 0.6 percent and the smallcap index rising 0.9 percent.

STOCKS TODAY

GAIL

Gas Authority of India Ltd shares slipped up to 2 percent to Rs 182 per share on May 15 after the company reported weak March quarter performance (Q4FY25). The company reported standalone net profit of Rs 2,049 crore in the March quarter, a 5.87 percent decline from the year-ago period. The gas distributor had reported a net profit of Rs 2,177 crore last year.

Torrent Power

Torrent Power shares experienced a downturn in today’s session, falling by 2.03%. Despite reporting a record 146 percent jump in Q4 net profit, investors focused on a dip in revenue and the quality of earnings. Analysts flagged concerns over softer power demand, project delays, and stretched valuations following a recent rally, prompting profit-booking.

Remsons Industries Ltd

The small-cap stock Remsons’ share price jumped 17% during Thursday’s trading session after the company received several orders totaling more than ₹300 crore from Stellantis N.V., North America, for over seven years. The contract marks a significant milestone in Remsons’ history, with deliveries starting in the upcoming financial year.

Persistent Systems

Shares of Persistent Systems fell sharply on Thursday after a major US client, UnitedHealth Group, saw its Chief Executive Officer step down abruptly. and pulled back its 2025 financial guidance. The shares fell around 2 percent and ended at Rs 5646.50 per share.

Wentdt India

Shares of precision component maker Wendt India languished over 15 percent lower on May 15 after the company announced that its German parent Wendt GmbH is planning to exit by fully selling its holding via an Offer For Sale (OFS). The company’s shares were at a two-month low, falling nearly 39 percent in the past six months, and down 46 percent so far in 2025.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.