POST MARKET

Indian equity indices ended the final session of 2025 on a strong note with Nifty finishing above 26,100 on December 31.

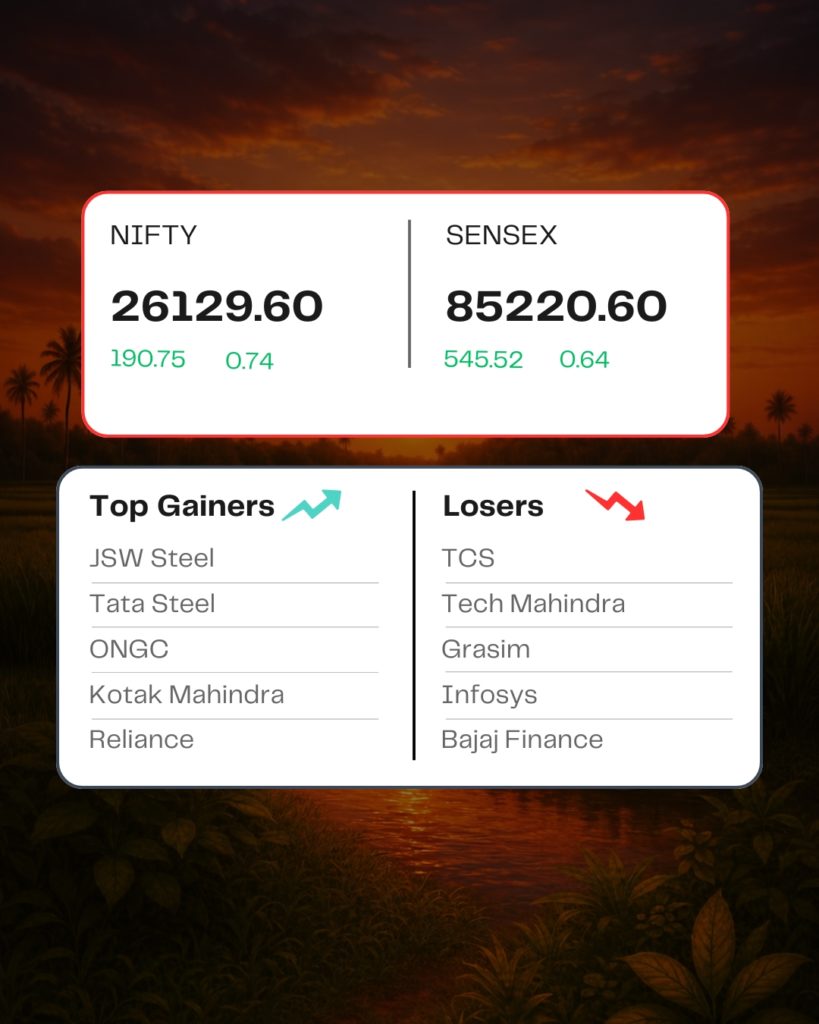

At close, Sensex was up 545.52 points or 0.64 percent at 85,220.60, and the Nifty was up 190.75 points or 0.74 percent at 26,129.60. About 2555 shares advanced, 1330 shares declined, and 123 shares remained unchanged.

The biggest Nifty gainers were JSW Steel, Tata Steel, ONGC, SBI Life Insurance, Kotak Mahindra Bank, while losers included TCS, Bajaj Finance, Tech Mahindra, Grasim Industries, and Infosys.

On the sectoral front, except IT and telecom, all other indices closed in the green with metal, media, capital goods, realty, Private Bank, PSU Bank, consumer durables, and power up 1% each, while the oil & gas index rose 2.5%.

Among the broader market indices, the BSE Midcap and smallcap indices added 1% each.

STOCKS TODAY

Vodafone Idea

The shares of Vodafone Idea tumbled over 11.5 percent after media reports claimed that the Union Cabinet had approved an adjusted gross revenue (AGR) relief package for the telecom giant. The government has given its nod for a 5-year moratorium on the AGR dues of the telecom giant, they added.

JSW Steel

Shares of JSW ended almost 5 percent higher on the last day of the year after the government announced a three-year safeguard duty of up to 12 percent on select steel imports, boosting expectations of better pricing protection for domestic producers. The shares went up over 27 percent in 2025.

BEML

Shares of the defence company went up 1.66 on December 31. The stocks rose after the Ministry of Defence on Tuesday signed contracts worth Rs 4,666 crore for battle carbines and torpedoes. The stocks of the company went down by over 9.5 percent this year.

Hindustan Zinc

Hindustan Zinc shares fall over 2 percent as Silver prices sharply dropped on December 31, after soaring to fresh record highs following a significant bull run. The fall in the precious metal pushed the shares of Hindustan Zinc as well as silver ETFs down sharply. The share price went up 37.89 percent in 2025.

Source – Money Control