POST MARKET

Indian equity indices were near the day’s low in the last hour of trade on Wednesday, September 24, succumbing to selling pressure for the fourth consecutive session.

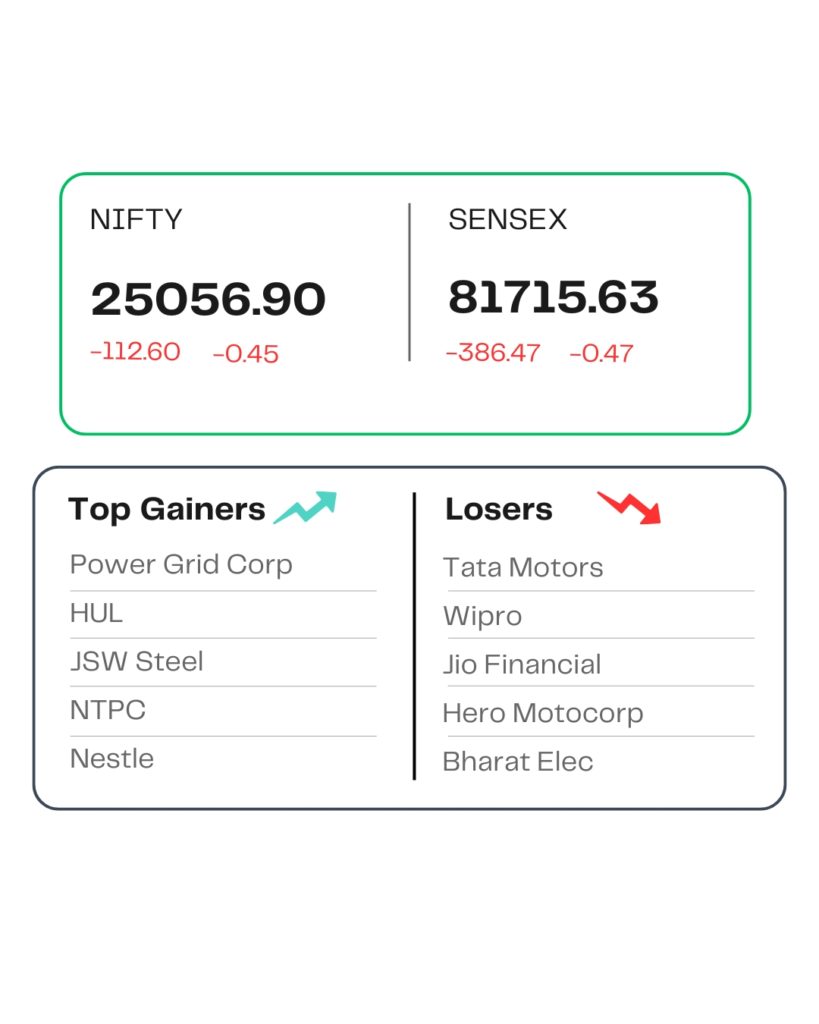

At close, the Sensex was down 386.47 points or 0.47 percent at 81,715.63, and the Nifty was down 112.60 points or 0.45 percent at 25,056.90. About 1535 shares advanced, 2445 shares declined, and 143 shares remained unchanged.

The biggest Nifty losers were Tata Motors, Wipro, Bharat Electronics, Jio Financial, Hero MotoCorp, while gainers included HUL, Nestle, NTPC, JSW Steel, and Power Grid.

Except for FMCG, all other sectoral indices ended in the red with auto, IT, media, metal, oil & gas, and realty down 0.5-2%.

Among the broader market indices, the BSE midcap index shed nearly 0.9% and the smallcap index was down 0.5%.

STOCKS TODAY

Swiggy

Food delivery and quick commerce player Swiggy Ltd saw its shares fall 2.39 percent on Wednesday, September 24, following the sale of its 12 percent stake in Rapido and the restructuring of its quick commerce arm, Instamart.

Bajaj Electricals

Shares of home appliances and cookware company Bajaj Electricals are higher by over 2 percent on acquiring the intellectual property rights of the Morphy Richards brand for India and neighbouring markets from Glen Electric for Rs 146 crore.

Tech Mahindra

The shares of Tech Mahindra went down 1.32 percent along with other IT company shares, taking down the Nifty IT index, after the US President Donald Trump-led administration proposed major changes to the H-1B visa process.

Techno Electric

Techno Electric & Engineering Company Limited shares went down 1.91 percent after they announced the declaration of a final dividend of ₹9 per equity share at its 20th Annual General Meeting (AGM) held on Tuesday, September 23, 2025. The dividend was approved along with other key resolutions by the members present.

Shipping Corporation of India

The shares went up over 4 percent after a news report said that the Union Cabinet is expected to take up three shipping sector schemes worth Rs 70,000 crore.

Source – Money Control