POST MARKET

Indian benchmark indices snapped a six-day winning streak and ended the week on a weak note, amid selling across the sectors barring metal and telecom names.

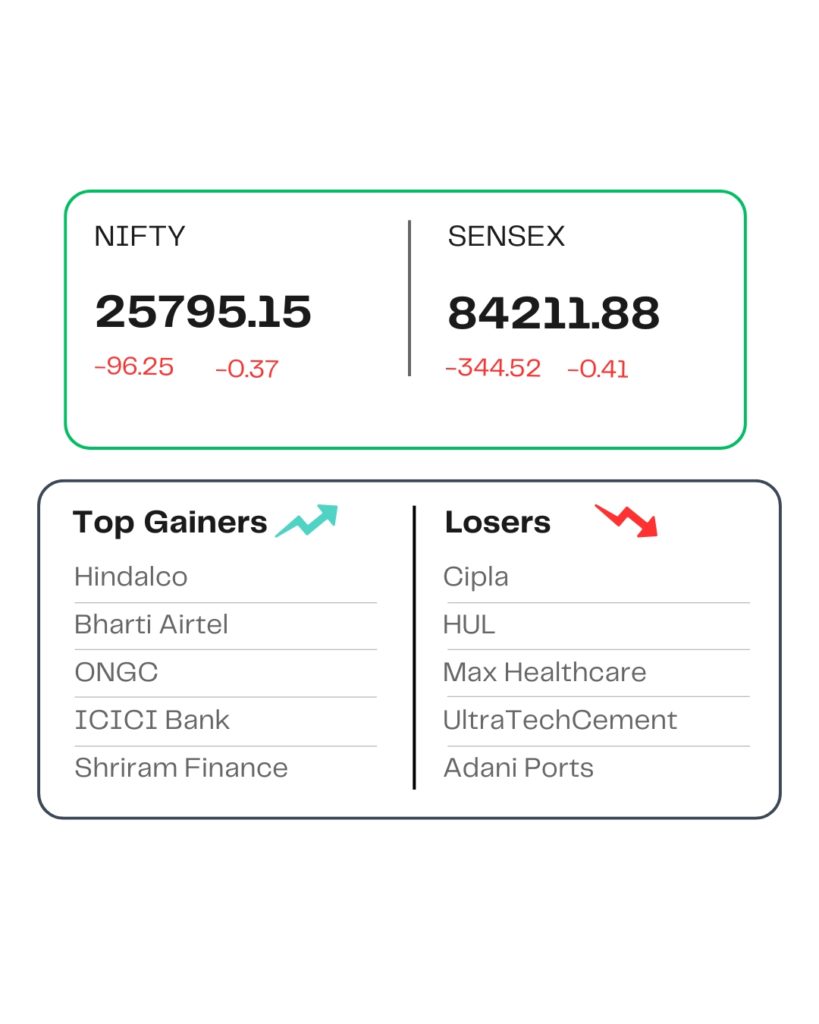

At close, the Sensex was down 344.52 points or 0.41 percent at 84,211.88, and the Nifty was down 96.25 points or 0.37 percent at 25,795.15. About 1785 shares advanced, 2205 shares declined, and 154 shares remained unchanged.

Cipla, HUL, Adani Ports, Max Healthcare, and UltraTech Cement were among the top losers on the Nifty, while gainers were Hindalco, Bharti Airtel, ONGC, Shriram Finance, and ICICI Bank.

On the sectoral front, metal and telecom indices are up 1% each, while FMCG, PSU Bank, pharma, private bank, and consumer durable are down 0.5-1%.

Among the broader market indices, the BSE Midcap and Smallcap indices are trading flat.

STOCKS TODAY

Utkarsh Small Finance Bank

The shares of Utkarsh Small Finance Bank rallied 18.25 percent after the company announced that it had allotted more than 5.71 crore shares to ace investor Madhusudan Kela’s fund house Cohesion MK Best Ideas Sub-Trust as part of its rights issue.

Cipla

The shares of Cipla dropped more than 3 percent on October 24, even after the pharma giant announced a deal with Eli Lilly to market diabetes and obesity drug Tirzepatide in India under a new brand name. The sharp fall in the share price comes after the stock gained more than 7 percent in the past eight sessions amid buzz over the deal.

NALCO

The shares of National Aluminum Company (NALCO) jumped 3.43 percent in trade, bucking the overall downturn in the stock markets. The sharp rise in the share prices pushed the Nifty Metal index up more than 2 percent to 10,457.40 in the morning.

Hero Motocorp

ITC Hotels

ITC Hotels shares went up over half a percent as the company reported a net profit of Rs 133 crore for the second quarter of the financial year 2026. This marks a 74 percent year-on-year (YoY) increase from the Rs 76 crore net profit reported in the same period last year.

Source – Money Control