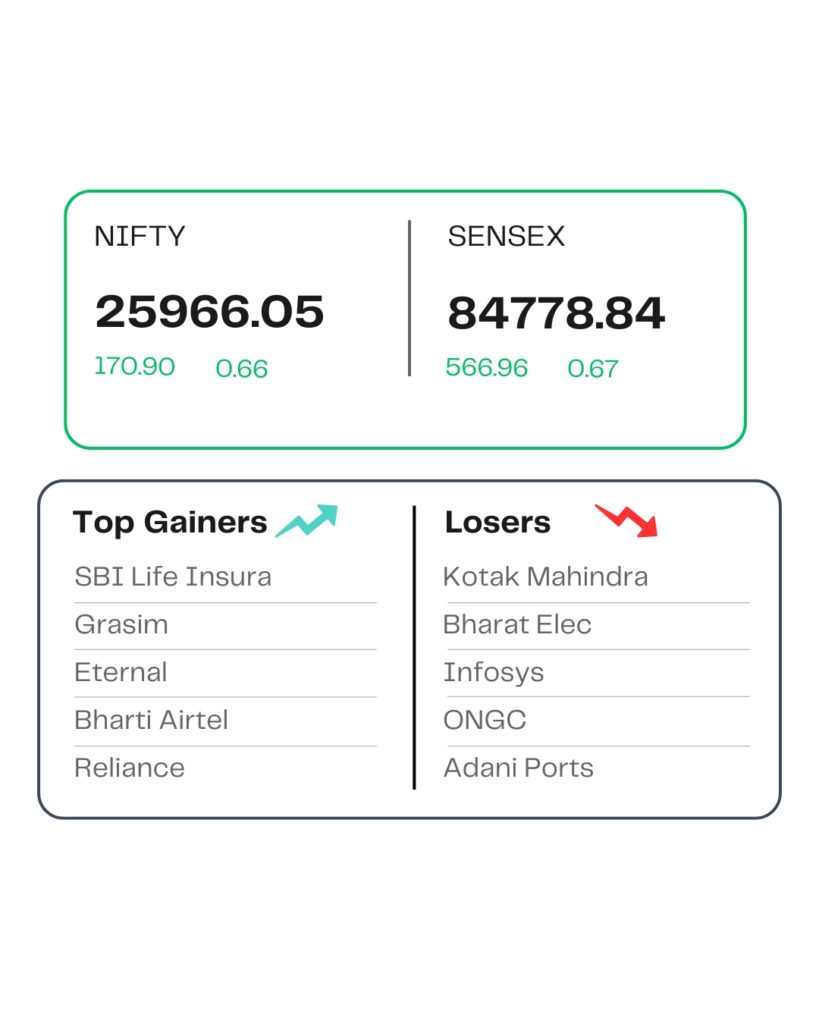

POST MARKET

The Indian equity indices ended the day higher, helped by supportive global cues and broad-based buying on October 27.

At close, the Sensex was up 566.96 points or 0.67 percent at 84,778.84, and the Nifty was up 170.9 points or 0.66 percent at 25,966.05. About 1925 shares advanced, 1994 shares declined, and 155 shares remained unchanged.

SBI Life Insurance, Bharti Airtel, Reliance Industries, SBI, and Eternal were among the top gainers on the Nifty, while the losers included Bharat Electronics, Kotak Mahindra Bank, Infosys, Adani Ports, and Bajaj Finance.

Except media, pharma, all other sectoral indices ended in the green with metal, PSU Bank, oil & gas, realty index up 1-2%.

Among the broader market indices, the BSE Midcap index added 0.7% and the smallcap index rose 0.5%.

STOCKS TODAY

Shriram Properties

The shares of Shriram Properties jumped over 2 percent after the company announced that it had signed a joint development agreement (JDA) for a land parcel spanning 7 acres of land. This is part of a larger deal of approximately 15 acres of land in North Bengaluru.

Coforge

The shares of Coforge jumped more than 4 percent after the company released better-than-expected results for the second quarter of the financial year 2026. Brokerages have raised target prices for the stock, anticipating strong upside potential from the current levels.

Federal Bank

The shares of Federal Bank jumped almost 3 percent after brokerages issued positive notes for the stock. This comes after the company announced that Blackstone will invest $705 million in the Indian private lender.

Vedanta

Shares of Vedanta went up 1.87 percent along with other metal stocks, after a softer-than-expected US inflation print boosted expectations of a rate cut by the US Federal Reserve during the October 28 – 29 policy meeting.

SBI Cards

The shares of SBI Cards dropped over 3 percent in trade on October 27 after the second-quarter earnings for the credit card issuer failed to meet expectations.

Source – Money Control