POST MARKET

The Indian equity indices pared some of their losses on Tuesday as late-session buying in select IT counters, optimism around India-US trade discussions, and firm cues from global markets helped lift sentiment.

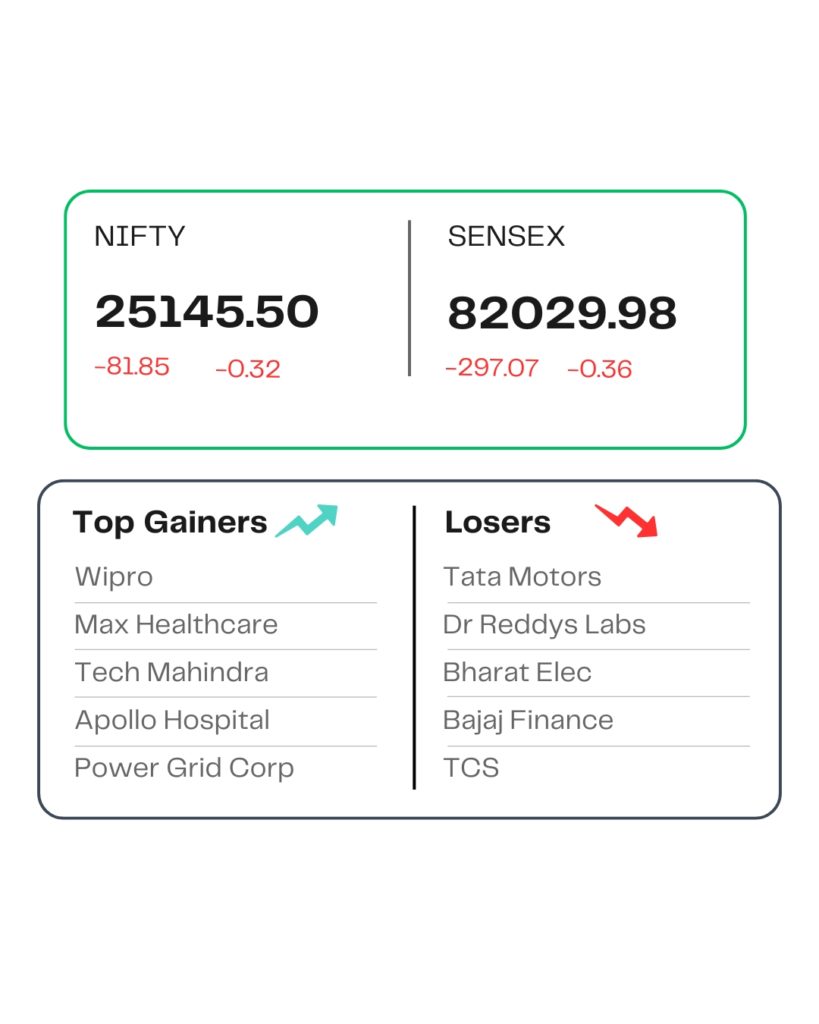

At close, the Sensex was down 297.07 points or 0.36 percent at 82,029.98, and the Nifty was down 81.85 points or 0.32 percent at 25,145.50. About 1140 shares advanced, 2692 shares declined, and 97 shares were unchanged.

All the sectoral indices ended in the red with pharma, consumer durables, metal, media, and PSU Bank index down 1-1.5%.

Dr Reddy’s Laboratories, Bajaj Finance, Bharat Electronics, TCS, and Trent were among the major losers on the Nifty, while gainers included Max Healthcare, Apollo Hospitals, Tech Mahindra, Wipro, and ICICI Bank.

Among the broader market indices, the BSE Midcap index shed 0.8 percent, and the smallcap indices fell 1%.

STOCKS TODAY

Leela Palaces

The shares of recently-listed Leela Palaces Hotels & Resorts dropped 5.68 percent after the company reported a net profit of Rs 74.7 crore for the second quarter of the financial year 2026, as against a net loss of Rs 51.17 crore in the same period last year.

Anand Rathi Wealth

The shares of Anand Rathi Wealth rallied more than 7 percent after the company reported a 31 percent on-year jump in consolidated net profit in the second quarter of the ongoing financial year 2026.

Cochin Shipyard

Shares went up 1.39 percent, after it had bagged the ‘mega’ order from a European client for the design and construction of six feeder container vessels. The company classifies orders worth over Rs 2,000 crore as ‘mega’. Cochin Shipyard did not disclose the identity of the client.

Hindustan Zinc

The shares of Hindustan Zinc erased all early gains and ended flat, after silver prices saw some correction after hitting fresh lifetime high levels earlier during the day. Hindustan Zinc is the largest producer of silver in India.

Source – Money Control