POST MARKET

Indian benchmark indices slipped into negative on November 4 as investors stayed on the sidelines amid lingering uncertainty over the US Federal Reserve’s next move on interest rates, muted second-quarter earnings, and the lack of clarity surrounding US–India trade talks

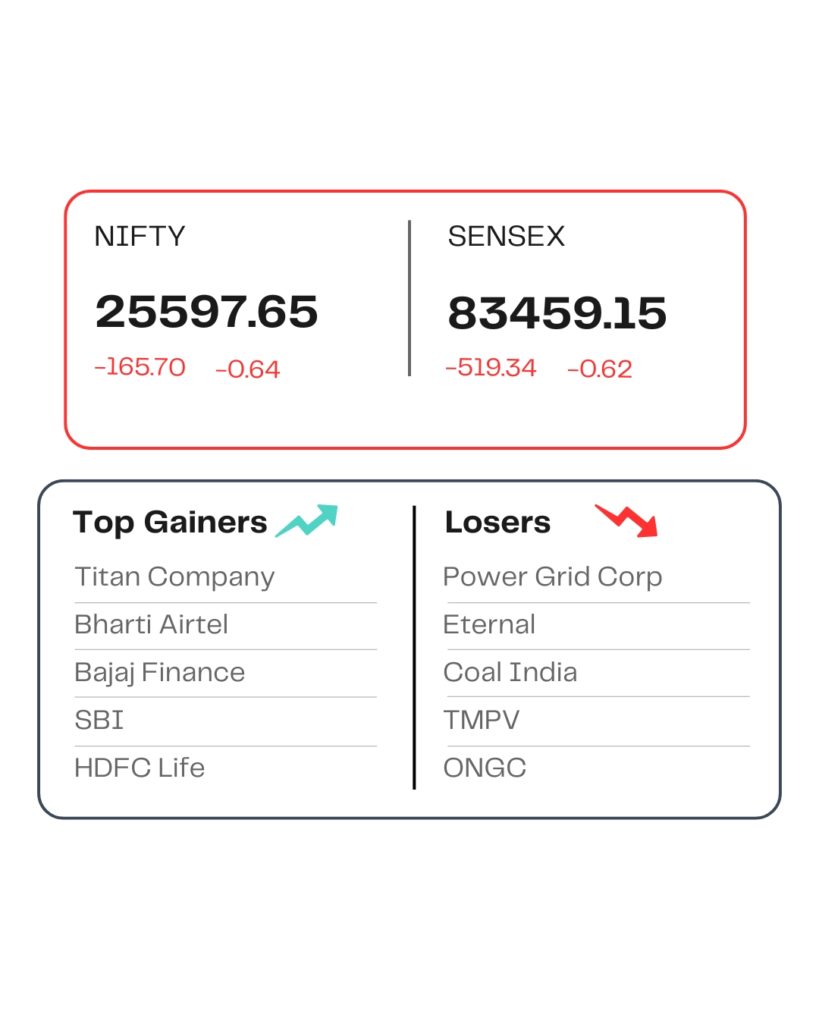

At close, the Sensex was down 519.34 points or 0.62 percent at 83,459.15, and the Nifty was down 165.70 points or 0.64 percent at 25,597.65. About 1543 shares advanced, 2439 shares declined, and 152 shares were unchanged.

The biggest Nifty losers were Power Grid Corp, Coal India, Tata Motors Passenger Vehicles, Bajaj Auto, Eternal, while gainers included Titan Company, Bharti Airtel, Bajaj Finance, HDFC Life, and M&M.

Except for consumer durable and telecom, all other sectoral indices ended in the red with IT, auto, FMCG, metal, power, realty, and PSU indices down 0.5-1%.

Among the broader market indices, the BSE midcap index fell 0.2% and the smallcap index shed 0.7%.

STOCKS TODAY

One MobiKwik

Fintech company One MobiKwik Systems’ shares went down almost 4.5 percent after the company reported a consolidated net loss of Rs 28.6 crore for the quarter ended September 30, 2025, compared to a net loss of Rs 3.6 crore in the same quarter last year, as profitability was impacted by a one-time exceptional charge related to a fraud provision.

M&M

Shares of automaker Mahindra & Mahindra (M&M) went up almost a percent after they reported a rise of 18% year-on-year (y-o-y) in standalone net profit for the quarter ended September 2025, driven by a robust demand for its high-margin sport utility vehicles (SUVs) and tractors.

Titan Company

Titan Company Ltd shares gained 2.3 percent after the company posted a strong second-quarter performance, marked by double-digit revenue growth and robust festive demand momentum across key businesses.

Bharti Airtel

Bharti Airtel shares rose almost 2 percent, with brokerages sharing bullish views after the telecom major reported a strong July-September quarter performance. The company’s Q2 FY26 results were marked by higher profitability, premium subscriber additions, rising ARPU, and operational momentum across India and Africa.

Interglobe Aviation

Interglobe Aviation Ltd (IndiGo) shares went down 1.15 percent after the company posted its Q2 FY26 net loss surged over two-and-a-half times year-on-year to Rs 2,581.7 crore, as the aviation major’s expenditure far outpaced the revenue growth.

Source – Money Control