POST MARKET

Indian equity indices ended in the green for a fourth straight session on June 27, powered by broad-based buying on hopes of extension of the Trump tariff deadline and the possibility of a sooner-than-expected US Fed rate cut.

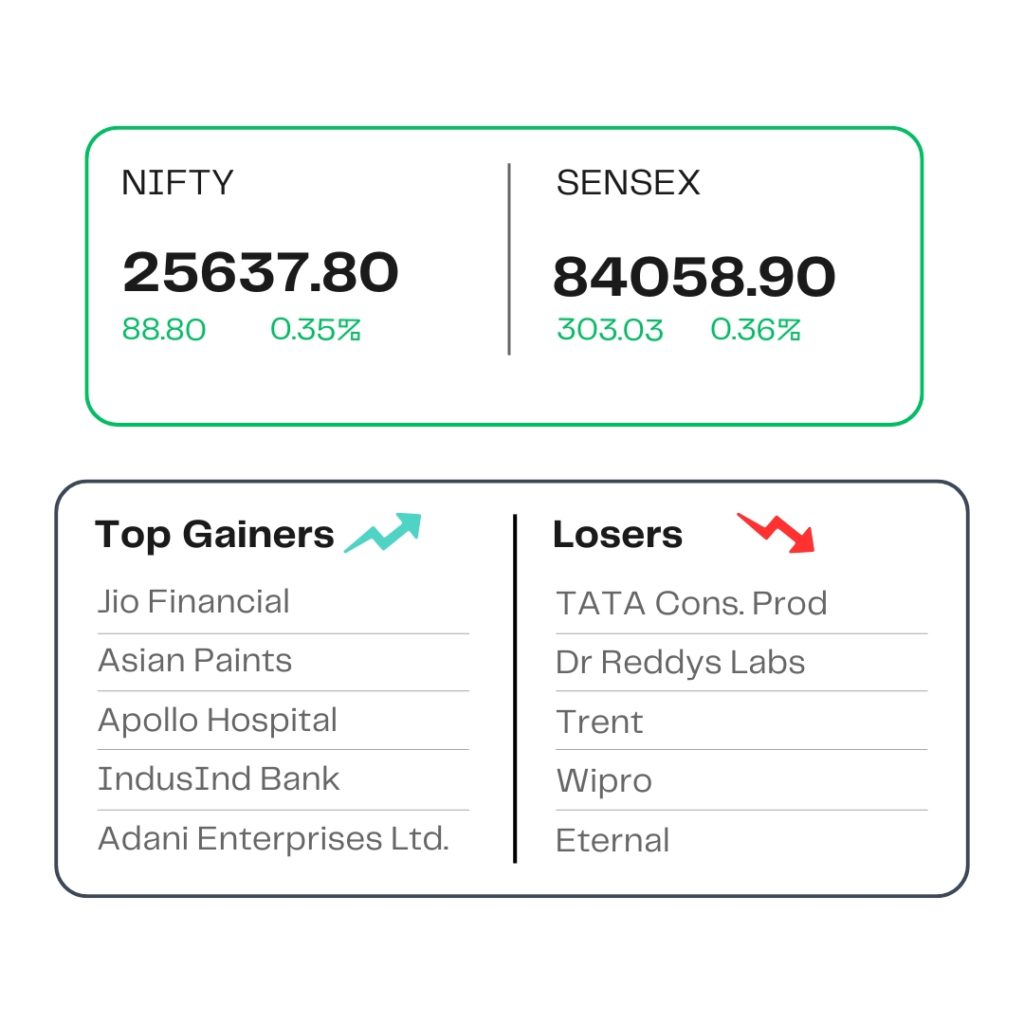

At close, the Sensex was up 303.03 points or 0.36 percent at 84,058.90, and the Nifty was up 88.80 points or 0.35 percent at 25,637.80. About 2135 shares advanced, 1727 shares declined, and 140 shares remained unchanged.

Among sectors, except consumer durables, IT and realty, all other indices ended in the green with Capital Goods, Healthcare, oil & gas, power, telecom, and PSU Bank up 0.5-1 percent.

Jio Financial, IndusInd Bank, Adani Enterprises, Asian Paints, and Apollo Hospitals were among the major gainers on the Nifty, while losers were Trent, Dr Reddy’s Labs, Eternal, Wipro, and Tata Consumer.

The broader market indices closed higher, with the BSE Midcap index rising 0.4 percent and the smallcap index gaining 0.5 percent.

STOCKS TODAY

Jio Financial Services

Shares of Jio Financial Services rose nearly 4 percent on Friday after the Securities and Exchange Board of India (SEBI) approved Jio BlackRock Broking to function as a stockbroker in the market.

Vedanta

Shares of the company increased almost 2 percent, after the White House Press Secretary said the July 9 deadline for reimposition of tariffs on imports was ‘not critical’ and could be extende,d but that is a decision for President Trump to make.

SBI

SBI shares rose over 1% after CLSA reiterated its ‘outperform’ rating, citing the bank’s strong fundamentals and consistent market share gains. CLSA set a target price of ₹1,050, implying a potential 32% upside from current levels. While the outlook remains strong for FY25, CLSA cautioned about possible margin pressure in FY26.

AkzoNobel

This multinational company’s shares, Akzo Nobel India Ltd, rallied over seven percent to 7.19 percent, after JSW Paints signed agreements to acquire up to 74.76 percent stake in Akzo Nobel India from its parent company and affiliates for up to Rs 8,986 crore, subject to final adjustments.

IndusInd Bank

The shares of IndusInd Bank sharply surged nearly 4 percent on June 27 after it was reported that Axis Bank’s Rajiv Anand is a strong candidate for its CEO position. HDFC Bank’s Rahul Shukla and Bajaj Finance’s Anup Saha are also likely to be running for the role.

Source – Money Control