POST MARKET

The equity benchmark indices declined on Monday, weighed down by selling in information technology shares after the US administration raised H-1B visa fees.

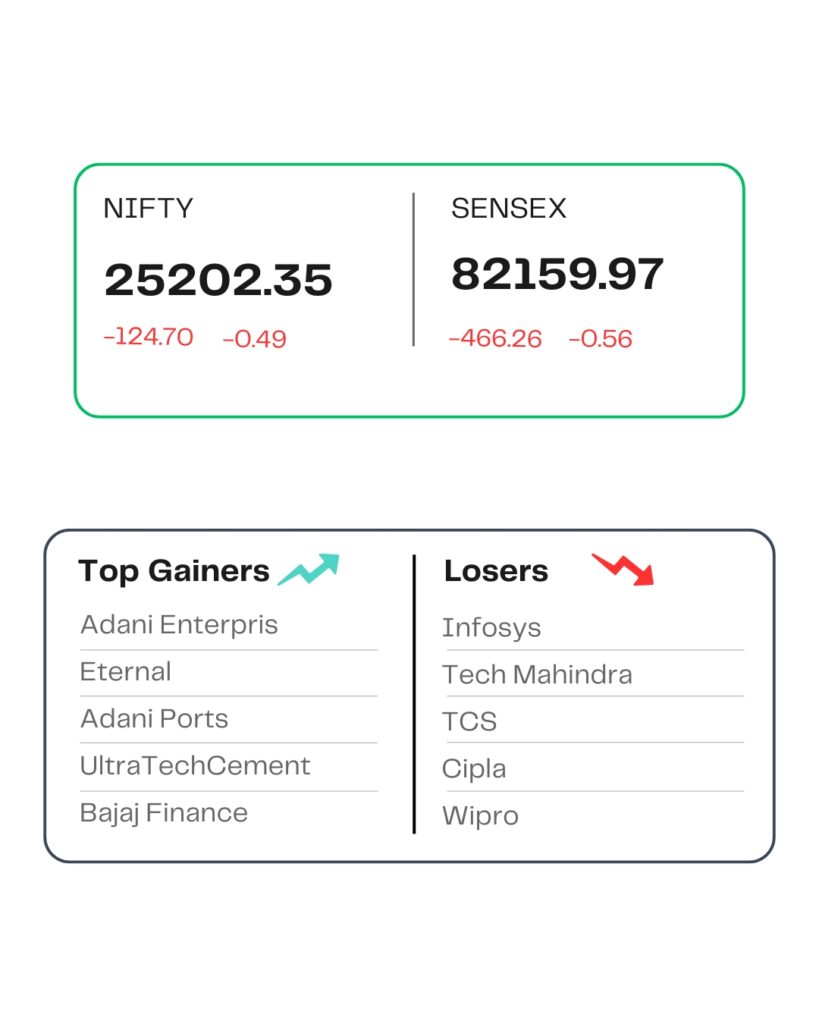

At close, the Sensex was down 466.26 points or 0.56 percent at 82,159.97, and the Nifty was down 124.70 points or 0.49 percent at 25,202.35. About 1715 shares advanced, 2467 shares declined, and 149 shares were unchanged.

On the sector front, the IT index is down 2.7 percent, pharma is down 1.2 percent, while the power index is up 1.6 percent, the oil & gas index is up 0.4 percent, and the metal index rose 0.4 percent.

The biggest Nifty losers were Tech Mahindra, TCS, Infosys, Wipro, Cipla, while gainers were Adani Enterprises, Bajaj Auto, Eternal, Adani Ports, and Bajaj Finance.

Among the broader indices, the BSE Midcap and smallcap indices shed 0.7% each.

STOCKS TODAY

Apex frozen

The shares of Indian shrimp exporter Apex Frozen dropped nearly 3.5 percent in trade, as investors remained concerned over the ‘India Shrimp Tariff Act’, which was recently introduced in the American Congress.

Netweb Technologies India

Netweb Technologies India’s share price rose 7.81 percent, hitting a 52-week high in the opening trade on September 22, following the company’s receipt of the purchase order for the supply of Tyrone AI GPU Accelerated Systems. The estimated order value is approximately Rs 450 crores.

Swiggy

Food and grocery delivery platform Swiggy’s shares dropped almost 2 percent on September 22, ending a five-day winning streak during which the stock rose by 9%. JM Financial Institutional Securities downgraded the stock from ‘hold’ to ‘reduce,’ though it increased its target price by nearly 5% to Rs 440.

Cochin Shipyard

The shares went up over 1 percent as the government approved infrastructure status to large ships. The government accorded the infrastructure status to “large ships” on September 19, which comes seven months after Finance Minister Nirmala Sitharaman announced it in her Budget speech.

Source – Money Control