POST MARKET

Indian benchmark indices started the week on a strong note, breaking a two-day fall to end higher, ignoring mixed global cues amid ongoing Middle East tensions.

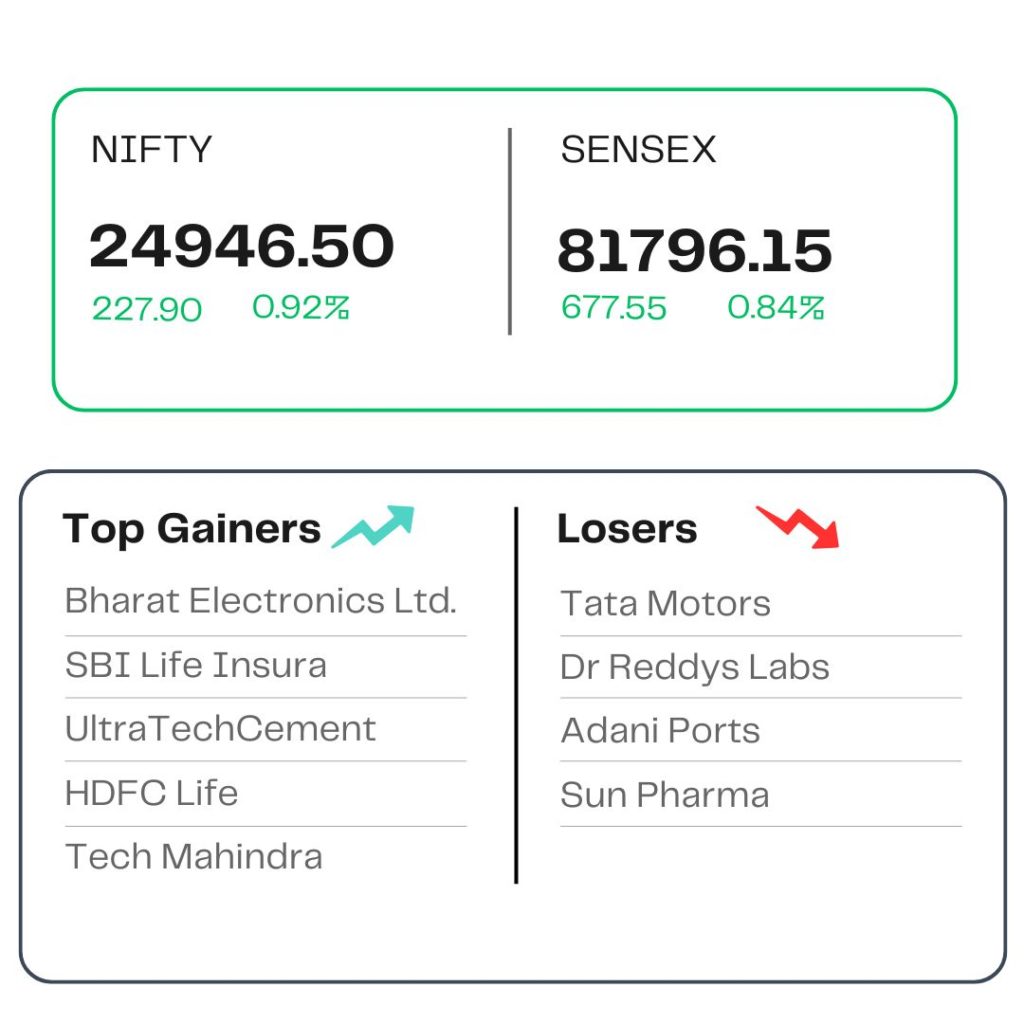

At close, the Sensex was up 677.55 points or 0.84 percent at 81,796.15, and the Nifty was up 227.90 points or 0.92 percent at 24,946.50. About 1898 shares advanced, 2026 shares declined, and 163 shares remained unchanged.

Biggest Nifty gainers included SBI Life Insurance, UltraTech Cement, Bharat Electronics, HDFC Life, ONGC, while losers were Tata Motors, Dr Reddy’s Laboratories, Adani Ports, and Sun Pharma.

All the sectoral indices ended in the green with IT, metal, realty, and oil & gas stocks leading the gains, rising over one percent each.

The broader market indices saw an increase, with the BSE midcap index adding 0.9 percent and the smallcap index rising 0.4 percent.

STOCKS TODAY

Tata Motors

The stock slid as much as 5 per cent after Jaguar Land Rover (JLR), its UK-based luxury arm, flagged weak free cash flow expectations and a slew of macro risks in its latest investor presentation. JLR said it expects free cash flow to be “close to zero” in FY26, even as it remains committed to its investment plans and aims to maintain EBIT margins in the range of 5–7 percent.

Sterlite Tech

Shares jumped up to 20 percent after the company announced an expansion of its data centre portfolio to cater to growing AI infrastructure needs. In a filing, the company said it has launched next-gen solutions, ranging from cabling to full-stack connectivity, tailored for AI-led data centres. Sterlite also cited industry projections, estimating the global data centre market will touch $517 billion by 2030, growing at a CAGR of 10.5 percent.

Mazagon Dock Shipbuilders

The share price of the company dropped around 2 percent on June 16. The stock has seen a notable decline recently, after a record rally triggered by optimism over higher order inflows post Operation Sindoor. The recent rise in tensions between Israel and Iran further boosted the stocks. However, analysts have flagged the elevated valuations in these stocks.

Spicejet

Shares ended over 2 percent lower even as the airline reported a sharp jump in earnings for the March quarter of FY2025. SpiceJet has reported its highest-ever quarterly net profit of Rs 319 crore for Q4 FY25, a 12-fold jump from Rs 26 crore in the previous quarter, signalling a strong turnaround for the low-cost carrier after years of financial turbulence.

IHCL

Shares of Indian Hotels Company Limited (IHCL) climbed nearly 3 percent after Jefferies reiterated its bullish view, citing the company’s strong FY26 guidance and multiple growth levers that support its long-term outlook. Management reaffirmed confidence in the positive demand-supply dynamics for the hospitality sector in India and reiterated its FY26 guidance of double-digit revenue growth.

Source – Money Control