POST MARKET

Indian benchmark indices ended slightly lower on Monday, snapping a two-day winning streak, as weak global cues and profit booking at higher levels capped gains despite selective buying in auto, financial, and telecom stocks.

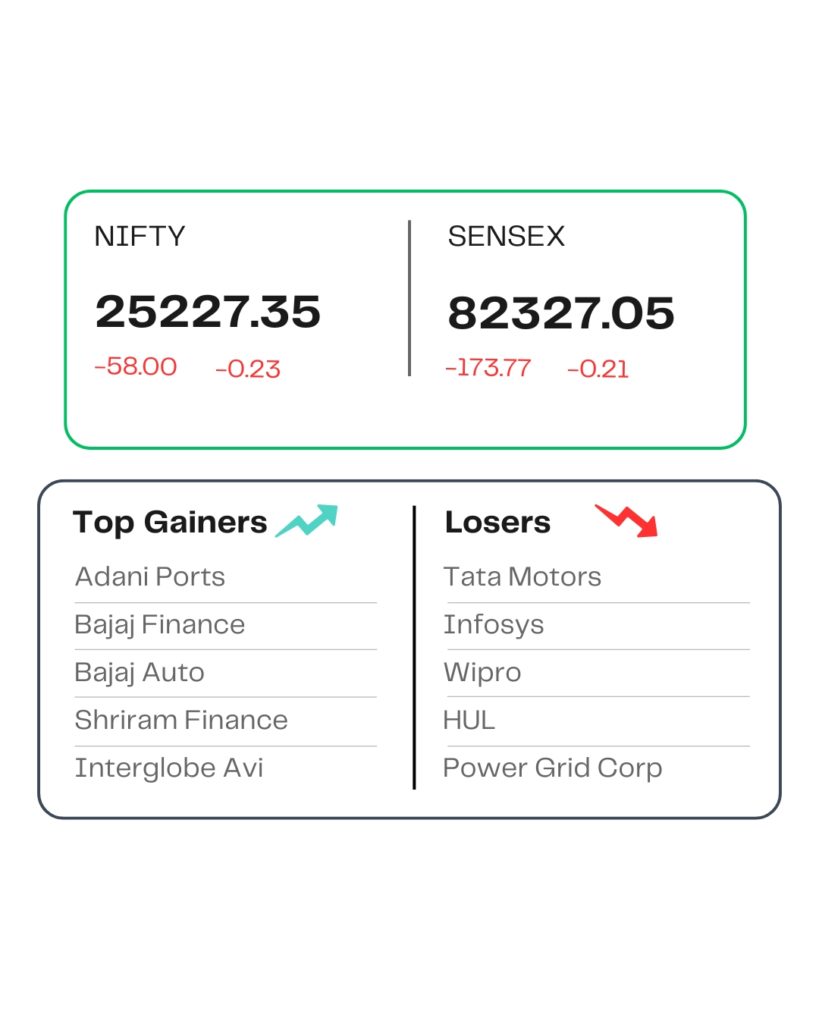

At close, the Sensex was down 173.77 points or 0.21 percent at 82,327.05, and the Nifty was down 58 points or 0.23 percent at 25,227.35. About 1619 shares advanced, 2478 shares declined, and 154 shares remained unchanged.

Among sectors, metal, telecom, IT, FMCG, capital goods, and consumer durables slipped between 0.5-1%.

Tata Motors, Infosys, Wipro, Nestle, and HUL were among the major losers on the Nifty, while gainers were Bharti Airtel, Bajaj Auto, Adani Ports, Shriram Finance, and Bajaj Finance.

Among the broader market indices, the BSE Midcap index was down 0.2 percent, and the smallcap indices shed 0.4 percent.

STOCKS TODAY

CE Infosystems

Shares of map services company CE Info Systems, the makers of MapMyIndia, were higher by almost 5 percent on expectations of further government push for home-grown digital services, after Railway Minister Ashwini Vaishnaw posted about the features of one of its products – Mappls – on his social media platform. The railways will soon sign an agreement with the company to use the application, Minister Vaishnaw added.

BLS International

The shares of BLS International Services tumbled lower around 11 percent, hitting a fresh 52-week low. This comes after the Ministry of External Affairs (MEA) banned the company from participating in future tenders of the ministry and the India Mission abroad for two years.

Travel Food Services

TFS shares went up 1.22 percent after the company’s subsidiary, TFS Gurgaon Airport Services, entered into a License Agreement with Delhi International Airport for setting up, operating, managing, and maintaining Food & Beverage (F&B) outlets at Terminal 2 of Indira Gandhi International Airport, New Delhi.

Mankind Pharma

Shares went down 0.97 percent after the company executed a Business Transfer Agreement with its subsidiary Bharat Serums and Vaccines (BSV) for the acquisition of its branded generic business related to the women’s health Rx portfolio, on a going concern basis, by way of slump sale for Rs 797 crore.

Source – Money Control