POST MARKET

Indian equity benchmarks ended on a strong note in the volatile session on February 2, erasing part of the losses from the previous Budget day.

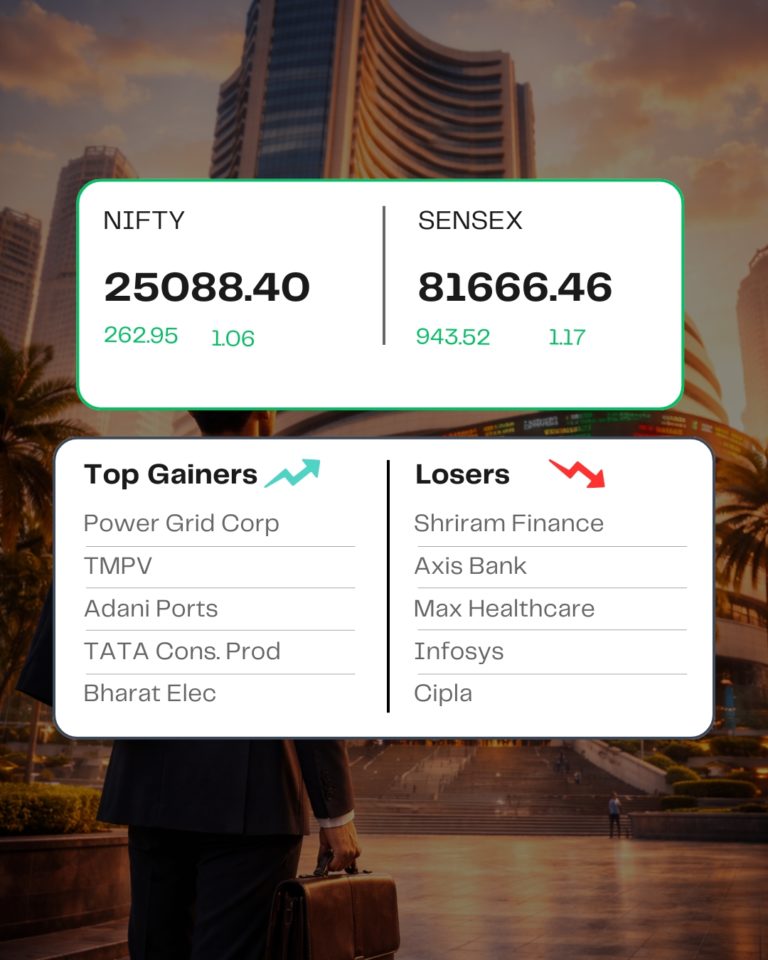

At close, the Sensex was up 943.52 points or 1.17 percent at 81,666.46, and the Nifty was up 262.95 points or 1.06 percent at 25,088.40. About 1919 shares advanced, 2166 shares declined, and 159 shares were unchanged.

Tata Motors Passenger Vehicles, Tata Consumer, Adani Ports, Power Grid, Bharat Electronics were among the major gainers on the Nifty, while losers included Shriram Finance, Max Healthcare, Cipla, Axis Bank, Infosys.

On the sectoral front, FMCG, metal, oil & gas, energy, infra, and realty jumped 1-2%, while the IT index shed 0.5%.

Among the broader market indices, the Nifty midcap index rose 1%, while the smallcap index added 0.6%.

STOCKS IN NEWS

Power Grid Corporation of India

The shares of Power Grid Corporation of India jumped nearly 8 percent on February 2 after the company’s management revised the company’s FY26 capex guidance to Rs 32,000 crore from the earlier Rs 28,000 crore. It also raised capitalisation guidance for the ongoing financial year to Rs 22,000 crore from the earlier Rs 20,000 crore.

L&T

The shares of Larsen & Toubro (L&T) gained more than 2.5 percent on February 2, as FY27 capex is projected at Rs 12.2 lakh crore, and a strong capex boost was also announced by Finance Minister Nirmala Sitharaman yesterday, which boosted sentiment.

E2E Networks

The shares of cloud infrastructure provider E2E Networks jumped almost 7 percent on February 2, extending gains for the second consecutive session after Finance Minister Nirmala Sitharaman presented the Union Budget 2026.

Shriram Finance

Shares of non-banking financial company (NBFC) Shriram Finance declined 3.17 percent, after the government outlined its borrowing programme for FY27, without announcing measures to boost demand for credit. The Centre plans to raise Rs 17.2 lakh crore in FY27, an increase of about 17 percent over the current financial year.

OMC

The shares of oil marketing company OMC (Omnicom Group Inc) jumped almost 2 percent on February 2 as tensions between the US and OPEC member Iran eased, boosting investor sentiment. The shares of oil explorers, however, declined.

Source – Moneycontrol