POST MARKET

Indian equity benchmarks ended lower for a second consecutive session on August 1, mirroring global market weakness as heightened US tariffs dampened investor sentiment.

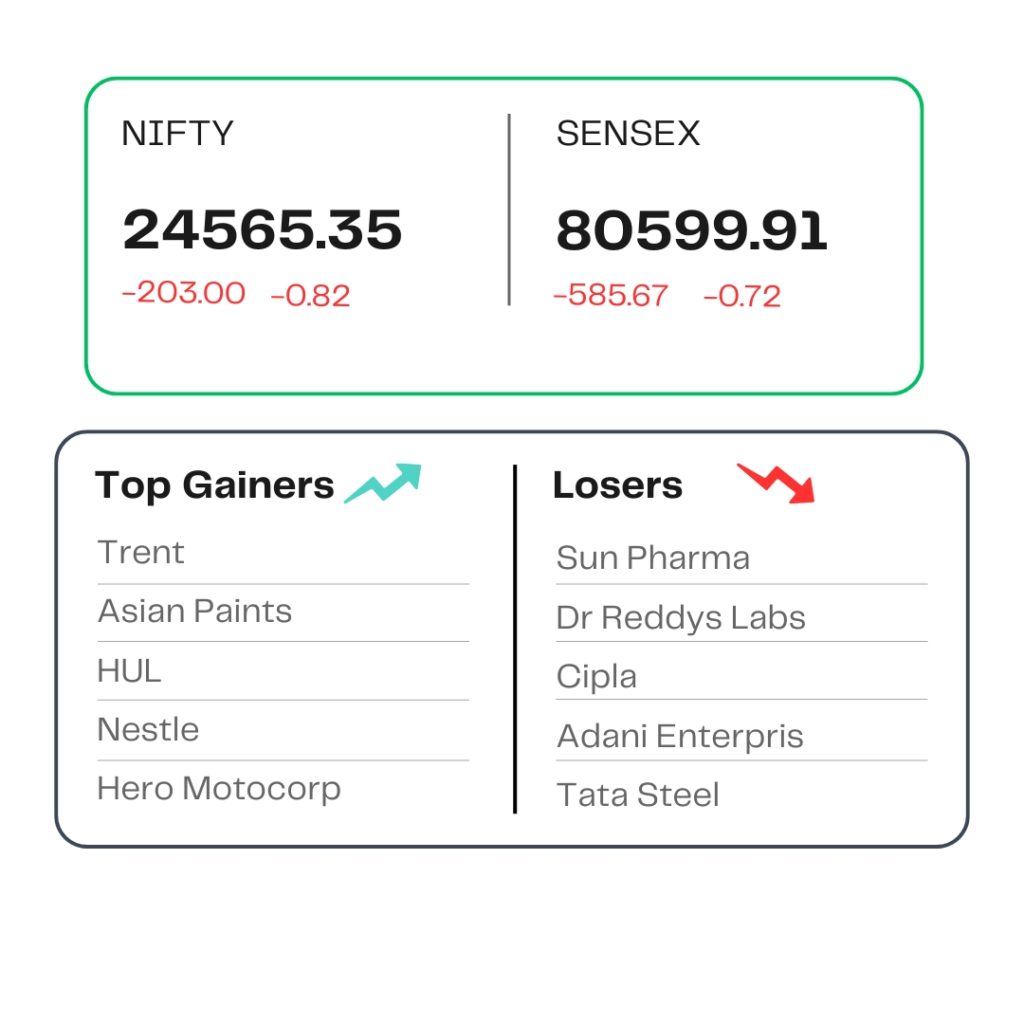

At close, the Sensex was down 585.67 points or 0.72 percent at 80,599.91, and the Nifty was down 203 points or 0.82 percent at 24,565.35. About 1264 shares advanced, 2582 shares declined, and 154 shares remained unchanged.

The biggest Nifty losers were Sun Pharma, Dr Reddy’s Labs, Adani Enterprises, Tata Steel, Cipla, while gainers included Trent, Asian Paints, Hero MotoCorp, HUL, Nestle.

Except FMCG, all other sectoral indices ended in the red with auto, realty, pharma, IT, metal, oil & gas, PSU Bank, telecom down 0.5-2 percent.

The broader market indices underperformed, with the BSE midcap index falling 1.3 percent and the smallcap index shedding 1.6 percent.

STOCKS TODAY

Gokaldas Export

The shares of the textile company continued to record significant losses for the second consecutive session on August 1. This comes after the US President Donald Trump announced a 25 percent tariff and an additional penalty on India, rattling the export-oriented stocks.

Ambuja Cements

Ambuja Cements shares rose over 2.5 percent on August 1, a day after the stock plunged 4.5 percent following the release of its April-June quarter results. The rise in the share price today comes as brokerages remained optimistic on the stock, seeing strong upside potential from current levels.

Sun Pharma

Shares of Sun Pharmaceutical Industries lost 4.5 percent, making it the worst Nifty 50 loser, after reporting June quarter earnings. Brokerages gave a diverse range of calls for the pharma stock as it reported a higher adjusted profit on Thursday, aided by strong domestic sales.

Adani Power

Shares of Adani Power went down 3.59 percent after the company reported 1a 3.5% decline in consolidated net profit at Rs 3,384 crore for the quarter ended June 30, 2025. It reported consolidated net profit of Rs 3,913 crore in the year-ago period. The Adani Group firm’s consolidated revenue fell 6% to Rs 14,109 crore in Q1FY26 as against Rs 14,956 crore in Q1FY25.

Netweb

Shares of Netweb Technologies, a high-end computing solutions (HCS) provider, soared over 5 percent, riding on strong profit growth and AI revenue for the June quarter. The net profit doubled to Rs 30.48 crore and total income rose to Rs 302.32 crore at a growth of 97 percent on year, during the June quarter. Income from AI systems rose by 300% on the year during Q1FY26, helped by a large AI-related deal.

Source – Money Control