POST MARKET

The Indian equity indices surged nearly 1 percent on Wednesday, tracking firm global markets amid signs of easing geopolitical tensions in the Middle East.

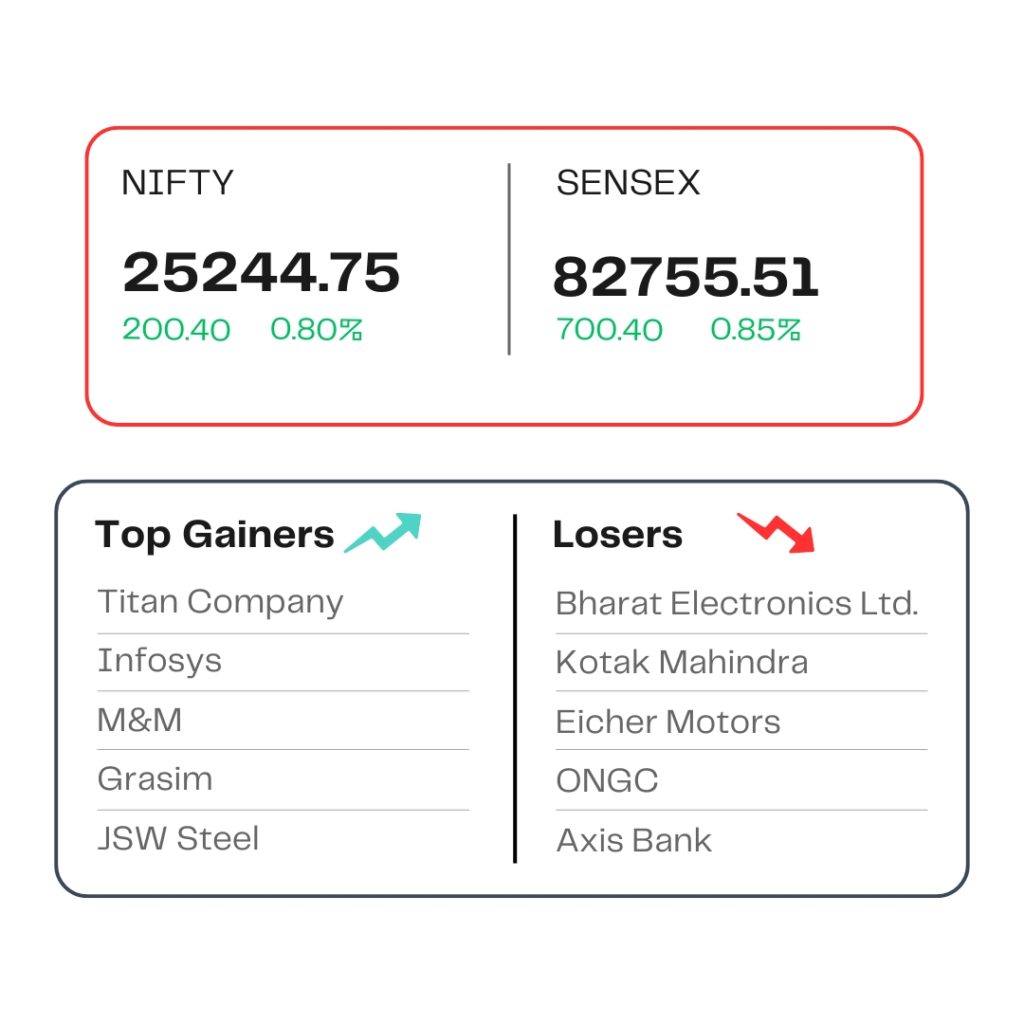

At close, the Sensex was up 700.40 points or 0.85 percent at 82,755.51, and the Nifty was up 200.40 points or 0.80 percent at 25,244.75. About 2711 shares advanced, 1163 shares declined, and 127 shares remained unchanged.

Titan Company, Infosys, M&M, Grasim Industries, and JSW Steel were among the top gainers on the Nifty, while losers were Bharat Electronics, Kotak Mahindra Bank, Eicher Motors, Axis Bank, and ONGC.

All the sectoral indices ended in the green with auto, consumer durables, IT, telecom, healthcare, and media up 1-2 percent.

The broader market indices also closed higher, with the BSE Midcap index rising 0.6 percent and the smallcap index adding 1.6 percent.

STOCKS TODAY

Titan Company

Titan Company shares topped the Nifty index with a gain of over 3 percent. This comes after Macquarie reaffirmed its positive outlook, believing that a healthy recovery in demand will aid growth in jewellery sales in the current quarter of FY26.

IHCL

Shares rose 2 percent after JPMorgan initiated coverage on the stock with an overweight rating on strong growth prospects. It believes Indian Hotels could achieve its FY30 targets ahead of schedule. The company’s Return on Capital Employed is projected to cross 19 percent by FY28, supported by a rising share of capital-light business and a significant jump in managed hotel keys.

ArisInfra Solutions

The shares of Arisinfra Solutions were listed at Rs 205 apiece on NSE, thereby making a weak debut on the stock market on June 25. The shares were listed at a discount of nearly 8 percent from their IPO price of Rs 222 apiece. The stock closed nearly 20 percent lower in today’s session.

Timex Group India

Shares hit their five percent lower circuit after the promoter of the watchmaker Timex Group Luxury Watches BV will sell 15 percent in the firm via the offer for sale (OFS) route. The offer includes a base issue of 7.5 percent of the total equity, which amounts to 75.71 lakh shares, combined with an additional 7.5 percent equity under a green shoe option, taking the potential total to 1.51 crore shares.

Dixon Tech

Shares faced selling pressure on June 25 after Phillip Capital slashed its target price for the EMS stock. Phillip Capital maintained its sell rating on the EMS stock by trimming its price target to Rs 9,085 from Rs 11,077, which implies up to 36 percent downside for the multi-bagger stock. The broking firm said the company’s domestic business was facing increasing competition.

Source – Money Control