POST MARKET

Indian equity indices ended near the day’s high, with Nifty reclaiming the 24,900 level on a broad-based rally in metal, financial, and consumer durable shares, closing higher every week as well.

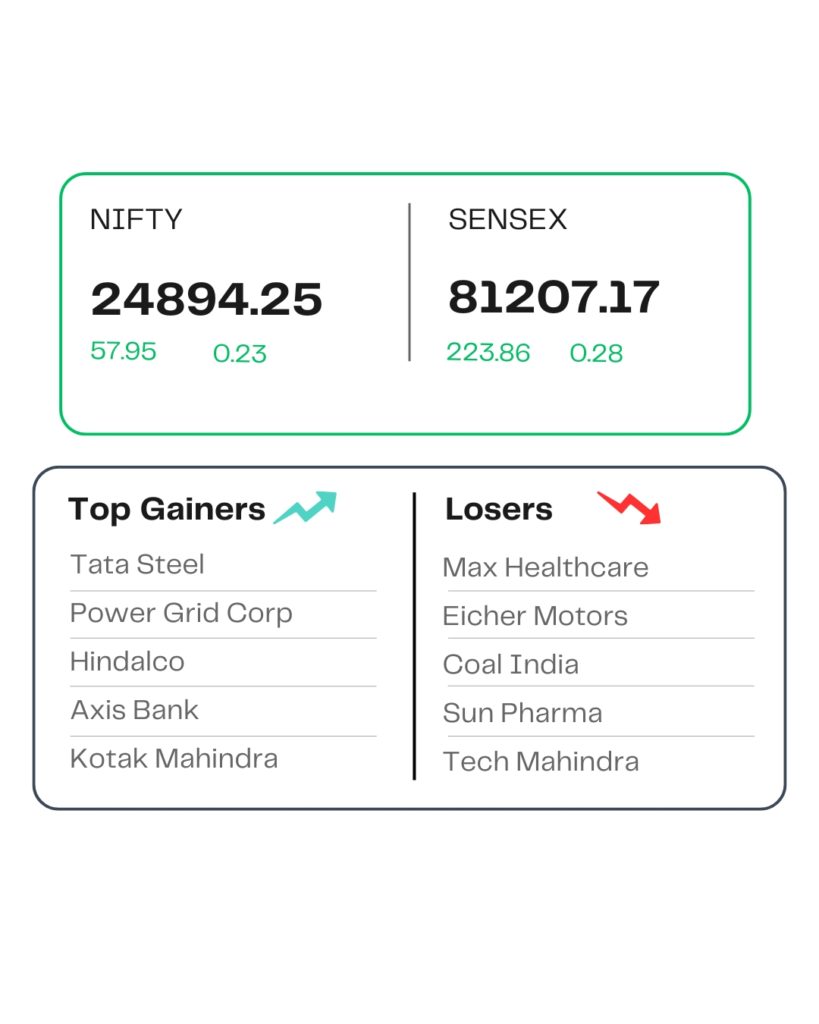

At close, the Sensex was up 223.86 points or 0.28 percent at 81,207.17, and the Nifty was up 57.95 points or 0.23 percent at 24,894.25. About 2592 shares advanced, 1411 shares declined, and 132 shares remained unchanged.

Tata Steel, Power Grid Corp, Hindalco, Axis Bank, and L&T were among the major gainers, while losers included Max Healthcare, Coal India, Maruti Suzuki, Tech Mahindra, and SBI Life Insurance.

Except for pharma, realty, and FMCG, all other sectoral indices ended in the green, with the metal index rising nearly 2 percent, and PSU Bank up 1 percent.

Among the broader market indices, the BSE midcap index was up 0.8 percent, and the smallcap index added 1 percent.

STOCKS TODAY

V Mart

Value retailer V-Mart’s business update sparked a massive, almost 16 percent rally in the share prices on October 3 after the company posted a 22 percent on-year growth in provisional revenue from operations at Rs 807 crore, with a Same Store Sales Growth (SSSG) of over 11 percent for the quarter, a company filing showed.

Sammaan Capital

NBFC Sammaan Capital shares fell almost 3 percent to snap their six-day gaining streak after the company approved a Rs 8,850-crore preferential issue to Global investment company International Holding Co (IHC) at Rs 139 per share.

Nuvama Wealth Management

Capital market regulator Sebi has approved Nuvama Wealth Management’s application seeking to act as a sponsor to set up a mutual fund, the company informed exchanges through a filing, sending the shares higher by more than 4 percent.

Vodafone Idea

Vodafone Idea Ltd (VIL) shares rose nearly 4% on October 3 as the Supreme Court is likely to hear on October 6 the telco’s plea seeking the quashing of the additional adjusted gross revenue (AGR) demands for the period until 2016-17.

Azad Engineering

The shares went up 7.29 percent along with other private defence stocks. This positive sentiment on the private defence stocks emerged after Goldman Sachs initiating coverage on eight Indian defence stocks due to various factors like a six-fold rise in domestic defence spending, scope for indigenisation and export expansion.

Source – Money Control